Fujian Tianma Science and Technology Group Co., Ltd (SHSE:603668) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

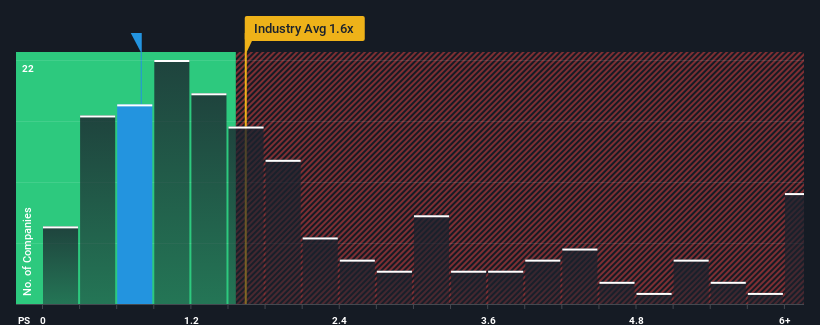

Following the heavy fall in price, Fujian Tianma Science and Technology Group's price-to-sales (or "P/S") ratio of 0.8x might make it look like a buy right now compared to the Food industry in China, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Fujian Tianma Science and Technology Group's P/S Mean For Shareholders?

Fujian Tianma Science and Technology Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Fujian Tianma Science and Technology Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Fujian Tianma Science and Technology Group's Revenue Growth Trending?

In order to justify its P/S ratio, Fujian Tianma Science and Technology Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 92% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Turning to the outlook, the next year should generate growth of 39% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

In light of this, it's peculiar that Fujian Tianma Science and Technology Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Fujian Tianma Science and Technology Group's P/S Mean For Investors?

Fujian Tianma Science and Technology Group's recently weak share price has pulled its P/S back below other Food companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at Fujian Tianma Science and Technology Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Fujian Tianma Science and Technology Group (at least 1 which shouldn't be ignored), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Fujian Tianma Science and Technology Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.