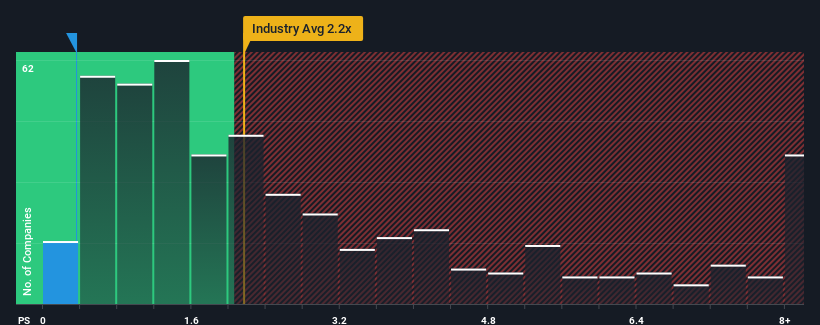

Rongsheng Petrochemical Co., Ltd.'s (SZSE:002493) price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 2.2x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Rongsheng Petrochemical's Recent Performance Look Like?

Recent revenue growth for Rongsheng Petrochemical has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rongsheng Petrochemical.How Is Rongsheng Petrochemical's Revenue Growth Trending?

In order to justify its P/S ratio, Rongsheng Petrochemical would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.7% last year. This was backed up an excellent period prior to see revenue up by 202% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 7.5% over the next year. That's shaping up to be materially lower than the 20% growth forecast for the broader industry.

With this information, we can see why Rongsheng Petrochemical is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Rongsheng Petrochemical's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 2 warning signs for Rongsheng Petrochemical that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.