[Investment projects]

Wanxiang Qianchao (000559.SZ): Plans to build an R&D and manufacturing project with an annual output of 9 million constant velocity drive shafts

Wanxiang Qianchao (000559.SZ) announced that it intends to sign a framework agreement with the Wuhu Economic and Technological Development Zone Management Committee for an R&D and manufacturing project with an annual output of 9 million constant velocity drive shafts. The total investment in this project does not exceed 1.5 billion yuan.

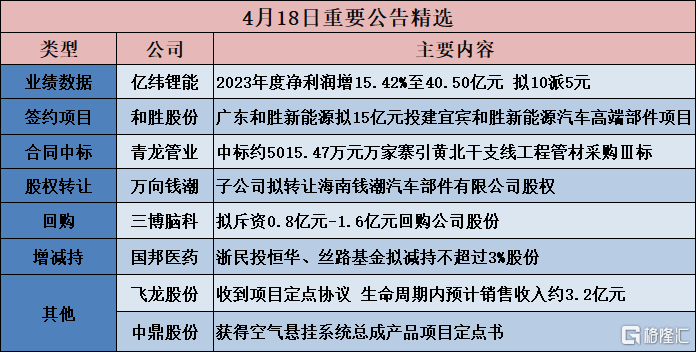

Hesheng Co., Ltd. (002824.SZ): Guangdong Hesheng New Energy plans to invest 1.5 billion yuan to build high-end components project for Yibin Hesheng NEV

Hesheng Co., Ltd. (002824.SZ) announced that the 31st meeting of the fourth board of directors was held on April 18, 2024 to review and pass the “Proposal on the Company's Signing of the 'Investment Agreement'” and agreed that the wholly-owned subsidiary Guangdong Hesheng New Energy Technology Co., Ltd. (“Guangdong Hesheng New Energy” or “Party B” for short) sign the “Investment Agreement” with the Yibin Sanjiang New Area Management Committee (“Party A”). After agreement between the two parties, it was decided to invest in the construction of the Yibin Hesheng New Energy Vehicle high-end components project in Yibin Sanjiang New Area (“Sanjiang New Area”). The total investment of the project is estimated at 1.5 billion yuan.

[[Contract won the bid]

Qingyun Technology (688316.SH): Qingyun Intelligent Computing signs 170 million yuan computing power service contract

Qingyun Technology (688316.SH) announced that recently, Qingyun Intelligent Computing signed a “Computing Power Service Contract” with the customer. The total contract cost is RMB 170 million (tax included). The above contract is the company's daily operating contract.

Qinglong Pipe Industry (002457.SZ): Won the bid III for the procurement of pipes for the Wanjiazhai Huangbei branch line project of about 50.1547 million yuan

Qinglong Pipe Industry (002457.SZ) announced that recently, Ningxia Qinglong Steel Plastic Composite Pipe Co., Ltd., a holding subsidiary of Ningxia Qinglong Pipe Group Co., Ltd., received the “Notice of Winning Bid” issued by Shanxi Wanjiazhai Diversion Huangbei Branch Line Water Service Co., Ltd., and Ningxia Qinglong Steel & Plastic Composite Pipe Co., Ltd. was the winning bidder for Wanjiazhai Diversion Huangbei Branch Line engineering pipe procurement. The winning bid amount was approximately RMB 50,147,700.

[[Share acquisition]

Wanxiang Qianchao (000559.SZ): The subsidiary plans to transfer shares in Hainan Qianchao Auto Parts Co., Ltd.

Wanxiang Qianchao (000559.SZ) announced that Wanxiang Intelligent Manufacturing Co., Ltd., a holding subsidiary of the company, plans to transfer 100% of its shares in Hainan Qianchao Auto Parts Co., Ltd. (“Hainan Qianchao Parts”) to Wanqingyuan Intelligent Vehicle Co., Ltd. Wanxiang Zhizao plans to sign an “Equity Transfer Agreement” with Wanqingyuan. Wanxiang Qingyuan plans to purchase 100% of Tongda's shares held by Tongda Company in cash, with a transaction amount of 19.0289 million yuan.

[Performance data]

Perea (603605.SH): Net profit in 2023 increased 46.06% year-on-year, and plans to distribute 9.1 yuan for 10 shares

Perea (603605.SH) released its 2023 annual report, with operating revenue of 8.9 billion yuan, up 39.45% year on year, net profit of 1.19 billion yuan, up 46.06% year on year, after deducting non-net profit of 1,174 billion yuan, up 48.91% year on year, with basic earnings per share of 3.01 yuan. A cash dividend of 9.1 yuan will be distributed to all registered shareholders for every 10 shares.

Chongqing Department Store (600729.SH): Net profit increased 48.84% year-on-year in 2023, and plans to distribute 10 to 13.56 yuan

Chongqing Department Store (600729.SH) released its 2023 annual report. The company achieved revenue of 18.985 billion yuan in 2023, up 3.72% year on year; net profit to mother of 1,315 billion yuan, up 48.84% year on year; after deducting non-net profit of 1,129 billion yuan, up 41.73% year on year; and basic earnings per share of 3.32 yuan. It is proposed to distribute a cash dividend of 1.3561 yuan (tax included) per share to all shareholders.

