The Ping An Healthcare and Technology Company Limited (HKG:1833) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

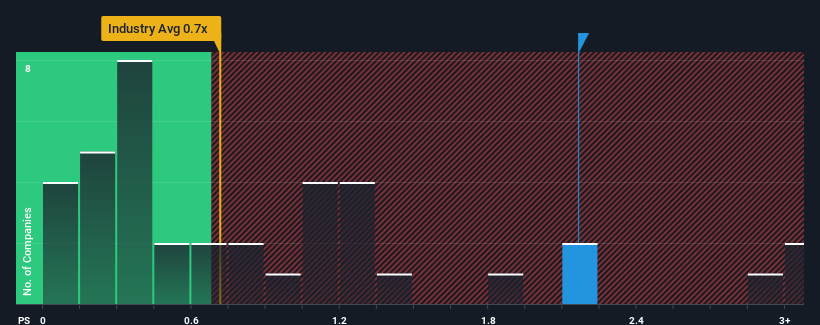

Even after such a large drop in price, given close to half the companies operating in Hong Kong's Consumer Retailing industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider Ping An Healthcare and Technology as a stock to potentially avoid with its 2.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Ping An Healthcare and Technology's P/S Mean For Shareholders?

Ping An Healthcare and Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Ping An Healthcare and Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Ping An Healthcare and Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Ping An Healthcare and Technology's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. As a result, revenue from three years ago have also fallen 32% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 13% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 13% each year, which is not materially different.

With this in consideration, we find it intriguing that Ping An Healthcare and Technology's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Ping An Healthcare and Technology's P/S?

There's still some elevation in Ping An Healthcare and Technology's P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Ping An Healthcare and Technology's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Ping An Healthcare and Technology with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.