Investors with a lot of money to spend have taken a bearish stance on Constellation Energy (NASDAQ:CEG).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CEG, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Constellation Energy.

This isn't normal.

The overall sentiment of these big-money traders is split between 37% bullish and 62%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $80,600, and 6 are calls, for a total amount of $764,033.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $180.0 to $195.0 for Constellation Energy over the recent three months.

Analyzing Volume & Open Interest

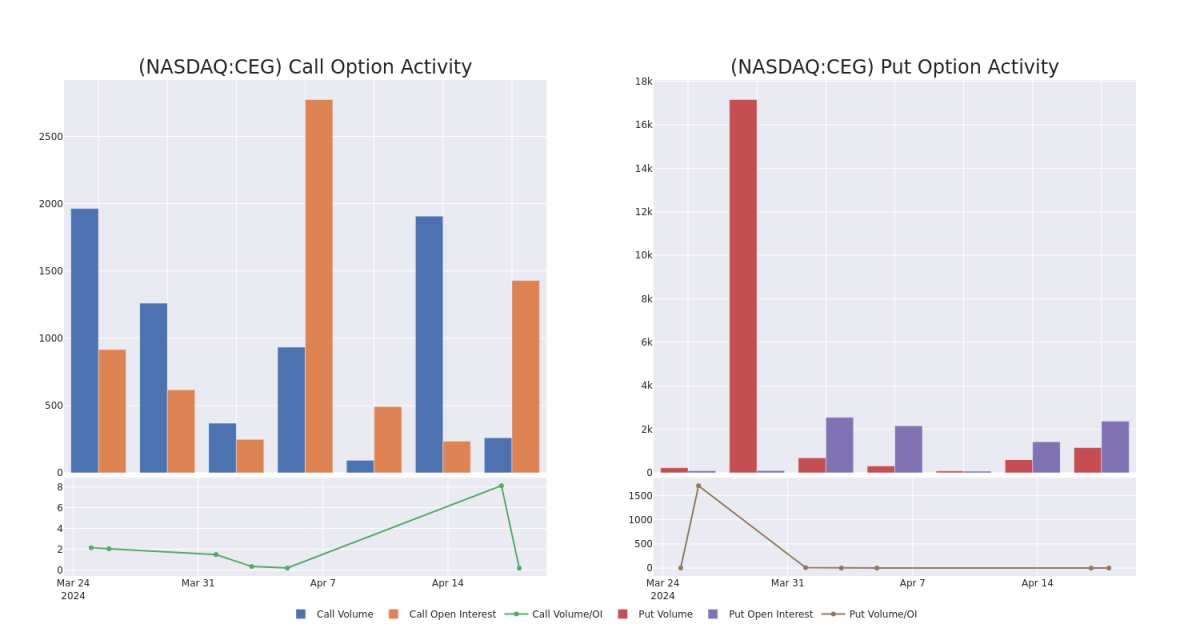

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Constellation Energy's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Constellation Energy's substantial trades, within a strike price spectrum from $180.0 to $195.0 over the preceding 30 days.

Constellation Energy Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | CALL | TRADE | BEARISH | 01/17/25 | $25.2 | $24.0 | $24.0 | $195.00 | $600.0K | 271 | 0 |

| CEG | PUT | SWEEP | BEARISH | 05/17/24 | $7.9 | $6.9 | $7.85 | $180.00 | $53.8K | 2.3K | 78 |

| CEG | CALL | SWEEP | BULLISH | 05/17/24 | $11.0 | $10.9 | $11.0 | $185.00 | $45.1K | 122 | 10 |

| CEG | CALL | SWEEP | BULLISH | 05/17/24 | $7.5 | $7.4 | $7.4 | $195.00 | $31.4K | 926 | 224 |

| CEG | CALL | TRADE | BEARISH | 11/15/24 | $27.3 | $25.6 | $26.1 | $185.00 | $31.3K | 110 | 12 |

About Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

Current Position of Constellation Energy

- With a trading volume of 637,015, the price of CEG is up by 0.45%, reaching $186.24.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 21 days from now.

What Analysts Are Saying About Constellation Energy

3 market experts have recently issued ratings for this stock, with a consensus target price of $194.66666666666666.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Constellation Energy, targeting a price of $193.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Constellation Energy, targeting a price of $198.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Constellation Energy with a target price of $193.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Constellation Energy options trades with real-time alerts from Benzinga Pro.