As the US economy grew month after month, hundreds of thousands of jobs were created. Experts warning of an impending recession were perplexed, and some Wall Streeters began to accept a marginal economic theory.

They are wondering if it is possible that all of these interest rate hikes in the past two years have actually boosted the economy. In other words, it is not “the economy is still booming despite rising interest rates”; the real situation is probably “the economy is booming precisely because interest rates have risen.”

The idea was so radical that it was almost heretical in mainstream academia and finance. Only Turkey's populist President Recep Tayyip Erdogan or the most fanatical fans of modern monetary theory would dare publicly state such a conclusion.

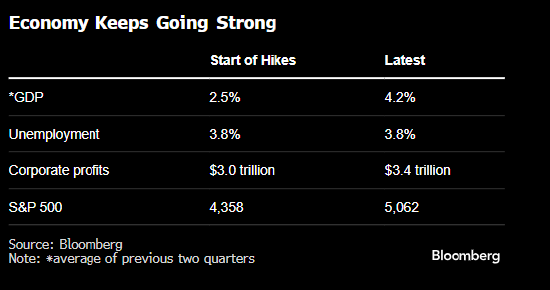

But some new “converts” and a few who admit to being at least curious about this idea believe that economic evidence is becoming increasingly impossible to ignore. Judging from key indicators such as GDP, unemployment, and corporate profits, the current economic expansion is as strong as when the Federal Reserve first raised interest rates, and it can even be said that it is even stronger.

Kevin Muir, a former derivatives trader at RBC Capital Markets, said, “There are opinions that this is because the increase in the benchmark interest rate from 0 to more than 5% enabled Americans to earn significant income from bond investments and savings accounts for the first time in 20 years. The reality is that people have more money”.

In theory, these people and businesses will use a large portion of the newly obtained capital to boost demand and stimulate economic growth.

In a typical interest-rate hike cycle, this group's additional spending is far insufficient to keep up with falling demand from those who have stopped borrowing; it is this that causes the economic downturn (associated with falling inflation) caused by the typical Federal Reserve. Muir said that Americans thought the economy would follow this pattern and “slow down sharply,” but “but I don't see it that way; I think the economy will become more balanced, and may even have a slight stimulus effect.”

David Einhorn of Greenlight Capital is one of the most well-known traitors. He cites several special reasons, the most important of which is the impact of the explosive growth of the US budget deficit. Government debt has soared to $35 trillion, double what it was ten years ago, meaning that US and foreign bond investors will have an additional interest income of about $50 billion a month.

This phenomenon makes rising interest rates stimulating rather than restrictive to the economy. Economist Warren Mosler clearly saw this for many years, but as one of the most outspoken advocates of modern monetary theory (MMT), his interpretation has long been dismissed as heresy. When Mosler saw some mainstream groups begin to shift, he had a feeling that his perspective was confirmed. “I've been talking about this a long time ago,” he said.

Muir readily admitted that he was one of those who mocked Mosler many years ago. He said, “I think he's crazy. This theory doesn't make sense at all”. But as the economy continued to take off after the pandemic ended, he felt it was necessary to take a close look at these numbers, and finally came to a surprising conclusion: Mosler was right.

Apollo Global Management chief economist Torsten Slok is “really weird”

As one of Wall Street's most famous value investors, Einhorn was exposed to this theory earlier than Muir. At the time, Einhorn observed that although the Federal Reserve kept interest rates at zero after the global financial crisis, economic growth was very slow. He believes that although raising interest rates to the limit clearly does not help the economy. For example, interest rates to 8% hit borrowers too hard, raising interest rates to a more moderate level may boost the economy.

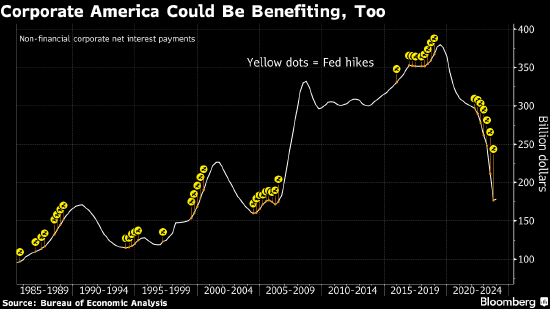

Einhorn points out that American households can earn income from over $13 trillion in short-term interest-bearing assets, which are almost three times the size of $5 trillion in consumer debt. He estimates that, based on today's exchange rate, the net income that residents can get each year is about 400 billion US dollars.

In a February podcast, Einhorn said, “When interest rates fall below a certain level, economic growth actually slows down.” He believes that the opinion that the Federal Reserve needs to start cutting interest rates to avoid a slowdown is “very strange.”

What needs to be clear is that the vast majority of economists and investors still believe in the age-old principle that high interest rates hinder economic growth. They used the rise in credit card and car loan delinquency rates as evidence, and that although employment growth is still strong, it has already slowed.

Mark Zandi, the chief economist at Moody's Analytics, represents the traditionalist, and he believes the new theory is completely “seriously wrong.” But even Zandi admits that high interest rates are causing less damage to the economy than before.

He said that one of the key factors for the economy to remain resilient is that many Americans have managed to keep interest rates on 30-year mortgages at ultra-low levels during the pandemic, which has greatly reduced the pain caused by interest rate hikes. (This is very different from the situation in other parts of the world. Mortgage interest rates in many developed countries have risen rapidly along with the benchmark interest rate.)

Bill Eigen, the J.P. Morgan Bond Fund manager, is not a direct supporter of the new theory. He is more inclined to support the general framework of this idea. This position made him realize the need to readjust his investment portfolio and inject more cash. This decision made the active bond fund he managed rank in the top 10% in the industry in terms of return over the past three years.

Eigen also has two side jobs; he runs a fitness center and an auto repair shop. Consumer spending at both stores continues to rise, Eigen said, particularly for retirees. He believes that retirees are probably the biggest beneficiaries of interest rate hikes.