[Investment projects]

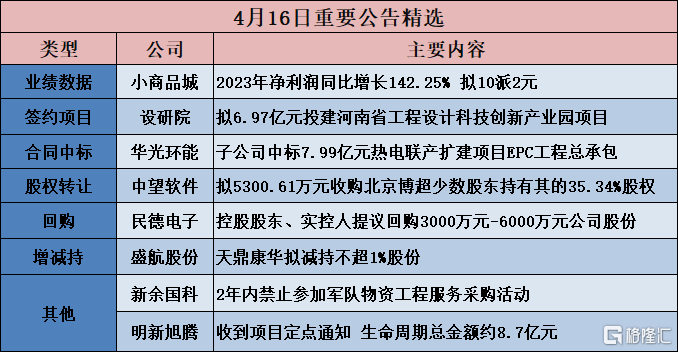

Research Institute (300732.SZ): Plans to invest 697 million yuan to build the Henan Engineering Design Science and Technology Innovation Industrial Park project

The Institute of Construction and Research (300732.SZ) announced that the company held the 20th meeting of the 3rd board of directors on April 16, 2024 to review and pass the “Proposal on Investing in the Construction of the Henan Engineering Design Science and Technology Innovation Industrial Park”. In response to the “Design Henan” strategic plan of the Henan Provincial Committee and the provincial government and the planning layout of Zhengzhou to build a “Design Henan” pilot zone and build a “design capital”, the Research Institute plans to build the “Henan Engineering Design Science and Technology Innovation Industrial Park”. The total investment of the project is estimated at 697 million yuan (including the cost of obtaining land use rights in the early stages of 89.3 million yuan). The industrial park plan is being implemented in two phases.

[[Contract won the bid]

Huaguang Huaneng (600475.SH): The subsidiary won the EPC general contract for the 799 million yuan cogeneration expansion project

Huaguang Huaneng (600475.SH) announced that the company's holding company, Huaguang Environmental Energy (Xi'an) Design and Research Institute Co., Ltd. (“Huaguang Huanguang Environmental Energy (Xi'an) Design Institute”) received the “Notice of Winning the Tender” from the tenderer, Wuxi Nengda Thermoelectric Co., Ltd., confirming that the company won the bid for the “Wuxi Nengda Thermoelectric Co., Ltd. Cogeneration Expansion Project EPC General Contract” project with a bid amount of 799 million yuan.

[[Share acquisition]

Starlight Co., Ltd. (002076.SZ): Proposed capital increase to acquire 51% of Guangdong Ruifeng Culture Technology's shares

Starlight Co., Ltd. (002076.SZ) announced that in order to promote collaboration, enable technological innovation in the main business, and enhance development space, the company plans to use its wholly-owned subsidiary Guangdong Xingguang Investment Holdings Co., Ltd. (“Starlight Investment Control”) to increase the capital of Guangdong Ruifeng Culture Technology Co., Ltd. (“Guangdong Ruifeng Culture Technology”) with its own capital of 35.3878 million yuan (“Guangdong Ruifeng Culture Technology”). After the capital increase is completed, the registered capital of Guangdong Ruifeng Culture Technology will increase from 20.08 million yuan to 49.796 million yuan. The company will hold 1% of Guangdong Ruifeng Culture Technology's 5 shares Quan, Guangdong Rui Feng Culture Technology will become a holding subsidiary of the company and will be included in the scope of the company's consolidated statements. The original shareholder Guangzhou Ruifeng Audio Technology Co., Ltd. will hold 49% of Guangdong Ruifeng Culture Technology's shares.

Zhongwang Software (688083.SH): Plans to acquire 35.34% of Beijing Bochao's minority shareholders for 53.61 million yuan

Zhongwang Software (688083.SH) announced that according to the company's overall strategic layout, and based on the company's confidence in the future development of Beijing Bochao, the company plans to use 53.06 million yuan of its own capital to acquire 35.34% of Beijing Bochao's shares held by Beijing Bochao minority shareholders Lin Fei, Xiao Zhou, Li Yonghe, Cao Weiwei, Jianzhao Technology, and Jianyuan Changxing. After the transaction was completed, the company held 100% of Beijing Bochao's shares, and Beijing Bochao is a wholly-owned subsidiary of the company.

Yatong Co., Ltd. (600692.SH): Plans to sell 100% of the shares in the wholly-owned subsidiary Yinma Industrial

Yatong Co., Ltd. (600692.SH) announced that it intends to transfer 100% of the shares held by the company in Shanghai Yinma Industrial Co., Ltd. (“Yinma Industrial”) through a private agreement on the Shanghai Joint Stock Exchange. The transaction price was determined to be 22.132,400 yuan based on the evaluation results.

[Performance data]

Small Commodity City (600415.SH): Net profit increased 142.25% year-on-year in 2023, and plans to pay 10 to 2 yuan

Commodity City (600415.SH) released its 2023 annual report. Operating revenue for the reporting period was 11.3 billion yuan, up 48.30% year on year; net profit attributable to shareholders of listed companies was 2,676 billion yuan, up 142.25% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 2,469 billion yuan, up 39.86% year on year; basic earnings per share were 0.49 yuan. It is proposed to distribute a cash dividend of RMB 2.00 (tax included) for every 10 shares.

