Unfortunately for some shareholders, the Gameone Holdings Limited (HKG:8282) share price has dived 35% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 74% share price decline.

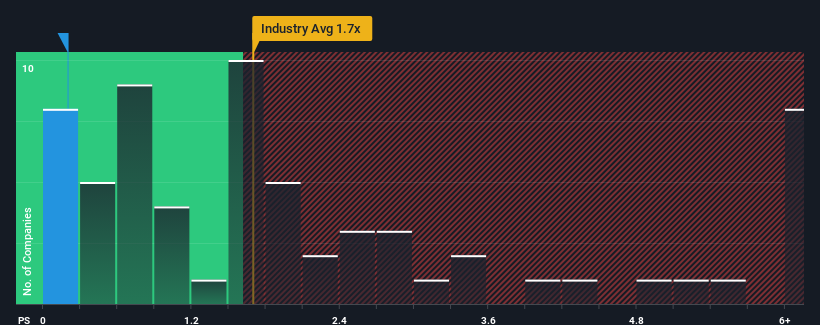

Since its price has dipped substantially, given about half the companies operating in Hong Kong's Entertainment industry have price-to-sales ratios (or "P/S") above 1.7x, you may consider Gameone Holdings as an attractive investment with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Gameone Holdings' Recent Performance Look Like?

Revenue has risen firmly for Gameone Holdings recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Gameone Holdings will help you shine a light on its historical performance.How Is Gameone Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Gameone Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The latest three year period has also seen an excellent 112% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 20% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Gameone Holdings' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Gameone Holdings' P/S Mean For Investors?

The southerly movements of Gameone Holdings' shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Gameone Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Gameone Holdings (of which 2 can't be ignored!) you should know about.

If these risks are making you reconsider your opinion on Gameone Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.