Focus on the latest fund information

1.The latest news from well-known fund managers

Qiu Dongrong: Adding Meituan to reduce holdings in China's Hongqiao

From the perspective of changes in scale, Qiu Dongrong's overall management scale fell below 20 billion yuan. According to Choice data, as of the end of the first quarter, Qiu Dongrong's management scale was 19.854 billion yuan, a decrease of 3,928 billion yuan compared to the end of last year. In terms of transferring positions and exchanging shares, Qiu Dongrong has increased positions in Hong Kong stocks in fields such as the Internet, biomedicine, and real estate.

According to the first quarterly report data, many funds managed by Qiu Dongrong of Zhonggeng Fund have reduced their holdings of individual stocks such as China's Hongqiao and Goertek shares. However, among Qiu Dongrong's top ten stocks in the first quarter, China's Hongqiao was still the biggest stock.

On the buying side, Qiu Dongrong bought Meituan and Poly Development. Individual stocks such as Hunan Gold and Changchun Hi-Tech are newly entering the top ten heavy stocks of Zhonggeng Value; Poly Development and Huagong Technology are entering the top ten high-value stocks with Zhonggeng's small-cap value; Kuaishou-W and Meituan-W are newly entering Zhonggeng Value's top ten heavy-duty stocks.

Talking about the promising segmentation circuit, Qiu Dongrong focuses on technology stocks such as Hong Kong stocks, pharmaceuticals, smart electric vehicles, etc.; real estate, finance, etc. in large-cap value stocks; and cost-effective companies that have room for demand growth and supply competitive advantages. At the same time, he mentioned that a high dividend strategy has long-term returns biased towards beta, and is not a low risk strategy; investing is more important in terms of fundamentals and pricing.

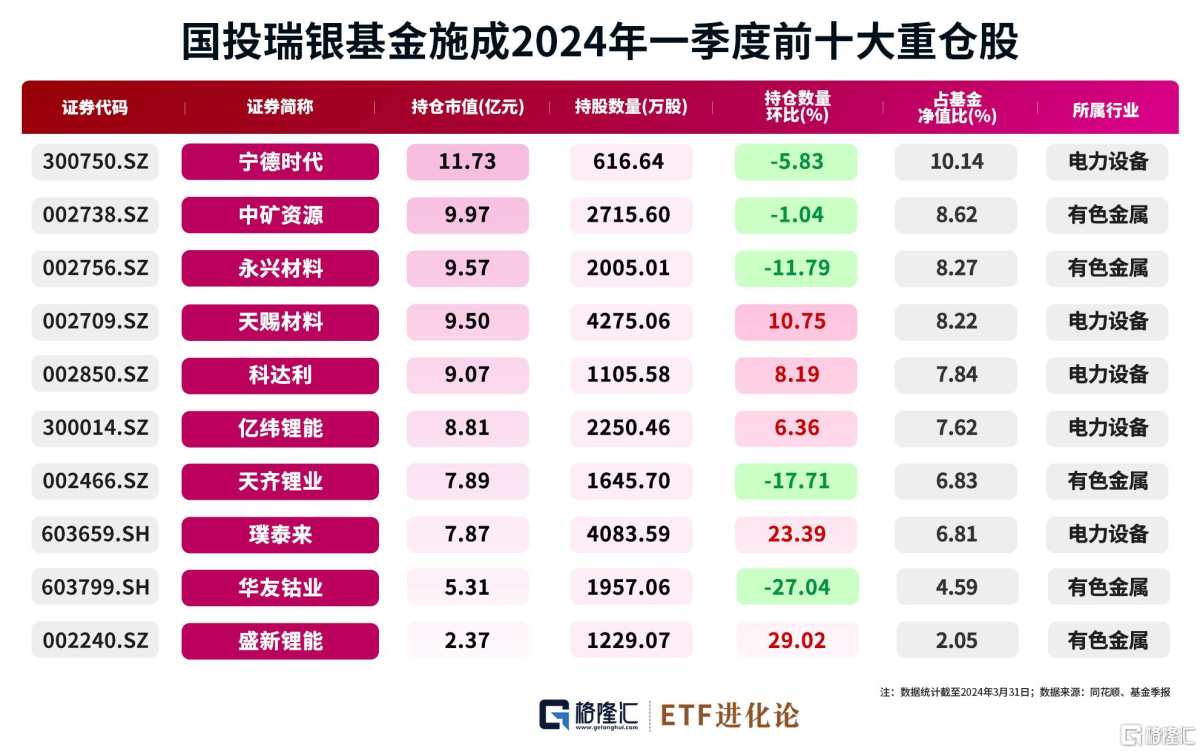

Shi Cheng: Increase the warehouse of Shengxin Lithium Energy and reduce the warehouse of Huayou Cobalt

SDIC UBS Fund's quarterly report was disclosed. In the first quarter, Shi Chengda bought Shengxin Lithium Energy, and its holdings increased by more than 29% month-on-month. In addition, it also increased its holdings of Tianci Materials, Kodali, and Everweft Lithium. Despite a slight reduction in positions in Ningde Era, China Mining Resources, and Yongxing Materials, these three individual stocks are still the top three major stocks in Shicheng. Tianqi Lithium and Huayou Cobalt have made the biggest cuts in positions.