Jiejia Weichuang (300724.SZ): 2023 net profit of 1,634 billion yuan, plans to distribute 10 to 12 yuan

Jiejia Weichuang (300724.SZ) announced its 2023 annual report. In 2023, the company achieved operating income of 8.733 billion yuan, up 45.43% year on year; net profit attributable to shareholders of listed companies was 1,634 billion yuan, up 56.04% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 1,525 billion yuan, up 57.03% year on year; basic income per share was 4.69 yuan; it plans to distribute a cash dividend of 12 yuan (tax included) for every 10 shares to all shareholders.

Dongfang Yuhong (002271.SZ): Achieving revenue of 32.823 billion yuan in 2023, plans to distribute 10 to 6 yuan

Dongfang Yuhong (002271.SZ) released its 2023 annual report. In 2023, the company achieved revenue of 32.823 billion yuan, an increase of 5.15% over the previous year; of these, the retail business achieved revenue of 9.287 billion yuan, an increase of 28.11% over the previous year. In 2023, net profit attributable to shareholders of listed companies was 2,273 billion yuan, up 7.16% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 1,841 million yuan, up 2.05% year on year; basic earnings per share were 0.91 yuan; and a cash dividend of 6.00 yuan (tax included) for every 10 shares was planned to be distributed to all shareholders.

Everweft Lithium Energy (300014.SZ): Net profit increased 15.42% in 2023 to 4,050 billion yuan, and plans to pay 10 to 5 yuan

Everweft Lithium Energy (300014.SZ) announced its 2023 annual report. In 2023, the company achieved operating income of 48.784 billion yuan, up 34.38% year on year; net profit attributable to shareholders of listed companies was 4,050 billion yuan, up 15.42% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 2,755 billion yuan, up 2.23% year on year; basic income per share was 1.98 yuan; it plans to distribute a cash dividend of 5.00 yuan (tax included) for every 10 shares to all shareholders.

Huakang Co., Ltd. (605077.SH): Net profit in 2023 increased 16.34% year-on-year, and plans to transfer 10 to 3 to 7 yuan

Huakang Co., Ltd. (605077.SH) announced its 2023 annual report, with operating income of 2,783 million yuan, up 26.48% year on year; net profit attributable to shareholders of listed companies was 371 million yuan, up 16.34% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 357 million yuan, up 12.26% year on year; basic earnings per share were 1.63 yuan. The company plans to distribute a cash dividend of 7 yuan (tax included) to all shareholders for every 10 shares, and plans to transfer 3 shares to all shareholders for every 10 shares in a capital reserve fund.

Youfa Group (601686.SH): Net profit increased 91.85% year-on-year in 2023, and plans to pay 3 yuan

Youfa Group (601686.SH) released its 2023 annual report. During the reporting period, it achieved operating income of 60.918 billion yuan, a year-on-year decrease of 9.56%; net profit attributable to shareholders of listed companies of 570 million yuan, an increase of 91.85%; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 503 million yuan, an increase of 130.36% year on year; and basic earnings per share of 0.40 yuan. It is proposed to distribute a cash dividend of 3 yuan (tax included) for every 10 shares to all shareholders.

Huada New Materials (605158.SH): Net profit increased 65.28% year-on-year in 2023, and plans to pay 10 to 2 yuan

Huada New Materials (605158.SH) released its 2023 annual report. During the reporting period, it achieved operating income of 7.579 billion yuan, a year-on-year decrease of 6.57%; net profit attributable to shareholders of listed companies of 334 million yuan, an increase of 65.28% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 313 million yuan, an increase of 61.13% year on year; and basic earnings per share of 0.65 yuan. It is proposed to distribute a cash dividend of 2 yuan (tax included) for every 10 shares to all shareholders.

[Repurchase]

Xiechang Technology (301418.SZ): Plans to spend 10 million yuan to 20 million yuan to buy back shares

Xiechang Technology (301418.SZ) announced that the company plans to repurchase the company's shares through centralized bidding transactions. The shares repurchased will be used to implement equity incentives or employee stock ownership plans. The total repurchase capital shall not be less than RMB 10 million (inclusive) and not more than RMB 20 million (inclusive). The source of the repurchase funds was the overraised capital obtained from the company's initial public offering of RMB common shares. The share repurchase price does not exceed RMB 61.22 per share. The implementation period for share repurchase is within 12 months from the date the board of directors reviewed and approved the share repurchase plan.

