Deep-pocketed investors have adopted a bearish approach towards MercadoLibre (NASDAQ:MELI), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MELI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 28 extraordinary options activities for MercadoLibre. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 28% leaning bullish and 71% bearish. Among these notable options, 14 are puts, totaling $794,523, and 14 are calls, amounting to $1,371,613.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $1000.0 to $2000.0 for MercadoLibre over the last 3 months.

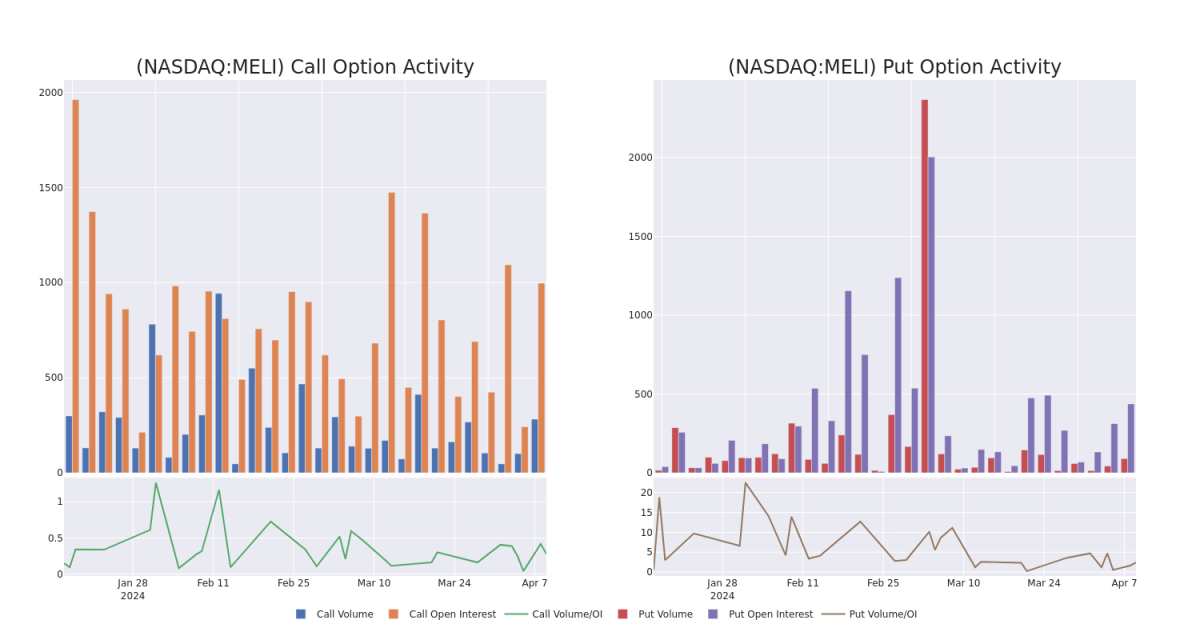

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for MercadoLibre's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MercadoLibre's whale trades within a strike price range from $1000.0 to $2000.0 in the last 30 days.

MercadoLibre Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | CALL | SWEEP | BEARISH | 01/17/25 | $271.8 | $258.8 | $261.69 | $1400.00 | $524.9K | 61 | 20 |

| MELI | CALL | TRADE | BEARISH | 06/21/24 | $150.7 | $142.6 | $145.1 | $1400.00 | $304.7K | 101 | 0 |

| MELI | PUT | SWEEP | BEARISH | 04/12/24 | $49.0 | $41.5 | $48.5 | $1520.00 | $145.5K | 39 | 35 |

| MELI | CALL | TRADE | BEARISH | 06/21/24 | $123.1 | $113.9 | $116.2 | $1450.00 | $116.2K | 19 | 0 |

| MELI | PUT | TRADE | BEARISH | 04/26/24 | $93.0 | $85.4 | $90.0 | $1550.00 | $90.0K | 19 | 21 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

After a thorough review of the options trading surrounding MercadoLibre, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

MercadoLibre's Current Market Status

- Trading volume stands at 234,969, with MELI's price down by -1.14%, positioned at $1478.0.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 21 days.

Expert Opinions on MercadoLibre

2 market experts have recently issued ratings for this stock, with a consensus target price of $1870.0.

- Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for MercadoLibre, targeting a price of $1940.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for MercadoLibre, targeting a price of $1800.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.