Funds managed by Feng Mingyuan entered the top ten tradable shareholders of Tongxingda

According to the 2023 annual report data, in the list of Tongxingda's top ten tradable shareholders, Feng Mingyuan's Xinao New Energy Industry shares appeared and held 1,704,600 shares.

Gan Chuanqi investigates Tin Industry Co., Ltd.

On April 12, Tin Industry Co., Ltd. was investigated by the agency, and Gan Chuanqi of the League of Nations Foundation appeared. According to data for the past six months, Gan Chuanqi has not yet held this stock in managed funds.

Xie Haibo became the new Chief Information Officer of Jiutai Fund

On April 16, Jiutai Foundation issued an announcement. Xie Haibo became the new Chief Information Officer on April 15. According to his past history, Xie Haibo has served in the Guangxi Regulatory Bureau of the China Securities Regulatory Commission and the Qinghai Regulatory Bureau of the China Securities Regulatory Commission.

II. Today's Fund News Fast Facts

Three departments: insurance capitalShouldThrough private equity funds, etc.A strategic emerging industryProviding support

April 16 -- The State Administration of Financial Supervision and Administration, the Ministry of Industry and Information Technology, and the National Development and Reform Commission issued the “Notice on Deepening Manufacturing Financial Services to Help Promote New Industrialization”, which mentions helping to cultivate and expand strategic emerging industries, strengthen financial support and risk protection, and expand the scale of credit loans for strategic emerging industries. Insurance funds should provide long-term stable financial support for strategic emerging industries through various forms such as bonds, direct equity, private equity funds, venture capital funds, and insurance asset management products on the premise that risks are manageable and commercial voluntariness.The share of fixed income funds has surged

The 2024 Public Fund Quarterly Report has been released one after another. Up to now, data from several fund companies' quarterly reports shows that fixed income fund shares surged in the first quarter, and bond fund shares in particular generally increased dramatically. Corresponding to this, most equity funds that have published a quarterly report experienced net redemptions in the first quarter. Five funds, including Zhonggeng Value Pioneer Stock, Zhonggeng Value Pilot Hybrid, and Nanhua Fenghui Hybrid, were net redeemed for more than 100 million shares.

The size of many debt bases surged by more than 60%

Since this year, bond yields have declined rapidly, and the market has exceeded market expectations. Many debt bases have outperformed performance comparison benchmarks in the first quarter of this year. According to the 2024 quarterly report, as of the end of the first quarter, the latest volumes of Debon Ruixing bonds and Debon short-term bonds were 6.678 billion shares and 6.768 billion shares respectively, up 64.46% and 67.92% respectively from the end of 2023.

A pension FOF faces the risk of contract termination or liquidation

On April 15, a hybrid FOF announcement with a pension target date of 2045 was announced. In order to protect the interests of fund share holders, subscription and regular fixed investment services will be suspended from now on. The announcement also mentioned that depending on the size of the assets, the fund may trigger the termination of the fund contract.

Quantified private equity achieved positive surplus for the first time in March

In March, quantitative product excess correction was made. According to data from the Private Equity Ranking Network, as of the end of March, the average excess amount of 4501 quantitative products with performance records in March was 2.35%, and the average profit was 2.36%. After 2 consecutive months of rebound, both quantitative product excess and revenue decline narrowed. The average excess in the first quarter was -1.71%, and the average revenue was -1.42%. Of these, 1,928 quantitative products achieved positive returns, accounting for 42.83%.

The world's largest hedge fund, Qiaosui has used AI to invest

Information disclosure materials recently submitted to the US Securities Regulatory Commission by Qiaosui, the world's largest hedge fund, show that it is already using artificial intelligence in investments. Qiaoshui analyzed the risks that artificial intelligence brings convenience to investment while at the same time. For example, when AI is used for fundamental analysis, there is a risk of errors. QiaShui talked about one of the problems AI may face: artificial illusion (AIHallucination), that is, artificial intelligence falsifies data and makes the fabricated data look like the real thing.

III. Recent developments in fund products