On the evening of April 18, Everweft Lithium Energy announced its 2023 annual results. The company's battery market share doubled, but it fell into a dilemma where revenue, net profit, and sales volume diverged.

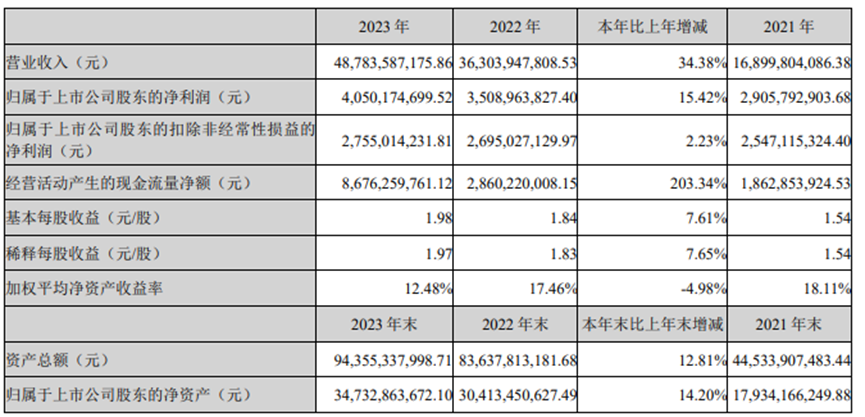

In 2023, Everweft Lithium achieved operating income of 48.78 billion yuan, up 32.38% year on year; net profit to mother was 4.05 billion yuan, up 15.42% year on year, of which net profit from the division's business was 3.54 billion yuan, up 30.19% year on year; after deduction, only 2.23% year on year; gross margin reached 17.04%, up 0.61 percentage points year on year; net interest rate reached 9.27%, down 0.84 percentage points year on year.

Despite the fact that the installed capacity of Everweft lithium energy batteries maintained three-digit growth, the growth rate of operating income and net profit was only 32% and 15.4%.

According to Wall Street News and Insight Research, the main reason for the mismatch between revenue and profit growth and the increase in installed capacity is the battery price war and the impact of declining investment returns.

1. The divergence between installed capacity, market share and profit growth

In 2023, in the context of the battery price war, Everweft Lithium achieved a contrarian increase in market share through price cuts, but also because the price drop was even greater, the revenue and profit growth rate slowed sharply.

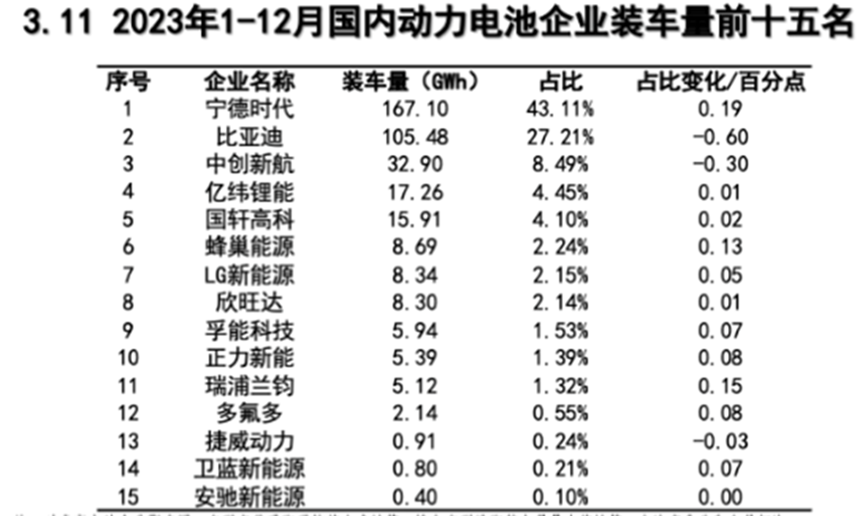

Throughout 2023, Everweft Lithium's domestic power battery installed capacity reached 17.26 GWh, an increase of 140% over the previous year, and its market share increased 2.01 percentage points to 4.45%.

