Guangdong Hoshion Industrial Aluminium Co., Ltd. (SZSE:002824) shares have had a really impressive month, gaining 28% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.4% over the last year.

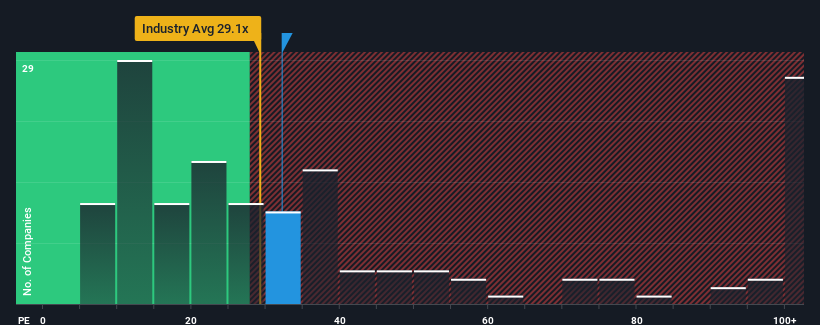

Even after such a large jump in price, there still wouldn't be many who think Guangdong Hoshion Industrial Aluminium's price-to-earnings (or "P/E") ratio of 32.2x is worth a mention when the median P/E in China is similar at about 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Guangdong Hoshion Industrial Aluminium's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Guangdong Hoshion Industrial Aluminium would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 403% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 21% each year as estimated by the dual analysts watching the company. That's shaping up to be similar to the 20% per year growth forecast for the broader market.

In light of this, it's understandable that Guangdong Hoshion Industrial Aluminium's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Its shares have lifted substantially and now Guangdong Hoshion Industrial Aluminium's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Guangdong Hoshion Industrial Aluminium's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Guangdong Hoshion Industrial Aluminium that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.