View the latest ETF news

1.Today's ETF market review

The three major A-share indices fell collectively today. By the close, the Shanghai Index fell 0.7% to 3027 points, the Shenzhen Index fell 1.6%, the GEM Index fell 2.06%, and the Beijing Stock Exchange 50 Index rose 1.63%. The turnover of the Shanghai and Shenzhen markets was 830 billion yuan, an increase of 33.6 billion yuan over the previous day. Over 4,300 stocks fell in both markets. The net sales of Northbound Capital were 4.114 billion yuan. On the market, gold, low-altitude economy, electricity, and industrial parent machine concepts rose the most; game media, computing power, photoresist, memory chips, and 6G communication concepts declined the most.

In terms of ETFs, Hong Kong stocks performed well. E-Fangda Fund's Internet ETF and Harvest Fund's Central Internet ETF rose 2.88% and 2.59% respectively. The precious metals sector continued to rise, with Yongying Fund's gold stock ETF and Dacheng fund non-ferrous ETF rising 2.44% and 1.99% respectively.

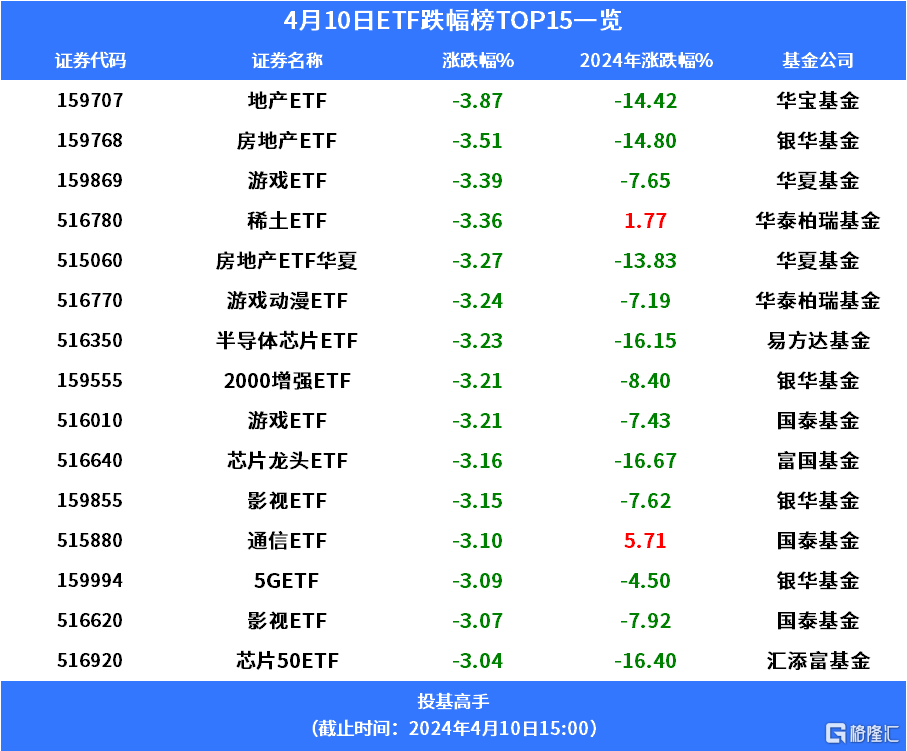

Real estate stocks weakened again, with real estate ETFs and real estate ETFs falling 3.87% and 3.51%, respectively. The gaming sector declined, and gaming ETFs fell 3.39%. The rare earth sector pulled back, and rare earth ETFs fell 3.36%.

II. Today's ETF trading situation

A total of 177 ETF funds in the market rose today, 60 rose more than 1%, and a total of 701 fell.

In terms of turnover, the total turnover of ETF funds in the entire market today was 1141.99 yuan, a decrease of 3,944 billion yuan from the previous trading day. There are 16 ETFs with a turnover of more than 1 billion yuan, and 130 ETFs with a turnover of more than 100 million yuan.

Among equity ETFs, Huaxia Fund's Hang Seng Internet ETF took first place, with a turnover of 2,918 billion yuan. Technology Network stocks rose, and many related ETFs performed well, and the trading situation was also active. Many products such as Huaxia Fund Hang Seng Technology Index ETF and E-Fangda China Internet ETF are on the list.

Looking back at the changes in ETF size on the previous trading day, the three products that increased their share the most in non-monetary ETFs on April 9 were:

Tianhong Fund's China Securities dividend was 100 ETF with low fluctuation. The fund share increased by 210 million shares, and the net inflow was 219 million yuan.

