Eagle Materials' (NYSE:EXP) stock is up by a considerable 25% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study Eagle Materials' ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. Put another way, it reveals the company's success at turning shareholder investments into profits.

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Eagle Materials is:

38% = US$501m ÷ US$1.3b (Based on the trailing twelve months to December 2023).

The 'return' is the profit over the last twelve months. That means that for every $1 worth of shareholders' equity, the company generated $0.38 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Eagle Materials' Earnings Growth And 38% ROE

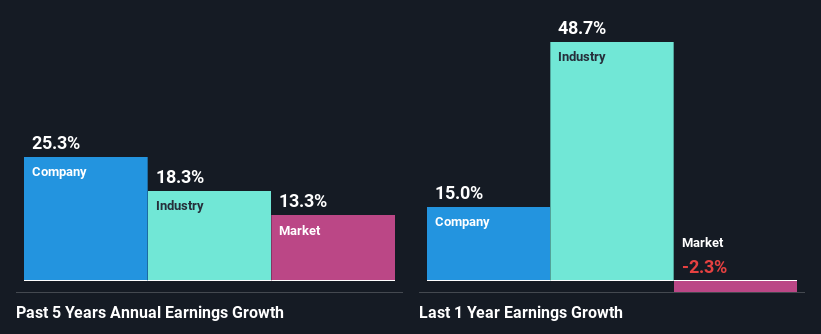

First thing first, we like that Eagle Materials has an impressive ROE. Secondly, even when compared to the industry average of 14% the company's ROE is quite impressive. Under the circumstances, Eagle Materials' considerable five year net income growth of 25% was to be expected.

As a next step, we compared Eagle Materials' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 18%.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for EXP? You can find out in our latest intrinsic value infographic research report.

Is Eagle Materials Making Efficient Use Of Its Profits?

Eagle Materials' three-year median payout ratio to shareholders is 7.8%, which is quite low. This implies that the company is retaining 92% of its profits. So it seems like the management is reinvesting profits heavily to grow its business and this reflects in its earnings growth number.

Besides, Eagle Materials has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 5.8% over the next three years. However, the company's ROE is not expected to change by much despite the lower expected payout ratio.

Summary

Overall, we are quite pleased with Eagle Materials' performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.