Despite an already strong run, Henan Shenhuo Coal Industary and Electricity Power Corporation Limited (SZSE:000933) shares have been powering on, with a gain of 28% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

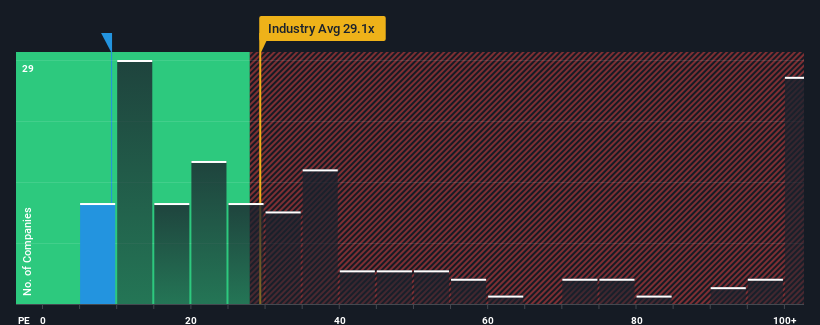

Although its price has surged higher, Henan Shenhuo Coal Industary and Electricity Power may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.2x, since almost half of all companies in China have P/E ratios greater than 31x and even P/E's higher than 56x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Henan Shenhuo Coal Industary and Electricity Power could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

Henan Shenhuo Coal Industary and Electricity Power's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 22%. Still, the latest three year period has seen an excellent 1,292% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 4.8% each year as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 20% each year, which is noticeably more attractive.

With this information, we can see why Henan Shenhuo Coal Industary and Electricity Power is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Shares in Henan Shenhuo Coal Industary and Electricity Power are going to need a lot more upward momentum to get the company's P/E out of its slump. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Henan Shenhuo Coal Industary and Electricity Power maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Henan Shenhuo Coal Industary and Electricity Power that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.