Huaxia Fund traded 50 ETFs, increasing the fund share by 200 million shares, and the net inflow was 487 million yuan.

E-Fangda Fund is the Shanghai Science and Technology Innovation Board 50 ETF. The fund share increased by 189 million shares, and the net inflow was 144 million yuan.

The three ETFs with the most significant share decline are:

E-Fangda Fund's Shanghai and Shenzhen 300 medical and health ETF reduced the fund share by 218 million shares, and the net outflow was 78 million yuan.

Huabao Fund's China Securities Bank ETF reduced its fund share by 191 million shares, with a net outflow of 223 million yuan.

Huabao Fund's China Securities Medical ETF reduced its fund share by 166 million shares, with a net outflow of 54 million yuan.

III.Today's ETF News Fast Facts

The size of gold ETFs has surged

According to Choice data, as of April 8, 2024, the total size of 14 gold ETFs was 41.82 billion yuan, an increase of more than 9 billion yuan from 30.94 billion yuan on March 1. Among them, Huaan Fund's gold ETF reached 18.663 billion yuan, and the gold ETF size of Bosch Fund also exceeded 10 billion yuan. Gold ETFs from Huaan, Bosch, and E-Fangda Fund have all had an average daily turnover of over 100 million yuan since this year, and their turnover has increased markedly since March.

Quantify the list of major companies appearing in bond ETF holders

Recently, public fund annual reports revealed one after another. According to statistics from the private equity ranking network, by the end of last year, a number of 10-billion quantitative private equity firms, such as Kuan Investment, Stable Investment, and Zhufeng Asset, had allocated treasury bond ETFs and treasury bond ETFs. For example, the Wenbo Wushen No. 1 Private Equity Investment Fund appeared on the list of the top ten holders of Cathay Pacific's 5-year treasury bond ETF, with a holding share of 303,000 shares.

There are also ETFs that take the initiative to split fund shares to reduce net value

Recently, a China Securities coal trading open index fund announced the implementation of fund share splitting. This is also the second fund to split shares during the year. According to reports, after fund shares are split, the net unit value is reduced, and the transaction threshold for investors is lowered accordingly, which helps to improve the convenience of transactions.

4.Today's market reviews

Today, the A-share market opened low throughout the day, and all three major indices closed down. By the close, the Shanghai Index was down 0.7%, the Shenzhen Index was down 1.6%, and the GEM Index was down 2.06%. More than 4,300 stocks fell across the market.

Volume has picked up somewhat. Today's turnover of the two markets is 830 billion dollars, an increase of 33.7 billion dollars compared to the previous trading day. Northbound capital sold a net sale of 4.114 billion dollars throughout the day.

On the market, due to a new high in international gold prices, gold stocks rose again today, and Lexen Tongling and Cuihua Jewelry rose or stopped. According to the news, the market overtook the Federal Reserve to cut interest rates, and the price of gold continued to hit record highs.

Electricity stocks are active, and the development of Huayin Electric Power and Langfang has come to a standstill. Gas stocks rallied during the intraday period, and Nanjing utilities rose and stopped.

Industrial mother machine concept stocks soared, while Huadong Heavy Machinery and Huadong CNC rose and stopped. According to the news, seven departments including the Ministry of Industry and Information Technology jointly issued the “Implementation Plan to Promote Equipment Renewal in the Industrial Sector”, which proposes that by 2027, the scale of investment in equipment in the industrial sector will increase by more than 25% compared to 2023; the focus will be on promoting the upgrading of machine tools that have been in service for more than 10 years in the industrial mother machine industry.

The concept of low-altitude economy fluctuated and picked up in the afternoon, and CITIC Haizhi and Zong Shen Dynamics rose and stopped.

On the downside, memory chip concept stocks fluctuated lower, and Demingli fell to a standstill.

The market fell into adjustment again today. The recovery of the index was relatively weak yesterday. Today, the Shanghai index fell further below the 5-day EMA, and the GEM index fell more than 2%, but the volume can once again expand to more than 800 billion yuan, which can still be viewed as a range-bound fluctuation structure.

Hualong Securities believes thatJudging from recent economic data performance, the overall performance is good, such as 1-Industrial companies' profits achieved relatively rapid growth in February, reflected at the micro level. The overall performance of listed companies in the first quarter is expected to remain resilient or improve further year-on-year. While market valuations are still low, the performance of listed companies remains resilient or continues to improve, which will support the later performance of the market.

5. The latest developments in fund products