Key Insights

- City Developments will host its Annual General Meeting on 24th of April

- Salary of S$986.0k is part of CEO Sherman Kwek's total remuneration

- The total compensation is 316% higher than the average for the industry

- City Developments' EPS grew by 92% over the past three years while total shareholder loss over the past three years was 21%

Shareholders of City Developments Limited (SGX:C09) will have been dismayed by the negative share price return over the last three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 24th of April. They could also influence management through voting on resolutions such as executive remuneration. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

How Does Total Compensation For Sherman Kwek Compare With Other Companies In The Industry?

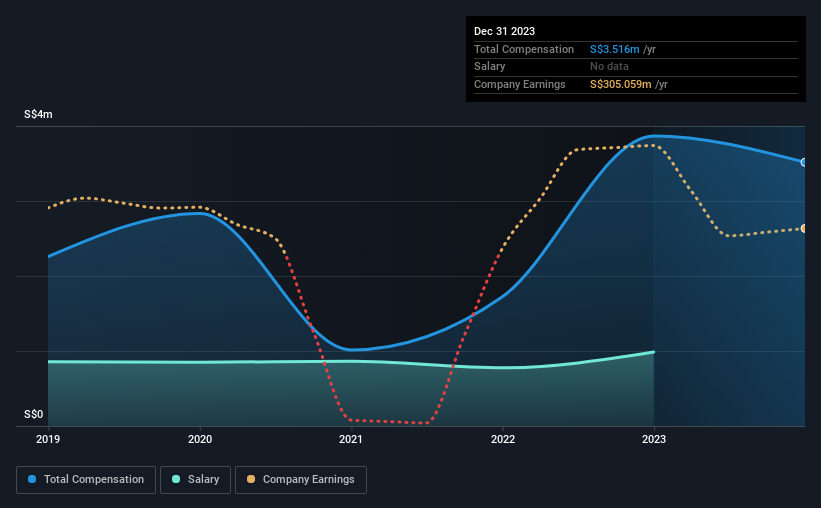

According to our data, City Developments Limited has a market capitalization of S$5.1b, and paid its CEO total annual compensation worth S$3.5m over the year to December 2023. That's a notable decrease of 9.1% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at S$986k.

In comparison with other companies in the Singaporean Real Estate industry with market capitalizations ranging from S$2.7b to S$8.7b, the reported median CEO total compensation was S$844k. Hence, we can conclude that Sherman Kwek is remunerated higher than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | S$986k | S$776k | 28% |

| Other | S$2.5m | S$3.1m | 72% |

| Total Compensation | S$3.5m | S$3.9m | 100% |

On an industry level, around 59% of total compensation represents salary and 41% is other remuneration. In City Developments' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

City Developments Limited's Growth

Over the past three years, City Developments Limited has seen its earnings per share (EPS) grow by 92% per year. In the last year, its revenue is up 50%.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has City Developments Limited Been A Good Investment?

Since shareholders would have lost about 21% over three years, some City Developments Limited investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 3 warning signs for City Developments (1 is potentially serious!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.