The China Tianrui Automotive Interiors Co., LTD (HKG:6162) share price has done very well over the last month, posting an excellent gain of 30%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.3% in the last twelve months.

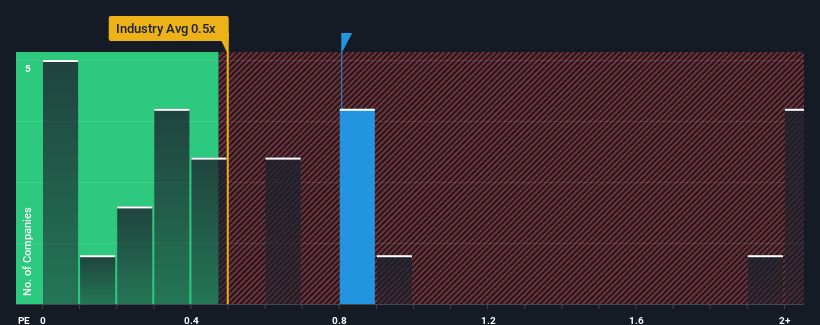

Although its price has surged higher, there still wouldn't be many who think China Tianrui Automotive Interiors' price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Hong Kong's Auto Components industry is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does China Tianrui Automotive Interiors' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, China Tianrui Automotive Interiors has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for China Tianrui Automotive Interiors, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, China Tianrui Automotive Interiors would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 35% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 27% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that China Tianrui Automotive Interiors is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

China Tianrui Automotive Interiors appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that China Tianrui Automotive Interiors currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It is also worth noting that we have found 2 warning signs for China Tianrui Automotive Interiors (1 doesn't sit too well with us!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.