Up to now, over 100 companies in the A-share and Hong Kong-share utilities and environmental protection industries have successively published their 2023 annual reports. Among many utility companies, the performance of most companies showed a steady growth trend, which once again proved the industry's high performance certainty. Among these, the performance of Volkswagen Public Service is particularly remarkable. The growth rate of net profit to mother after deducting non-recurring profit and loss in 2023 was remarkable.

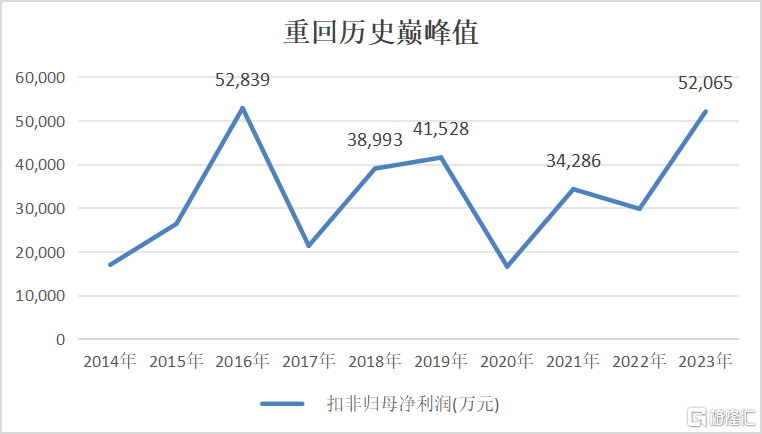

According to the 2023 annual report of Volkswagen Public Utilities, the company achieved operating income of 6.303 billion yuan during this fiscal year, an increase of 9.26% over the same period last year, successfully breaking the record; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss increased by 223 million yuan year-on-year, an increase of 74.81%! This result is also the second peak achieved by the company since listing, and is only slightly lower than the highest data in 2016. It can be said that Volkswagen Public Utilities has basically returned to the peak of its historical performance.

Analyzing this financial report in depth, it is not difficult to find that the company has not only achieved significant growth in performance, but also achieved high-quality growth. The company's overall debt level has been effectively improved, showing a sound financial structure. At the same time, the company's cash flow remains abundant, laying a solid foundation for future development.

Focus on the main utility industry

This series of results was achieved thanks to the company's optimization of the business structure and precise strategic layout in 2023. The company focused on its main business, continued to strengthen the strength of the utility sector, and achieved steady operation. In the field of financial venture capital, the company maintained a cautious attitude and effectively avoided potential risks by promoting the orderly exit of the project.

During the reporting period, the company steadily promoted the development of the gas business. Financial reports show that in 2023, the company's revenue from gas sales increased 11.03% year on year to 5.358 billion yuan, up 11.03% year on year, and gross margin increased 1.62 percentage points year on year to 10.33%. Volkswagen Public Utilities has extensive market penetration in the Yangtze River Delta region. It provides services to millions of users through a network of thousands of kilometers long, and has a strong market base. Shanghai Dazhong Gas has consolidated its competitive position by steadily expanding its incremental business; Nantong Dazhong Gas has completed price adjustment and the development of a comprehensive smart gas management platform. During the reporting period, Shanghai Dazhong Gas achieved 1.02 billion cubic meters of natural gas sales, an increase of 5.92% over the previous year; while the sales volume of Nantong Dazhong Gas reached 380 million cubic meters, an increase of 7.13% over the previous year.

Since 2023, many parts of the country have successively promoted favorable price policies for residents to solve the problem of inverted sales prices on the residential side of urban combustion companies and guarantee residents' gas consumption. According to statistics, between 2022 and February 2024, a total of 135 prefecture-level cities (accounting for 47%) across the country had favorable gas prices for residents, with a price increase of 0.22 yuan/square meter. The Dongwu Securities Research Institute believes that the off-season is coming soon, and cities that have not had favorable prices will use the off-season window period to continue to promote favorable prices. It is expected that more cities will promote the implementation of favorable prices before the 2024 heating period arrives (before the end of October 2024), and estimates that the reasonable value of urban fuel gas distribution costs is 0.6 yuan/square meter or more, and there is still room for 20% repair of the price difference. Influenced by the upward trend in price spreads, the elasticity of Volkswagen's utility gas business is expected to continue to expand.

