Whales with a lot of money to spend have taken a noticeably bearish stance on Edwards Lifesciences.

Looking at options history for Edwards Lifesciences (NYSE:EW) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 12% of the investors opened trades with bullish expectations and 87% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $599,616 and 4, calls, for a total amount of $420,066.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $80.0 to $95.0 for Edwards Lifesciences over the last 3 months.

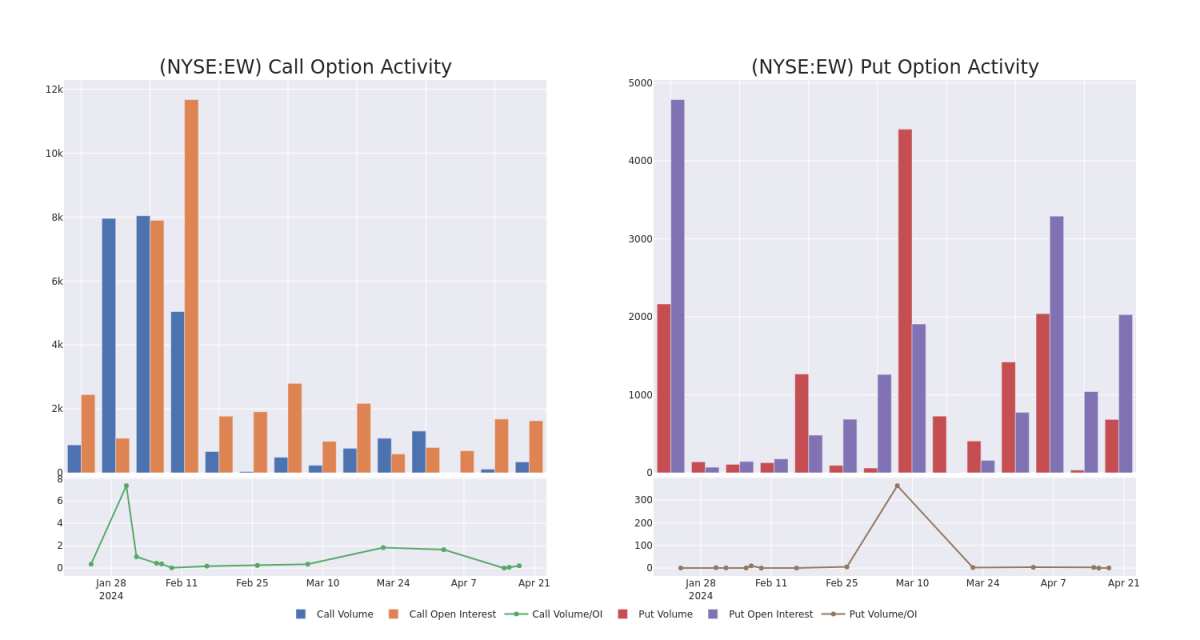

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Edwards Lifesciences's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Edwards Lifesciences's substantial trades, within a strike price spectrum from $80.0 to $95.0 over the preceding 30 days.

Edwards Lifesciences Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EW | PUT | SWEEP | BEARISH | 08/16/24 | $7.6 | $7.2 | $7.4 | $90.00 | $272.3K | 768 | 476 |

| EW | PUT | SWEEP | BEARISH | 01/17/25 | $9.4 | $9.2 | $9.4 | $90.00 | $250.6K | 86 | 0 |

| EW | CALL | SWEEP | BULLISH | 01/17/25 | $7.0 | $6.8 | $7.0 | $95.00 | $187.1K | 313 | 2 |

| EW | CALL | SWEEP | BEARISH | 08/16/24 | $5.5 | $5.3 | $5.31 | $90.00 | $138.4K | 1.0K | 214 |

| EW | CALL | SWEEP | BEARISH | 06/21/24 | $9.2 | $9.0 | $9.0 | $80.00 | $59.4K | 301 | 0 |

About Edwards Lifesciences

Spun off from Baxter International in 2000, Edwards Lifesciences designs, manufactures, and markets a range of medical devices and equipment for advanced stages of structural heart disease. It has established itself as a leader across key products, including surgical tissue heart valves, transcatheter valve technologies, surgical clips, and catheters. The firm derives about 55% of its total sales from outside the US.

Following our analysis of the options activities associated with Edwards Lifesciences, we pivot to a closer look at the company's own performance.

Where Is Edwards Lifesciences Standing Right Now?

- Currently trading with a volume of 3,121,938, the EW's price is down by -0.91%, now at $86.45.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 7 days.

Professional Analyst Ratings for Edwards Lifesciences

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $99.8.

- An analyst from Citigroup persists with their Neutral rating on Edwards Lifesciences, maintaining a target price of $98.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Edwards Lifesciences with a target price of $103.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Edwards Lifesciences, targeting a price of $92.

- An analyst from RBC Capital has decided to maintain their Outperform rating on Edwards Lifesciences, which currently sits at a price target of $101.

- An analyst from Mizuho has decided to maintain their Buy rating on Edwards Lifesciences, which currently sits at a price target of $105.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Edwards Lifesciences options trades with real-time alerts from Benzinga Pro.