To the annoyance of some shareholders, Peijia Medical Limited (HKG:9996) shares are down a considerable 28% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 67% share price decline.

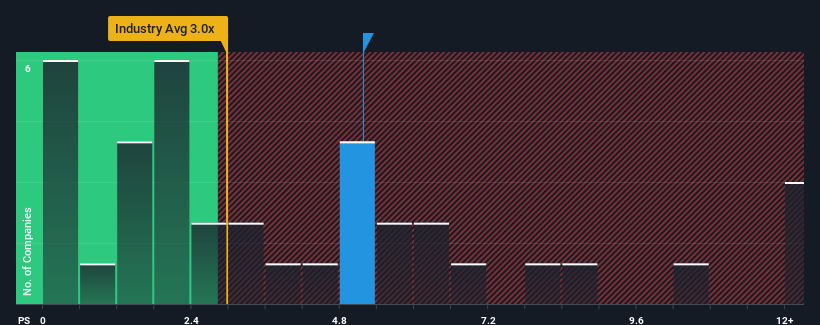

Although its price has dipped substantially, given around half the companies in Hong Kong's Medical Equipment industry have price-to-sales ratios (or "P/S") below 3x, you may still consider Peijia Medical as a stock to avoid entirely with its 5.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Peijia Medical's Recent Performance Look Like?

Recent times have been advantageous for Peijia Medical as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Peijia Medical will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Peijia Medical would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 76% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 56% per annum as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 48% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Peijia Medical's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Peijia Medical's P/S Mean For Investors?

A significant share price dive has done very little to deflate Peijia Medical's very lofty P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Peijia Medical shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Peijia Medical with six simple checks.

If these risks are making you reconsider your opinion on Peijia Medical, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.