In terms of sewage treatment business, the company achieved revenue of 312 million yuan during the reporting period, an increase of 17.21% over the previous year. Currently, the company operates 9 sewage treatment plants in Shanghai and Jiangsu, with a total treatment capacity of 440,000 tons/day. Among them, the subsidiary Volkswagen Jiading has a daily treatment scale of 175,000 tons, and the effluent standard has reached Level 1 A+, the highest sewage discharge standard in Shanghai; the subsidiary Jiangsu Volkswagen's current business mainly involves Yunlong District, Jiawang District and Pei County in Xuzhou City, Jiangsu Province, and the four districts and counties of Pizhou City and Donghai County in Lianyungang, with a total treatment scale of 265,000 tons/day. These projects have entered a stable and mature stage, and have become high-quality assets with low volatility and high dividends.

It is worth mentioning that during the reporting period, the company actively assumed social responsibility, greatly helped people's livelihood and work, and was once again included in the “2023 Shanghai Top 100 Service Enterprises List”. In 2023, Shanghai Dazhong Gas completed two practical municipal government projects: “Replacing gas fuel connecting hoses for existing gas residents” and “installing gas alarms for elderly people living alone”. Furthermore, Shanghai Volkswagen Gas and Volkswagen Logistics became the insurance and supply units for the 6th China Import Expo, and successfully completed the luggage transportation guarantee task for foreign political delegates to the 6th CIIE, and received a letter of commendation from the Shanghai Foreign Affairs Office. All of the above highlights the public's heavy public responsibility.

Empowering technology to promote a virtuous cycle of “technology - industry - finance”

Looking at it from the top down, it's easy to see that the development of the digital economy has become the strongest voice of the times. According to the “14th Five-Year Plan” digital economy, China will further promote the development of the digital economy. By 2025, the digital economy should enter a comprehensive expansion model, and the value added of core industries in the digital economy will account for 10% of GDP.

The government's tasks this year will prioritize vigorously promoting the construction of a modern industrial system and speeding up the development of new quality productivity. New quality productivity is a new type of productivity that is different from traditional productivity. It is a type of productivity based on scientific and technological innovation. It is a new type of productivity that breaks away from traditional growth paths and meets the requirements of high-quality development. It is also a key focus point for China to reshape new advantages in global competition in the new era. Currently, our country is at a critical stage in the digitalization of the economy.

In this context, mass utilities are based on digital and intelligent technology to achieve deep integration between public utilities and the digital economy, and create new business formats, models, and new scenarios for smart utilities that integrate numbers and reality.

Specifically, in terms of urban gas, through the application of ERP systems, the company cooperates with many organizations to actively expand extended services and continuously increase the revenue share of gas value-added services; in the environmental and municipal sector, public utilities are further promoting informatization construction and achieving intelligent management through the establishment of energy consumption and equipment management systems to reduce operation and maintenance costs and ensure the continuous and stable operation of environmental facilities.

In the urban transportation and logistics business, public utilities are also actively exploring and innovating. In terms of urban transportation, the company combined the Internet model to improve the operational efficiency of the urban transportation system through functions such as the “mass travel app”. In terms of logistics transportation, the company has achieved integrated management of various logistics operation resources through a self-built logistics public information service platform and a supply chain collaborative innovation service platform, providing users with efficient and convenient logistics vehicle services.

As can be seen, public utilities are promoting the transformation of public utilities to digitalization and intelligence, which not only brings more efficient and convenient public services, but also injects new impetus into the sustainable development of cities. In the future, with the continuous advancement of technology and the deepening of applications, public utilities will continue to play a leading role, making greater contributions to building smart utilities, smart cities, and promoting the digital economy.

