Investors with a lot of money to spend have taken a bearish stance on Mastercard (NYSE:MA).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 12 uncommon options trades for Mastercard.

This isn't normal.

The overall sentiment of these big-money traders is split between 41% bullish and 58%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $59,400, and 10 are calls, for a total amount of $301,415.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $460.0 to $485.0 for Mastercard during the past quarter.

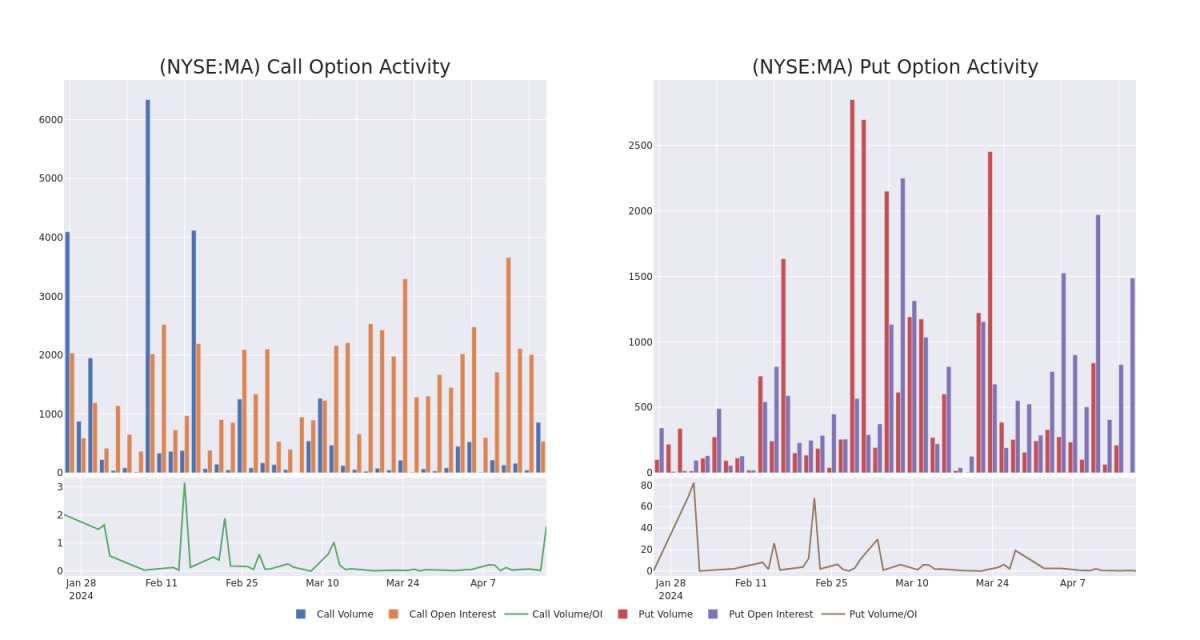

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Mastercard's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Mastercard's significant trades, within a strike price range of $460.0 to $485.0, over the past month.

Mastercard 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MA | CALL | SWEEP | BEARISH | 09/20/24 | $18.6 | $18.2 | $18.45 | $485.00 | $31.3K | 374 | 18 |

| MA | CALL | SWEEP | BULLISH | 09/20/24 | $18.25 | $17.95 | $18.25 | $485.00 | $31.0K | 374 | 103 |

| MA | CALL | SWEEP | BULLISH | 09/20/24 | $18.25 | $18.0 | $18.25 | $485.00 | $31.0K | 374 | 69 |

| MA | CALL | SWEEP | BEARISH | 09/20/24 | $18.4 | $17.95 | $18.2 | $485.00 | $30.9K | 374 | 120 |

| MA | CALL | SWEEP | BEARISH | 09/20/24 | $18.35 | $17.9 | $18.15 | $485.00 | $30.8K | 374 | 86 |

About Mastercard

Mastercard is the second-largest payment processor in the world, having processed close to over $9 trillion in volume during 2023. Mastercard operates in over 200 countries and processes transactions in over 150 currencies.

In light of the recent options history for Mastercard, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Mastercard

- Currently trading with a volume of 165,151, the MA's price is down by -0.03%, now at $460.01.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 13 days.

Expert Opinions on Mastercard

In the last month, 5 experts released ratings on this stock with an average target price of $530.0.

- Maintaining their stance, an analyst from Mizuho continues to hold a Buy rating for Mastercard, targeting a price of $480.

- An analyst from TD Cowen has revised its rating downward to Buy, adjusting the price target to $545.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Mastercard with a target price of $545.

- Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Mastercard with a target price of $545.

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Mastercard, targeting a price of $535.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.