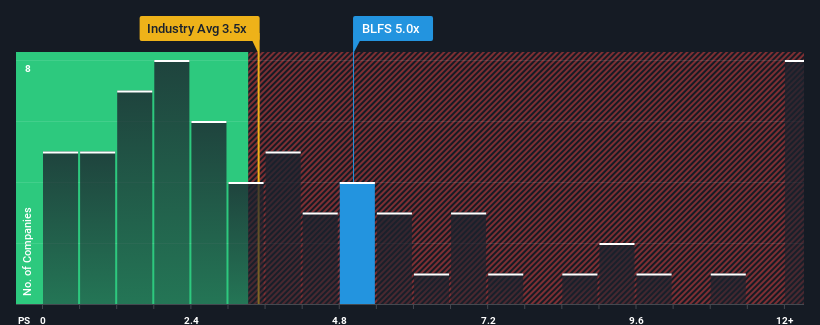

When you see that almost half of the companies in the Life Sciences industry in the United States have price-to-sales ratios (or "P/S") below 3.5x, BioLife Solutions, Inc. (NASDAQ:BLFS) looks to be giving off some sell signals with its 5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How BioLife Solutions Has Been Performing

With revenue that's retreating more than the industry's average of late, BioLife Solutions has been very sluggish. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think BioLife Solutions' future stacks up against the industry? In that case, our free report is a great place to start.How Is BioLife Solutions' Revenue Growth Trending?

BioLife Solutions' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. Even so, admirably revenue has lifted 198% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 3.5% per annum during the coming three years according to the nine analysts following the company. That's shaping up to be materially lower than the 6.4% each year growth forecast for the broader industry.

With this information, we find it concerning that BioLife Solutions is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does BioLife Solutions' P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that BioLife Solutions currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for BioLife Solutions you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.