Unfortunately for some shareholders, the Luminar Technologies, Inc. (NASDAQ:LAZR) share price has dived 32% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 78% loss during that time.

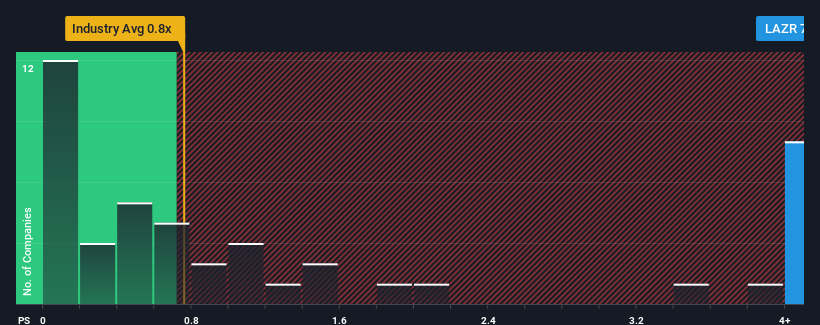

In spite of the heavy fall in price, you could still be forgiven for thinking Luminar Technologies is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7.9x, considering almost half the companies in the United States' Auto Components industry have P/S ratios below 0.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Luminar Technologies' Recent Performance Look Like?

Luminar Technologies certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Luminar Technologies will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Luminar Technologies?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Luminar Technologies' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 71% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 113% each year as estimated by the eleven analysts watching the company. With the industry only predicted to deliver 15% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why Luminar Technologies is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Even after such a strong price drop, Luminar Technologies' P/S still exceeds the industry median significantly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Luminar Technologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Auto Components industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 4 warning signs for Luminar Technologies that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.