Nexteer Automotive Group Limited (HKG:1316) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

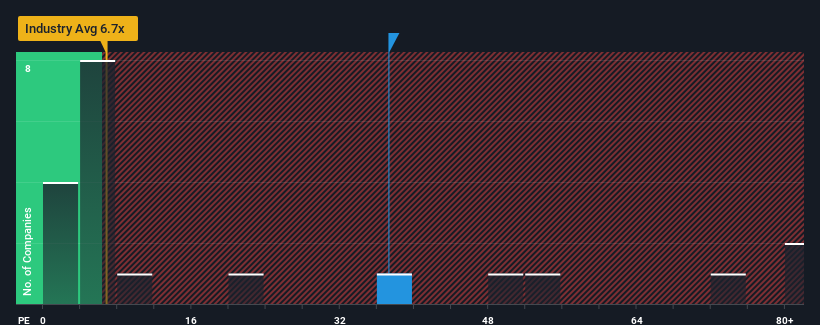

Since its price has surged higher, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider Nexteer Automotive Group as a stock to avoid entirely with its 37.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Nexteer Automotive Group could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Nexteer Automotive Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 69% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 75% per year over the next three years. That's shaping up to be materially higher than the 15% per annum growth forecast for the broader market.

With this information, we can see why Nexteer Automotive Group is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in Nexteer Automotive Group have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Nexteer Automotive Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Nexteer Automotive Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.