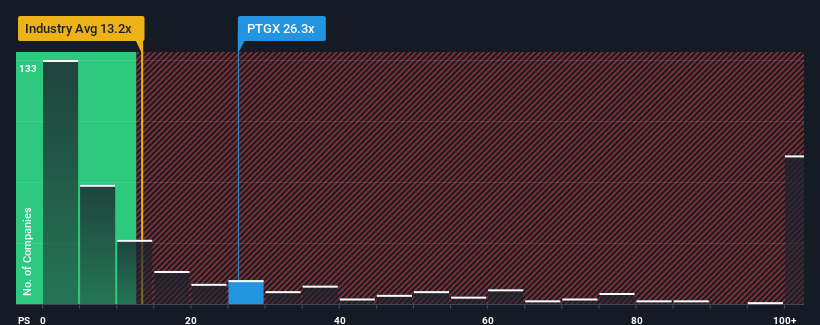

You may think that with a price-to-sales (or "P/S") ratio of 26.3x Protagonist Therapeutics, Inc. (NASDAQ:PTGX) is a stock to avoid completely, seeing as almost half of all the Biotechs companies in the United States have P/S ratios under 13.2x and even P/S lower than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Protagonist Therapeutics Performed Recently?

With revenue growth that's inferior to most other companies of late, Protagonist Therapeutics has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Protagonist Therapeutics.Do Revenue Forecasts Match The High P/S Ratio?

Protagonist Therapeutics' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 126% gain to the company's top line. Pleasingly, revenue has also lifted 110% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 34% each year as estimated by the six analysts watching the company. That's shaping up to be materially lower than the 167% each year growth forecast for the broader industry.

In light of this, it's alarming that Protagonist Therapeutics' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Protagonist Therapeutics' P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It comes as a surprise to see Protagonist Therapeutics trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Protagonist Therapeutics that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.