Read the bottom carefully

At the end of yesterday's trading, the Hong Kong stock market experienced a sharp drop. 3 individual stocks crashed, and the stock price of China Tianrui Cement fell 99%.

Today, in addition to China Tianrui Cement announcing the suspension of trading, Haosen Fintech,Shengneng GroupThe stock prices all showed a clear rebound.

After the flash crash, the explosion reached close to 750%

Yesterday, the stock price of China Tianrui Cement showed a cliff-style decline from around 3:45 p.m., and finally closed down 99.04%. The total market value evaporated from over HK$14 billion to only HK$140 million left.

Before today's market, Tianrui Cement announced,Trading will be suspended for a short time from 9:00 a.m. this morning, pending publication of inside information.

According to the Financial Services Association, a person familiar with the matter at Tianrui Cement Hong Kong Office said:“The company's director and other relevant officials are handling this matter. The company is currently operating normally.”

At the same time, several employees at the company headquarters said, “It is unclear why the company's stock price suddenly crashed, but the company's production and operation are normal, and there are no abnormalities.”

Also collapsing at the same time were Hosen Fintech and Shengneng Group, but the two stocks mentioned above have rebounded sharply today.

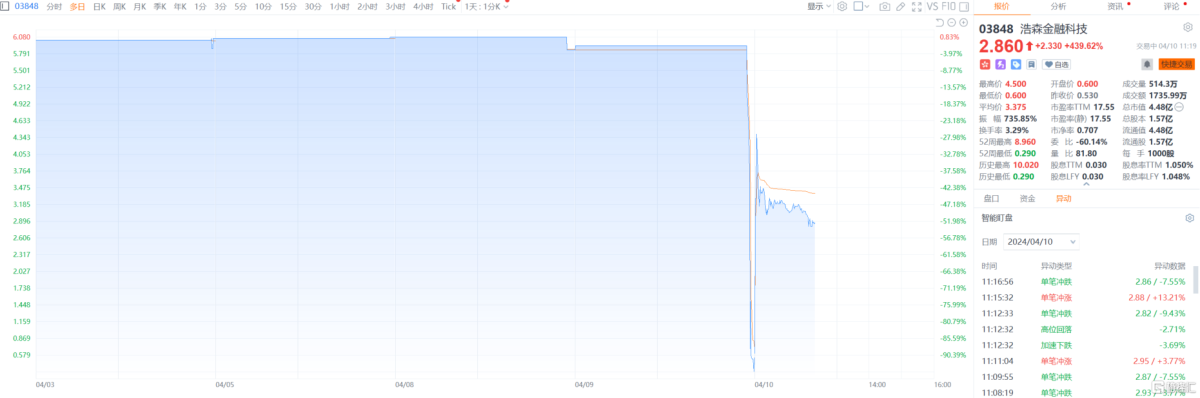

Among them, Horson Fintech once plummeted 95% to HK$0.29 yesterday, and finally closed down 90.96%. The full-day transaction was only HK$673,300, leaving a market capitalization of only HK$82.99 million.

Today, Haosen Fintech rebounded markedly. At one point, it rose 749.06% to HK$4.5. Up to now, the increase has fallen back to 439.62% to HK$2.86, with a total market value of HK$448 million and a turnover of HK$17.359,900.

Shengneng Group once plummeted by nearly 53% to HK$1.97 yesterday, and finally closed down 49.88% to HK$2.1 million. The transaction was HK$2.74 million, with a market value of HK$2,121 billion.

Today, Shengneng Group's stock price rebounded 52.38% to HK$3.2 billion, with a total market capitalization of HK$3.32 billion and a turnover of HK$24.1623 million.

WHAT HAPPENED?

Due to poor liquidity in the Hong Kong stock market, it is not unusual for individual stock prices to skyrocket and plummet. The reasons for the flash collapse may include “cutting positions” on pledge orders and “laundering” hogs.

In response to yesterday's sudden sharp drop, there is market speculation.Multiple stock chains have plummeted. Perhaps the same person's stock pledge was cut off.

Some analysts believe that the stock price experienced such a “cliff-style” decline, and trading volume increased markedly, similar to the situation where pledges were liquidated.

Take Tianrui Cement as an example. The daily turnover of this stock in the past month was basically hundreds of thousands of shares. It traded 90,000 shares on April 8. After trading volume at the end of April 9, 281.3 million shares were traded throughout the day. The volume increased significantly.

However, some investors speculate that the sharp drop in stock prices is related to the fundamentals of individual stocks.

Tianrui cementIn 2023, revenue of 7.889 billion yuan was achieved, a year-on-year decrease of 28.64%; loss attributable to company owners was 634 million yuan, compared to profit of 449 million yuan in the same period last year. The year-on-year profit turned into a loss, with a loss of 0.22 yuan per share.

The gross margin fell from about 24.5% the previous year to about 20.7%, mainly due to the fact that the decline in cement prices in 2023 was greater than the cost of a ton of cement.

Hosen FintechIn 2023, revenue was about 113 million yuan, up 13.6% year on year; net profit to mother fell 3.89% year on year to 23.173 million yuan.

Regarding the reason for the increase in revenue and the lack of profit, Housen Fintech said it was mainly due to the expected net credit loss provision for loans and accounts receivable of about 43.1 million yuan, and a decrease of about RMB 13.4 million in other revenue.

Shengneng GroupIn 2023, revenue was approximately US$72.3 million, a year-on-year decrease of about 37.4%; net loss of US$15.476 million changed from profit to loss.

In the face of such a sharp rise and fall, some investors discussed “breaking the bottom and collapsing stocks” and “making a net profit of 100 times a day” at stock bars.

Some investors also issued a warning saying that undermining individual stocks have many risks, such as not being able to buy the minimum, stopping trading when buying and then delisting.

Even after experiencing today's sharp rise, the stock prices of the individual stocks mentioned above have not returned to yesterday's level, and we still need to be cautious if we want to bottom out.