The European stock market was slightly higher, supported by steady financial reports from some companies, and technology stocks were pressured by market concerns that interest rates would be higher and longer.

The Stoxx 600 index closed up 0.3% in the London market, fluctuating between ups and downs throughout the trading day. The banking and utilities sector outperformed the market, and interest-sensitive tech stocks lagged behind.

In terms of individual stocks, ABB Ltd. rose, and the company raised its full-year profit margin outlook. Demand for electrified products led to stronger orders than expected, offsetting the decline in Chinese business. Yoghurt producer Danone rose, and the company reported first-quarter sales exceeding analysts' expectations, boosted by increased demand for bottled water.

Investors are watching the central bank official's speech on Thursday. Federal Reserve Bank of New York Governor John Williams said that interest rate hikes are not his baseline expectations, but if economic data prove that this is necessary in order to achieve the Federal Reserve's inflation target, then rate hikes are still possible.

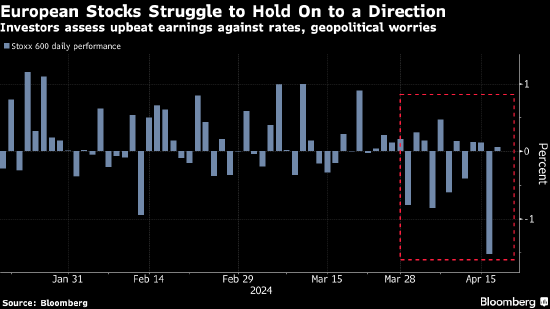

European stock market volatility has soared in recent weeks as the Federal Reserve hinted that interest rates might stay higher for a longer period of time. The geopolitical tension in the Middle East has added another layer of risk. The benchmark Stoxx 600 index has been trying to find direction in April. A Eurozone stock market volatility indicator briefly broke through 20 for the first time since October last year.

Liberum strategist Joachim Klement said the uncertainty surrounding interest rates and geopolitics made “investors unwilling to trade in either direction.” However, he thinks the pullback is temporary.