The Advanced Fiber Resources (Zhuhai), Ltd. (SZSE:300620) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 11% in that time.

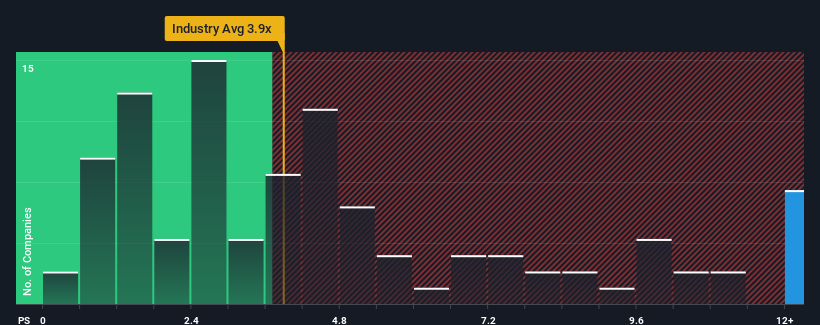

Even after such a large drop in price, given around half the companies in China's Communications industry have price-to-sales ratios (or "P/S") below 3.9x, you may still consider Advanced Fiber Resources (Zhuhai) as a stock to avoid entirely with its 15.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Advanced Fiber Resources (Zhuhai) Has Been Performing

Advanced Fiber Resources (Zhuhai) certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Advanced Fiber Resources (Zhuhai).What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Advanced Fiber Resources (Zhuhai)'s to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen an excellent 44% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 26% per year as estimated by the four analysts watching the company. With the industry predicted to deliver 29% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's curious that Advanced Fiber Resources (Zhuhai)'s P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Advanced Fiber Resources (Zhuhai)'s P/S?

Even after such a strong price drop, Advanced Fiber Resources (Zhuhai)'s P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting Advanced Fiber Resources (Zhuhai)'s revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Plus, you should also learn about these 3 warning signs we've spotted with Advanced Fiber Resources (Zhuhai) (including 1 which is potentially serious).

If you're unsure about the strength of Advanced Fiber Resources (Zhuhai)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.