E-Home Household Service Holdings Limited (NASDAQ:EJH) shareholders are no doubt pleased to see that the share price has bounced 99% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 92% share price decline over the last year.

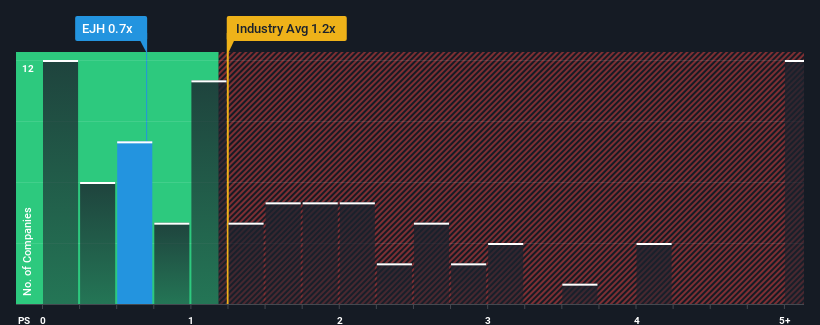

In spite of the firm bounce in price, it would still be understandable if you think E-Home Household Service Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.7x, considering almost half the companies in the United States' Consumer Services industry have P/S ratios above 1.2x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does E-Home Household Service Holdings' Recent Performance Look Like?

The recent revenue growth at E-Home Household Service Holdings would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on E-Home Household Service Holdings' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For E-Home Household Service Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like E-Home Household Service Holdings' to be considered reasonable.

Retrospectively, the last year delivered a decent 7.2% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 49% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 16% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing that E-Home Household Service Holdings' P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

What Does E-Home Household Service Holdings' P/S Mean For Investors?

E-Home Household Service Holdings' stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that E-Home Household Service Holdings currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for E-Home Household Service Holdings (3 are a bit concerning) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.