Wanan Technology (002590.SZ): 2023 net profit of 319.6 million yuan increased 346.07% year-on-year

Wanan Technology (002590.SZ) released its 2023 annual report. In 2023, the company achieved operating income of 3,983 billion yuan, an increase of 18.38%; net profit attributable to shareholders of listed companies was 319.6 million yuan, an increase of 346.07%; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 83.6101 million yuan, an increase of 917.00% year on year; and basic earnings per share were 0.67 yuan.

Jilin Aodong (000623.SZ): Net profit in 2023 fell 18.02% year-on-year, and plans to distribute 6 yuan for 10 shares

Jilin Aodong (000623.SZ) released its 2023 annual report, with operating income of 3.449 billion yuan, up 20.25% year on year, net profit of 1.46 billion yuan, down 18.02% year on year, after deducting non-net profit of 1,313 billion yuan, down 15.63% year on year, and basic earnings per share of 1.2971 yuan. A cash dividend of 6 yuan is distributed to all shareholders for every 10 shares.

Times Publishing (600551.SH): Net profit increased 61.21% year-on-year in 2023, and plans to convert 10 to 4 to 5 yuan

Times Publishing (600551.SH) released its 2023 annual report, with operating revenue of 8.64 billion yuan, up 13.03% year on year, net profit of 555 million yuan, up 61.21% year on year, after deducting non-net profit of 347 million yuan, up 21.90% year on year, with basic earnings per share of 1.1461 yuan. A cash dividend of RMB 5 is distributed to all shareholders for every 10 shares, and 4 shares are added to all shareholders for every 10 shares using the capital reserve fund.

Changliang Technology (300348.SZ): Net profit for 2023 increased by 42.98% to 32.1463 million yuan, and plans to pay 10 to 0.1 yuan

Changliang Technology (300348.SZ) announced its 2023 annual report. In 2023, the company achieved operating income of 1,918 billion yuan, up 1.62% year on year; net profit attributable to shareholders of listed companies was 32.1463 million yuan, up 42.98% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 257.366 million yuan, up 188.60% year on year; basic income per share was 0.0446 yuan; and plans to distribute 0.1 yuan (tax included) to all shareholders for every 10 shares.

Wuxi Zhenhua (605319.SH): Net profit increased 71.23% year-on-year in 2023, and plans to pay 10 to 3.8 yuan

Wuxi Zhenhua (605319.SH) released its 2023 annual report. In 2023, it achieved revenue of 2,317 billion yuan, up 23.19% year on year; net profit to mother of 277 million yuan, up 71.23% year on year; after deducting non-net profit of 266 million yuan, up 266.43% year on year; and basic earnings per share of 1.11 yuan. The company plans to distribute a cash dividend of 3.8 yuan (tax included) for every 10 shares to all shareholders.

[Repurchase]

Minde Electronics (300656.SZ): Controlling shareholders and actual controllers propose to buy back 30 million yuan to 60 million yuan of company shares

Minde Electronics (300656.SZ) announced that the board of directors of the company recently received a “Letter on Proposing Shenzhen Minde Electronic Technology Co., Ltd. to buy back the company's shares” from Mr. Xu Wenhuan, the controlling shareholder, actual controller, chairman and general manager of the company. Mr. Xu Wenhuan, the controlling shareholder, actual controller, chairman and general manager of the company, proposed that the company use its own funds to repurchase some of the company's issued RMB common shares (A shares). The total capital for the repurchase of shares should not be less than RMB 30 million (inclusive), and not more than RMB 60 million (inclusive).

[Increase or decrease holdings]

Shenghang Co., Ltd. (001205.SZ): Tianding Kanghua plans to reduce its holdings by no more than 1%

Shenghang Co., Ltd. (001205.SZ) announced that Tianding Kanghua, a shareholder holding 5% or more of the shares, plans to reduce the total holdings of the company by no more than 1,690,000 shares through bulk transactions within 3 months after 15 trading days from the date of disclosure of the announcement, that is, no more than 1% of the company's current total share capital.

China Railway Construction (601186.SH): China Railway Construction Group increased its A-share holdings by a total of 106 million yuan

China Railway Construction (601186.SH) announced that as of April 16, 2024, China Railway Construction Group has increased its holdings of the company's 13,580,000 A shares through centralized bidding transactions through the Shanghai Stock Exchange trading system, accounting for 0.1% of the company's total share capital. The increase amount is RMB 106 million. The implementation of this increase plan has been completed.

[Other]

Xinyu Guoke (300722.SZ) is prohibited from participating in military material engineering service procurement activities for 2 years

Xinyu Guoke (300722.SZ) announced that the military procurement network issued a penalty notice on April 16. The Procurement and Supply Bureau of the Army Logistics Department decided to ban Jiangxi Xinyu Guoke Technology Co., Ltd. from participating in military material engineering service procurement activities for 2 years from April 16, 2024 in accordance with the relevant regulations on military supplier management. During the ban period, the legal representative Jin Weiping Holdings or other enterprises managed are prohibited from participating in military procurement activities within the scope described above, and the bidding representative Hou Shuai is prohibited from participating in military procurement activities within the scope mentioned above on behalf of other suppliers.

Mingxin Xuteng (605068.SH): The total life cycle amount of about 870 million yuan was received from the project targeted notice

Mingxin Xuteng (605068.SH) announced that the company recently received a fixed notice from a well-known domestic automobile manufacturer (limited to a confidentiality agreement and unable to disclose its name, hereinafter referred to as the “customer”), and the company became the supplier of leather materials for its new project. According to the customer plan, mass production of the project is expected to begin in October 2024. The life cycle is about 5 years, and the total life cycle amount is about RMB 870 million.