Financial giants have made a conspicuous bullish move on Nucor. Our analysis of options history for $Nucor (NUE.US)$ revealed 14 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $402,619, and 9 were calls, valued at $314,549.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $225.0 for Nucor over the recent three months.

Analyzing Volume & Open Interest

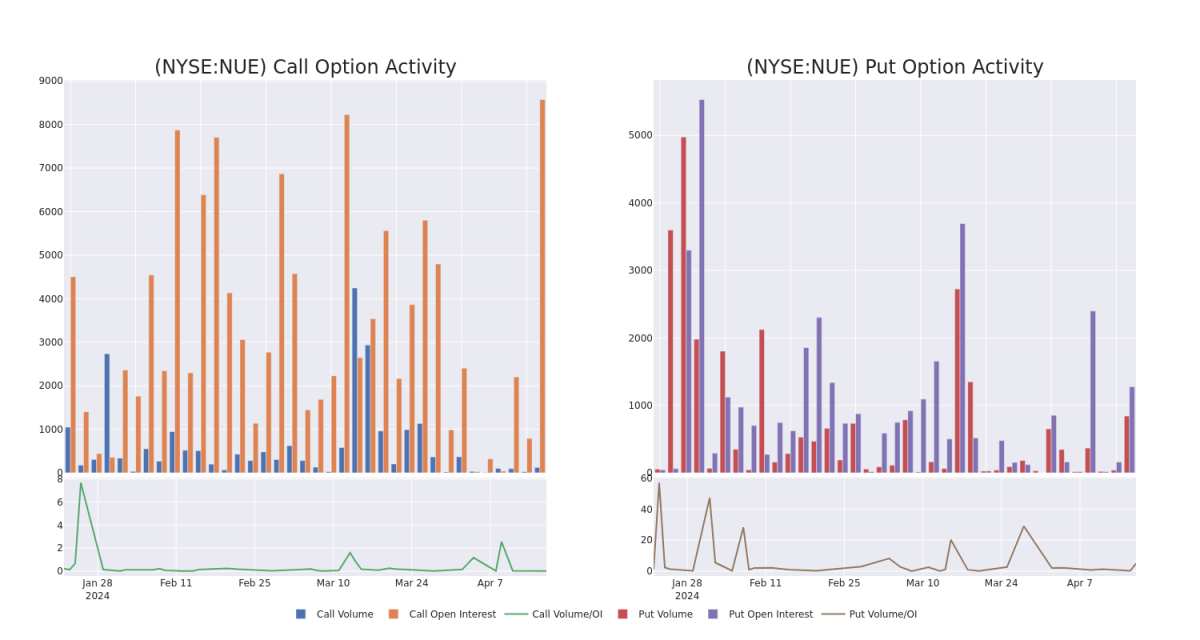

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Nucor's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Nucor's substantial trades, within a strike price spectrum from $150.0 to $225.0 over the preceding 30 days.

Nucor Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

NUE | PUT | TRADE | BULLISH | 06/21/24 | $5.8 | $5.5 | $5.5 | $185.00 | $220.0K | 922 | 413 |

NUE | PUT | SWEEP | BULLISH | 05/17/24 | $3.9 | $3.6 | $3.67 | $185.00 | $74.1K | 98 | 402 |

NUE | CALL | TRADE | BULLISH | 01/16/26 | $30.0 | $28.7 | $29.6 | $210.00 | $53.2K | 2.2K | 0 |

NUE | PUT | TRADE | BEARISH | 04/26/24 | $34.7 | $30.9 | $33.4 | $225.00 | $50.1K | 6 | 0 |

NUE | CALL | TRADE | BEARISH | 01/16/26 | $26.2 | $24.6 | $25.1 | $220.00 | $47.6K | 334 | 0 |

About Nucor

Nucor Corp manufactures steel and steel products. The company also produces direct reduced iron for use in its steel mills. The operations include international trading and sales companies that buy and sell steel and steel products manufactured by the company and others. The operating business segments are: steel mills, steel products, and raw materials, the steel mills segment derives maximum revenue. The steel mills segment includes carbon and alloy steel in sheet, bars, structural and plate; steel trading businesses; rebar distribution businesses; and Nucor's equity method investments in NuMit and NJSM.

Current Position of Nucor

With a volume of 1,150,369, the price of NUE is up 0.35% at $192.78.

RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

Next earnings are expected to be released in 5 days.

What The Experts Say On Nucor

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $195.0.

An analyst from JP Morgan persists with their Neutral rating on Nucor, maintaining a target price of $195.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.