Harmonic Inc. (NASDAQ:HLIT) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 32% share price drop.

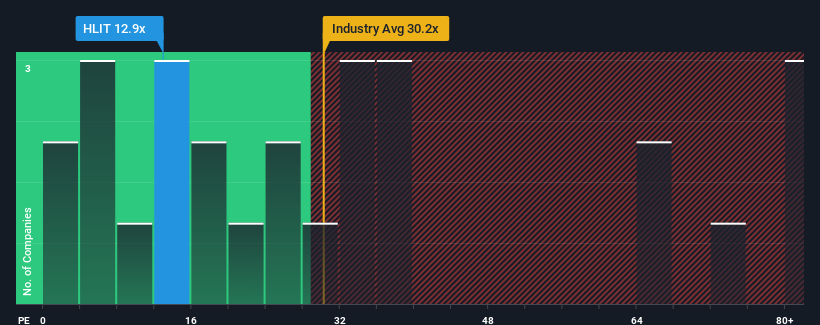

Although its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may still consider Harmonic as an attractive investment with its 12.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Harmonic certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Harmonic would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 181% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the five analysts covering the company suggest earnings growth is heading into negative territory, declining 54% over the next year. That's not great when the rest of the market is expected to grow by 11%.

In light of this, it's understandable that Harmonic's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Harmonic's P/E?

The softening of Harmonic's shares means its P/E is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Harmonic maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Harmonic (1 shouldn't be ignored!) that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.