From the perspective of the global power battery market, the global installed capacity of Everweft Lithium Energy reached 16.2 GWh in 2023, a year-on-year increase of 129.8%, and the market share increased by 0.9 percentage points to 2.3%. This is also the first time that Everweft Lithium has entered the world's top ten power battery installed capacity list.

However, it is worth noting that the rapid increase in the market share and installed capacity of Everweft Lithium Energy has not translated into an increase in revenue and profit levels. In 2023, Everweft Lithium's revenue and net profit growth rates were only 32% and 15% respectively, far below the installed capacity growth level.

According to Wall Street Insights and Insight Research, the reasons for this are as follows:

First, in 2023, Everweft Lithium's investment income fell short. Due to a sharp drop in SMOORE's profit of 34.5%, the investment income of Everweft Lithium Energy fell 51% to 600 million yuan.

Second, the strategy of reducing the price and maintaining volume of 100 million weft lithium energy failed to convert market share into revenue and profit.

Throughout 2023, the prices of lithium iron phosphate batteries and lithium ternary batteries fell by 52% and 44%, respectively. Obviously, the company's bargaining power with terminal car manufacturers is weaker, and the decline in raw materials has failed to translate into company profits.

2. Power batteries face the challenge of overcapacity, and energy storage batteries are still growing at a high rate

In 2023, Everweft Lithium Energy will revise its business classification from lithium primary battery business and lithium-ion battery business to consumer battery business, power battery business, and energy storage battery business with more clear business information.

(1) Power battery business

The power battery business of Everweft Lithium Energy is the company's main source of revenue. Shipments reached 28.08 GWh in 2023, a year-on-year surge of 64.22%, driving revenue to 23.98 billion yuan, an increase of 31.41%. Despite a sharp increase in shipments, the price war led to a 1.59 percentage point drop in gross margin to 14.37%, and capacity utilization from 91.5% to 86.6%. This is also why revenue growth is weaker than shipment volume.

However, the company is still active in expanding production capacity. Fixed assets increased 100.3% year over year, with a total value of 21.75 billion yuan, while investment in construction projects was 14.05 billion yuan, an increase of 5.68%. These data show that despite facing the challenge of overcapacity, Everweft Lithium Energy continues to invest and expand.

(2) Energy storage battery

Everweft Lithium Energy's energy storage battery business is the company's second-largest business segment, and achieved significant growth in 2023. Energy storage battery shipments reached 26.3 wGH, a year-on-year increase of 121%, ranking third in the world for two consecutive years, and the market share increased by 3 percentage points to 11%.

Since most orders are long-term contracts, the energy storage battery business was less affected by the price war. Revenue reached 16.34 billion yuan, up 73.24% year over year, accounting for 33.5% of total revenue, and gross margin also increased 8.07 percentage points to 17.03%.

(3) Consumer batteries

In contrast, the consumer battery business of Everweft Lithium Energy is becoming less and less important.

In 2023, the business's revenue was 8.36 billion yuan, down 1.78% year on year, gross margin fell 0.95 percentage points to 23.73%, and its share of revenue fell to 17.1%. This shows that the consumer battery business is basically dependent on stock and is gradually losing momentum for growth.

3. Cash flow continues to improve, but we need to be wary of shifting industry voice

In order to maintain market share, Everweft Lithium has sacrificed profitability to a certain extent by implementing a drastic price reduction strategy. Despite this, the company's cash flow situation continued to improve. Net operating cash flow reached 8.676 billion yuan in 2023, an increase of 203 percent over the previous year, setting a new record.

However, judging from the company's accounts receivable turnover and contractual liabilities throughout the year, the company's voice is gradually shifting to end customers, and the overall order level has also declined.

In 2023, Everweft Lithium's contract liabilities fell sharply by 58.9% year-on-year to 397 million yuan. This is the first time in the past three years that there has been a negative increase in contract liabilities; the number of accounts receivable turnover exceeded 90 days for the first time, reaching 92.38 days.

Although it is still possible to achieve market share growth in the fierce price war, the mismatch between revenue growth and profit growth, the decline in investment income, and a subtle shift in industry voice have brought uncertainty to the future development of Everweft Lithium Energy.

Looking forward to the future, whether Everweft Lithium can successfully overcome these challenges and get out of trouble will be the focus of market attention.