The rules of stock selection in this era have changed

Zhang Kun has never lacked strength or insight, but in this year's quarterly report, he explained his understanding and response to the times more clearly.

It's a topic he hasn't touched on before.

At the same time, none of his funds showed new heavy stocks in the first quarter, and none (all varieties have appeared in at least all historical portfolios).

This result was not that he was “lazy,” but rather a conclusion based on a series of thought decisions.

He said that in reviewing the long history of the capital market, one important reason why stocks have a higher long-term yield than bonds is that the former has continued to grow. ——Therefore, the meaning of growth should be greater than the pursuit of “dividends.”

He also said that the necessary condition for high-quality stocks is to have long-term continuous growth. Therefore, stock investors should always give considerable weight to looking for long-term growth.

However, in a period of high-quality development, the basic probability that the company will continue to grow rapidly is declining — this is the second important prerequisite.

Therefore, investors should never give up looking for moderate and sustained growth, and this kind of growth should be found in different segments.

Did you understand that?

When outsiders were worried that Zhang Kun's holdings might age and growth potential might decline, Zhang Kun used his own logic to explain the significance of his insistence on choosing:

First, in the new investment era, moderate growth is a rational investment goal that can be pursued.

Second, they're also cheap now.

Isn't this both very “calm” and very “Zhang Kun”?

We must not give up

On the days of writing the quarterly report, Zhang Kun carefully observed the market and came to his own conclusions (in the quarterly report).

He said that judging from the stock asset performance of long-term treasury bonds and bond-like bonds, the market's risk appetite has been lowered to a very low level. This is reflected in giving high weight to a static dividend rate level during pricing, and is skeptical about growth, especially the long-term growth of enterprises.

However, in his view, if the long history of the capital market is reviewed, an important reason why stocks have a higher long-term yield than bonds is that stocks have continuous growth, and the necessary condition for high-quality stocks is to have long-term continuous growth.

Therefore, he believes that as a stock investor, we should not give up on growth, and that we should always give considerable weight to seek long-term growth (in investment).

“Capture” growth from the segmentation structure

Zhang Kun also said that during the period of high-quality development, although the basic probability that the company will continue to grow rapidly is declining, the search for moderate and continuous growth should never be abandoned.

At the same time, he is convinced that such moderate and continuous growth can be obtained by looking for it in different segment (industry) structures.

He stressed that the growth he is looking for must be of high quality; it must not be brought about by extensive management or the burning of money; it should be obtained with a reasonable marginal return on investment.

Therefore, he will pay great attention to the company's ability to control costs and expenses, the ability to control working capital, the ability to generate free cash flow, the ability to allocate capital, and the will to return shareholders.

Company valuations are attractive

Zhang Kun used an example in the quarterly report: Under the simplified model, between company A with a 5% dividend rate +1% growth and company B with 3% dividend rate +8% growth, most of the market at this stage prefer to choose Company A. Such companies have also attracted the allocation of a large number of fixed income funds.

However, in his tone, he “questioned” such a choice.

He also mentioned that from a valuation perspective, in the past three years, due to continuous revisions in the market's long-term growth expectations, the valuation of Company A has increased, while the valuation of Company B has declined.

Therefore, judging from the absolute and relative levels of various valuation dimensions (price-earnings ratio, market capitalization/free cash flow), the current stage of market pricing makes company B with long-term high-quality growth attractive.

Oil stocks rose to the top position

Judging from the funds managed by Zhang Kun, he maintained the basic stability of his positions and heavy stock positions as a whole, and mainly made structural adjustments.

E-Fangda Blue Chip and E-Fangda High Quality Enterprises have mainly adjusted the structure of consumer and pharmaceutical industries in three years. E-Fangda Premium Selection has adjusted the structure of industries such as technology and consumer.

Interestingly, thanks to its own rise, CNOOC became the largest stock held by E-Fangda Blue Chip and E-Fangda High Quality Enterprise's two funds in three years.

Liquor replaces CXO

Most of Zhang Kun's remaining heavy stocks are “familiar faces” (take the example of E-Fangda Blue Chip Fund, same below).

For example, Shanxi Fenjiu replaced Yao Ming Biotech and entered the list of the top ten major stocks. However, the number of positions held has not changed compared to the 2023 annual report.

The most obvious change in the number of positions held was China Merchants Bank. At the end of the first quarter, the number of shares held was almost “short” compared to the end of 2023, and the “queen” took the last seat of the top ten most heavily held stocks.

Overall, the share of funds held in the financial industry also decreased by 3 percentage points compared to the previous period (A and H shares combined).

Best quarter of the past year

Looking at it another way, the current combination has also witnessed a kind of “success” for Zhang Kun.

Loving liquor, he placed additional bets on cyclical resource stocks. Historically, his holdings of financial and liquor stocks with large market capitalization also received good returns, and also enabled him to achieve positive returns in the first quarter.

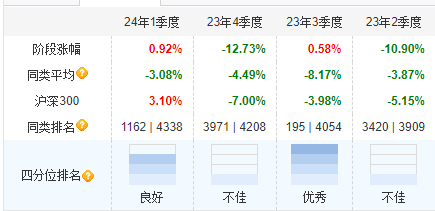

He himself also recorded the best quarterly earnings of the past year (blue chip funds, for example).

The Asian selection far outperformed the benchmark

An even more rare outstanding performance occurred with the E-Founda Asia Select Fund.

In the first quarter, the net share growth rate of E-Fangda Asia's selected reporting period was 9.67%, which was the best performing fund of all funds managed by Zhang Kun during the same period.

The fund is also the only fund managed by Zhang Kun that has significantly surpassed the performance benchmark (first quarter of this year).

Zhang Kun mentioned in the fund's quarterly report that the fund's stock position was basically stable in the first quarter, and only the structure was adjusted. It involved the structure of the technology and consumer industries, and also made some balance in the company's business distribution.

Overseas individual stocks are “in the bag”

However, judging from E-Fangda's Asia Select Fund's heavy stocks, Asmack, Prada, and Samsonite are new to the fund's heavy stock list.

All three companies are well known in their industries: the former is engaged in the most critical sector of the semiconductor industry and is a leading company; Prada is a well-known luxury goods dealer; Samsonite is a world-renowned luggage dealer.

Obviously, Zhang Kun is also focusing on varieties with absolute industrial competitiveness.

Many “fans” are still with us

Although the star fund manager who always talks about active equity has faded away, the 1st quarterly report shows that Zhang Kun still manages a scale of more than 64.73 billion dollars and is a very important presence among public fund managers.

On the other side, this shows one or more characteristics of current fund holders.

The proportion of young people among them is getting higher.

This younger group is less sensitive to yield than the older investors before.

But they attach great importance to the affirmation, encouragement, and even praise of the spiritual world. They have had the same or even longer-lasting interest in idols.

They will stay with fund managers for a long time.