Sanbo Neurology (301293.SZ): Plans to spend 80 million yuan to 160 million yuan to buy back the company's shares

Sanbo Brain Technology (301293.SZ) announced that based on confidence in future development and recognition of the company's value, the company plans to use no less than 80 million yuan (including capital) and no more than 160 million yuan (including capital) of its own capital to buy back the company's issued RMB common shares (A shares) through centralized bidding transactions in order to enhance investor confidence and maintain the interests of investors, taking into account the company's business conditions, business development prospects, company financial situation and future profitability. Under the condition that the repurchase price does not exceed 90 yuan/share (including the number of shares), the number of repurchases is about 1,777,777 shares, accounting for 1.12% of the company's total share capital; according to the lower limit of the total repurchase capital, the number of repurchases is about 888,888 shares, accounting for 0.56% of the company's total share capital. The implementation period for this repurchase shall not exceed 12 months from the date the board of directors reviewed and approved the share repurchase plan.

Guoxin Technology (688262.SH): Plans to spend 30 million yuan to 40 million yuan to buy back shares

Guoxin Technology (688262.SH) announced that the company plans to repurchase RMB common stock (A shares) shares already issued by the company through centralized bidding. The shares repurchased will be used for employee stock ownership plans or equity incentives at an appropriate time in the future. The total capital to be repurchased is not less than RMB 30 million (inclusive), and no more than RMB 40 million (inclusive). The repurchase price of shares shall not exceed RMB 32.56 per share (inclusive).

Qinghai Spring (600381.SH): Proposed to repurchase 30 million yuan to 50 million yuan of company shares

Qinghai Spring (600381.SH) announced that the total amount of capital to be repurchased is not less than RMB 30 million, no more than RMB 50 million of company shares, and that the repurchase price of shares shall not exceed RMB 8.19 per share.

[Increase or decrease holdings]

Nanwei Medical (688029.SH): Shareholder Huakang Limited plans to reduce its total holdings by no more than 1.99%

Nanwei Medical (688029.SH) announced that due to its own capital requirements, the company's shareholder Huakang Limited plans to reduce the total holdings of the company's shares by no more than 3,738,163 shares through centralized bidding and bulk transactions through the Shanghai Stock Exchange trading system. Of these, those planning to reduce their holdings through centralized bidding transactions on the stock exchange will reduce their holdings by no more than 1,878,474 shares within 90 days (May 15 to August 12, 2024) after 15 trading days (May 15 to August 12, 2024) from the date of disclosure of the shareholding reduction plan announcement The total number of shares held during the natural day will be reduced by no more than 1% of the total number of shares of the company; those who intend to reduce their holdings through bulk transactions will reduce their holdings by no more than 1,859,689 shares within 90 days (May 15 to August 12, 2024) after the disclosure of this holdings reduction plan. The total number of shares to be reduced through the above two methods does not exceed 1.99% of the company's total share capital.

Haichen Pharmaceutical (300584.SZ): Liu Xiaoquan plans to reduce its holdings by no more than 0.9%

Haichen Pharmaceutical (300584.SZ) announced that the shareholder Mr. Liu Xiaoquan plans to reduce his holdings of the company's shares by no more than 1,082,700 shares (0.90225% of the company's total share capital) through centralized bidding and bulk transactions within 3 months after 15 trading days from the date of disclosure of this announcement.

Guobang Pharmaceutical (605507.SH): Zhejiang Minjin Investment Henghua and Silk Road Fund plan to reduce their holdings by no more than 3%

Guobang Pharmaceutical (605507.SH) announced that due to their own capital requirements, shareholders Zhejiang Mintou Henghua and Silk Road Fund plan to reduce their holdings of the company's total shares by no more than 16,764,705 shares through centralized bidding and bulk transactions, with a reduction ratio of no more than 3% of the company's total share capital.

Jiangyan Group (601065.SH): Sino-Singapore Construction Investment Group plans to reduce its holdings by no more than 3%

Jiangyan Group (601065.SH) announced that Sino-Singapore Investment Corporation plans to reduce its holdings of the company's shares through centralized bidding and bulk transactions by no more than 19,283,281 shares, or no more than 3.00% of the company's total share capital.

[Other]

Zhongding Co., Ltd. (000887.SZ): Obtained the Air Suspension System Assembly Product Project Designation Letter

Zhongding Co., Ltd. (000887.SZ) announced that the company's subsidiary Anhui Zhongding Shock Absorber Rubber Technology Co., Ltd. recently received a notice from a customer that the company became a batch supplier of air suspension system assembly products for a new platform project of a domestic new energy brand OEM (limited to a confidentiality agreement, unable to disclose its name, “customer” for short). The life cycle of this project is 6 years, and the total life cycle amount is about 1,418 billion yuan.

Feilong Co., Ltd. (002536.SZ): Estimated sales revenue of about 320 million yuan during the life cycle of receiving the fixed-point agreement for the project

Feilong Co., Ltd. (002536.SZ) announced that the company recently received a “Project Fixed-Point Agreement” from an internationally renowned auto parts company (based on a confidentiality agreement between the parties, making it difficult to disclose the customer's specific name). According to the agreement, the company became the supplier of turbocharger housings for this customer's project, with estimated sales revenue of about 320 million yuan during the life cycle.