In addition to directly empowering utilities with technology, Dazhong Public Utilities has long had a forward-looking layout in the field of financial venture capital to promote the development of the technology industry and digital economy by guiding the efficient allocation of capital. The company's early investment layout has entered a period of harvest. Faced with an increasingly complex investment environment, the company has adopted a more prudent strategy, focused its work on utilities, and promoted the steady exit of already invested projects. This strategy not only helps the company optimize its business portfolio, but also lays a solid foundation for the company's long-term development. In the future, through a virtuous cycle of “technology - industry - finance”, public utilities are expected to contribute more to the booming development of the digital economy.

Actively give back to investors

As mentioned at the beginning, the company has achieved high-quality growth. Not only has it performed well in terms of book profit, but its actual cash flow value has also improved significantly. During the reporting period, net cash flow from the company's operating activities increased by 272 million yuan year on year, an increase of 65.26%; in terms of balance ratio, the company showed a steady financial situation, falling to 57.36% year on year, down 2.03 percentage points from the same period last year. Stable cash flow helps the company predict future capital conditions, while good profits and reduced debt levels help increase the company's distributable profits, which can be used for dividends.

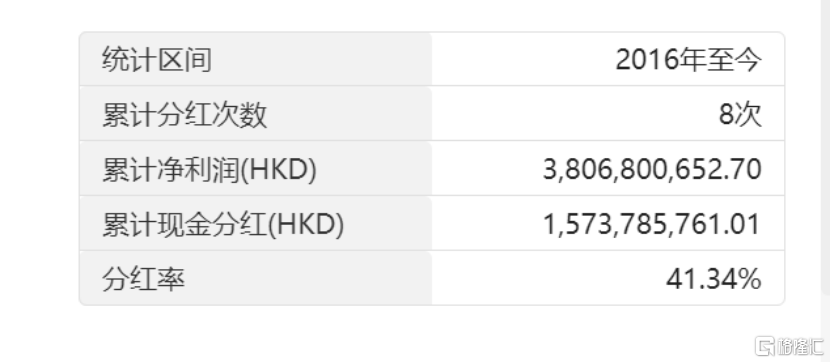

According to the announcement, the company announced a cash dividend of 0.35 yuan (tax included) for every 10 shares, and the share payout ratio is close to 50%. Dazhong Public Utilities has always had a good history of dividends, and insists on repaying the trust and support of shareholders and investors through continuous and stable dividends. The company maintained a share payout ratio of close to 50% for most of the years after listing. Even under the special circumstances of loss of profits in 2022, the company insisted on dividends, demonstrating the company's sincerity and high sense of responsibility towards shareholders and investors.

Public utilities have the three characteristics of steady operation, abundant cash flow, and stable dividends. When economic trends are unclear, there are no clear signs of prosperity, and booming industries are relatively scarce, these three advantages will be amplified, and it is expected that they will continue to be given a definitive premium.

This is reminiscent of Buffett's emphasis on investing in the utility sector. Berkshire Hathaway owns a number of utility companies, such as hydropower and energy sources, and has achieved a long-term steady return on investment. These companies have a strong ability to withstand falls because they provide basic necessities of life — no matter what, people always need electricity, gas, and running water (including sewage). As a result, good utility companies usually have solid fundamentals and generally have stable cash flow, which can meet the considerations of being resistant to economic cyclicality. In addition to the three major advantages, Berkshire Hathaway's “favorite” utilities often have longer-term considerations — utilities often face strict regulations and entry barriers, which create high competitive barriers for leading companies in the industry, help companies maintain long-term profitability and bring stable returns to investors.

In summary, Volkswagen Public Utility's performance in 2023 can be summed up as good financial performance, steady operating strength, and a stable and continuous dividend policy. Looking ahead, we expect the company to continue to maintain steady and continuous returns to shareholders and achieve long-term value growth.