Oil traders bought more than 3 million barrels of crude oil in options contracts, betting that as geopolitical risks remain high, oil prices will soar to $250 per barrel by June.

According to the data, about 3,000 lots of US crude oil with an execution price of 250 US dollars were traded in June, and the unit price was 1 cent. Some traders and brokers say this is probably a “lottery” transaction. If the price soars to an unheard level by the middle of next month, this lottery ticket may win, but it also seems that this deal also comes with a $25 put option, so it may also be a macro-strategic transaction.

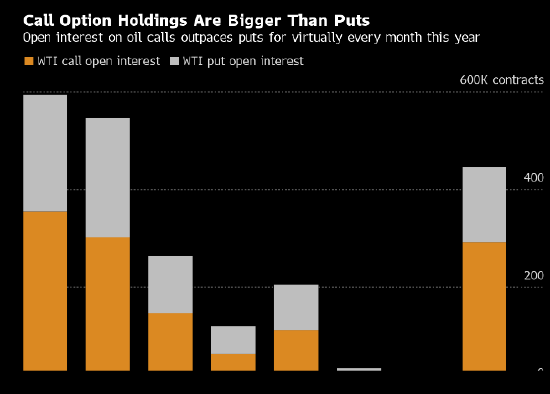

The volume of crude oil call options surged to a record high, and the premium of call options over put options jumped to the highest level since October last year this week.

U.S. crude oil futures rose above $85, and the price of Brent crude oil approached $90 as concerns about the escalation of the Middle East conflict were heightened by a background of tight supply and strong demand.