The Midland Holdings Limited (HKG:1200) share price has softened a substantial 31% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 15% share price drop.

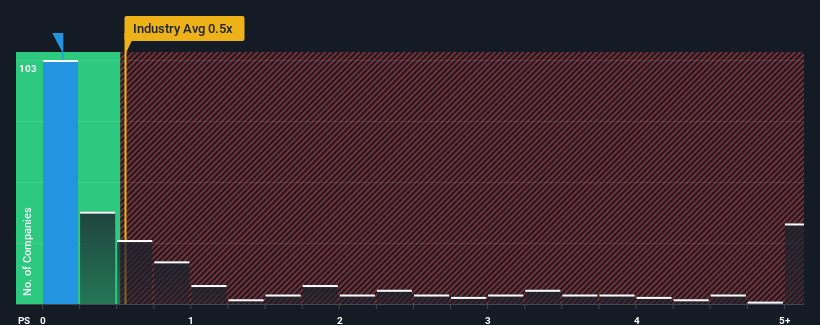

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Midland Holdings' P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in Hong Kong is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Midland Holdings' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Midland Holdings has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Midland Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Midland Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Midland Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 31% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 18% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 7.5% each year during the coming three years according to the sole analyst following the company. That's shaping up to be similar to the 5.6% per annum growth forecast for the broader industry.

In light of this, it's understandable that Midland Holdings' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Midland Holdings' P/S?

Midland Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Midland Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Real Estate industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Before you take the next step, you should know about the 2 warning signs for Midland Holdings (1 doesn't sit too well with us!) that we have uncovered.

If these risks are making you reconsider your opinion on Midland Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.