Focus on the latest fund information

1.The latest news from well-known fund managers

Shi Cheng: The era of reducing positions in the Ningde era

According to the fund's quarterly report data, SDIC UBS Fund's management product addition and reduction actions are quite consistent. SDIC UBS Advanced Manufacturing, SDIC UBS New Energy, and SDIC UBS Jinbao Hybrid Fund mainly reduced their holdings in Ningde Era, Yongxing Materials, Huayou Cobalt, Tianqi Lithium, etc. in the first quarter, and increased positions such as Putailai and Tianci Materials. The returns of many of the funds managed by Shi Cheng have been concentrated in the range of -31% to -34% in the past year.

Liu Yuanhai: Increase all heavy stocks and be firmly optimistic about AI

Dongwu Mobile Internet Hybrid, which had the highest performance ranking last year, also revealed its quarterly report today. Most of the shares held in the top ten major stocks increased in the first quarter. The most obvious change was that Zhuo Shengwei withdrew from the top ten, and Tuopu Group entered the top ten. The fund's share increased significantly. The Class A share increased from about 150 million shares at the beginning of the period to about 300 million shares at the end of the period, an increase of about 100%.

Liu Yuanhai said that the fund still operates at high positions, and the direction of industry allocation has remained basically the same. Looking at the main investment line, in the second quarter, we focused on investment opportunities in the following three directions to benefit the development of AGI technology: AI computing power and applications, electronic semiconductors, and automotive intelligence.

Xie Zhiyu:Reduced position Milkway

According to the data, Xie Zhiyu's Xingquan Herun appeared in Milkway's latest list of the top ten tradable shareholders, a decrease of 153,200 shares compared to the end of 2023.

Cao Mingchang:Chokura Shin-Taisho, Annunciation Bird

According to the 2023 annual report data, in the list of the top ten tradable shareholders of the new Taisho era, Cao Mingchang and Shen Yue appeared as a mix of the Chinese and European growth preferences, holding 3.265,300 shares. Furthermore, in the list of the top ten tradable shareholders published in the 2023 Annual Report of Annunciation Bird, Cao Mingchang and Shen Yue's Sino-European Growth Choice Hybrid appeared for the first time, holding 17.935 million shares.

Ge Weidong: Kakura Aerospace Hongtu“duvet cover”

On April 11, the science and technology innovation board company Aerospace Hongtu released its 2023 annual report. The data shows that Shanghai Chaos Investment (Group) Co., Ltd., with Ge Weidong at the helm, first appeared on the shareholder list of Aerospace Hongtu, a leader in remote sensing satellite applications, and its shareholding increased to 5.772,000 shares. The market value of shares held at the end of the period was 244 million yuan, ranking the 7th largest tradable shareholder. This is a rare increase in Chaos Investment's position in the past two or three years.

However, according to Aerospace Hongtu's latest financial data, the company lost 374 million yuan in net profit last year. The stock price fell by more than 17% in the fourth quarter of last year, and has continued to fall 47.70% since this year.

II. Today's Fund News Fast Facts

Mini funds are facing new requirements

According to an industry insider, mini funds recently introduced new requirements to encourage fund companies to independently bear the various fixed expenses of mini funds and no longer pay from fund assets. If the public offering option does not bear the fixed cost of the mini fund, it is necessary to provide a solution according to regulations before the end of June this year, and change the mini status or liquidation of the product before the end of the year. At the same time, it is strictly prohibited to use forms such as “help funds” to avoid irregularities such as paying fixed fees to mini funds.

Public funds actively deploy the Beijing Stock Exchange

According to research statistics from Shen Wan Hongyuan, by the end of 2023, the overall public fund holdings of the Beijing Stock Exchange were 7.259 billion yuan, an increase of 15.9% over the end of June 2023; the allocation ratio reached 0.14%, an increase from the end of June 2023, and both the allocation scale and ratio increased.

Harvest, Huaxia HongkongzifirmsApproved virtual asset management qualifications

Recently, the official website of the Hong Kong Securities Regulatory Commission updated the list of fund companies for virtual asset management, and added Harvest International and Huaxia Fund (Hong Kong). This means that the two Chinese public funds mentioned above have expanded their business in Hong Kong to virtual asset management business, and the pace of public funding into Bitcoin has accelerated.

Private equity futures strategies are picking up

According to data from the Private Equity Ranking Network, in the first quarter of this year, the average return on private equity futures and derivatives strategies was 1.79%, and the median was 0.82%. Better than private equity's stock strategy performance, the average return on stock strategies was -2.74%. Among futures and derivatives strategic private equity with a scale of more than 2 billion dollars and showing earnings data, the top three were Mingshi Fund, Mingwan Asset, and Inno Asset. Among them, Mingshi Fund had a strategic yield of 22.08% in the first quarter of this year, leaving a big gap with other private equity firms.

A number of Minmetals Trust products have been revealed to have been postponed

Recently, the three trust products “Hengxin Guoxing No. 636 - Kunming Capital Investment Pooled Fund Trust Plan”, “Hengxin Guoxing No. 657 - Yingsheng No. 51 Pooled Fund Trust Plan”, and “Minmetals Trust - Hengxin Guoxing No. 659 - Xindu No. 1 Pooled Fund Trust Plan”, which is managed by Minmetals International Trust Co., Ltd., a holding subsidiary of Minmetals Capital Co., Ltd., experienced overdue payments. Minmetals Capital said that Minmetals Trust will continue to maintain communication and negotiations with financiers and continue to work hard to advance collection work. Overdue payment of trust products will not have a significant adverse impact on Minmetals Capital's financial data.

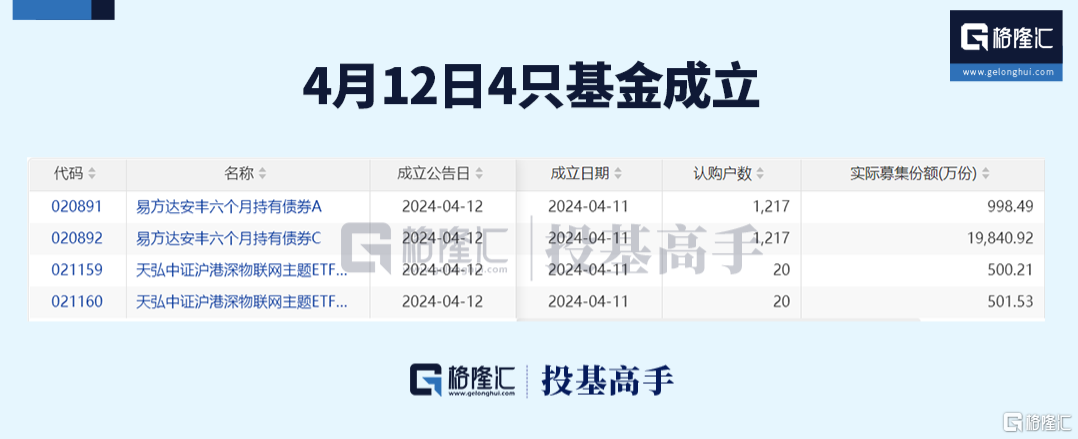

III. Recent developments in fund products