For investors, judging the inflection point of the cycle and understanding the pace of value return is the most important thing.

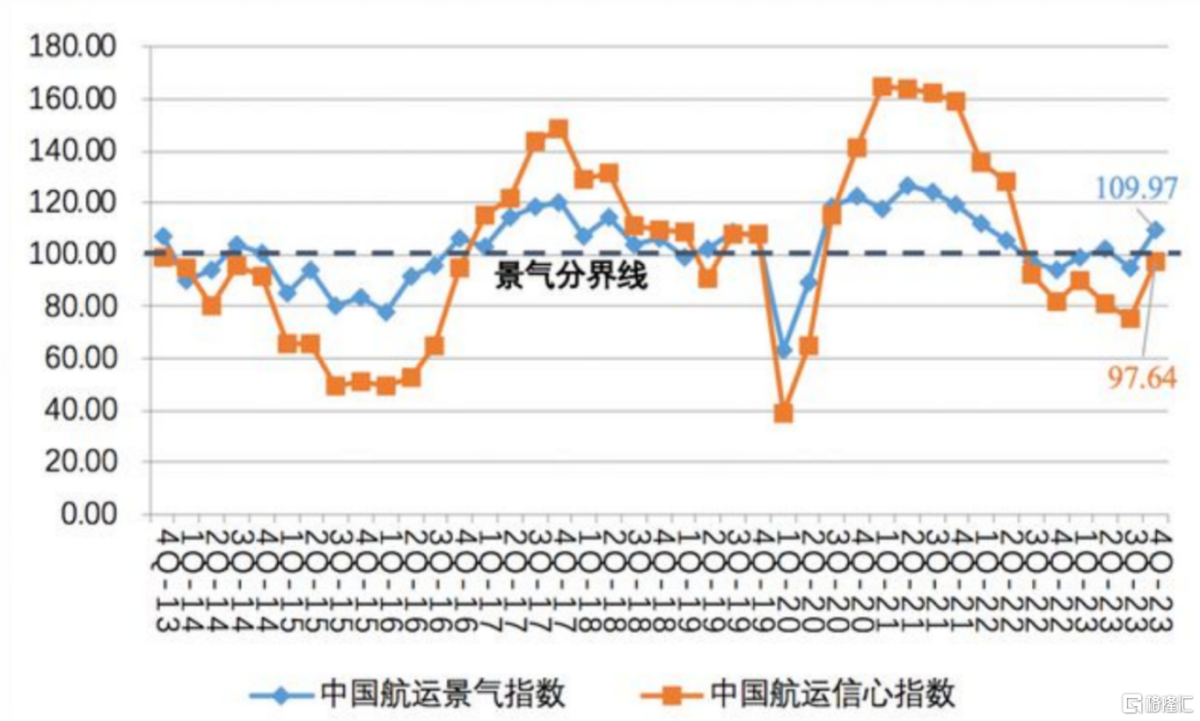

As one of the typical cyclical industries, the shipping industry is currently showing a recovery trend. According to the China Shipping Sentiment Report issued by the Shanghai International Shipping Research Center. In the fourth quarter of 2023, China's shipping sentiment index was 109.97 points, up 15.19 points from the previous month, crossing the boom dividing line and rising to the micro boom range. Meanwhile, China's shipping confidence index increased by 21.9 points to 97.64 points.

(Source: Shanghai International Shipping Research Center)

With the advent of the dawn of shipping recovery, the voices of related industrial chains entering a new major cycle are getting stronger and stronger.

On March 26, China Ship Leasing released its 2023 annual report. In 2023, the company achieved operating income of HK$3.626 billion, up 13% year on year, and net profit of HK$1.912 billion, up 10.2% year on year. Meanwhile, two core indicators, ROE (return on net assets) and ROA (return on assets), rose 0.1 and 0.2 percent, respectively.

As a representative enterprise in the ship leasing industry, the impressive performance of China Ship Leasing also confirms this judgment from the side.

In fact, apart from the impact of global health events in 2020, the company's performance has maintained an upward trend since 2017, mainly due to the company's core “know how” ability.

1. “Understanding boats” is also a kind of moat

Being able to continuously hand over outstanding report cards is inseparable from a deep “ship understanding” gene, and I have learned a unique set of tricks for “countercyclical shipbuilding, procyclical management”.

Simply put, when global ship prices were low, large-scale shipbuilding not only helped the upstream and downstream of the industrial chain overcome difficulties, but also enabled oneself to obtain high-quality assets at a lower cost; then, when prosperity increased, put previously built ships into operation to expand supply and enjoy industry beta dividends.

This style of play is easy to say, but it's not at all easy to do. The key point is how to predict and grasp the timing of changes in industry sentiment. This requires being extremely sensitive and forward-looking to industry trends. China Ship Leasing clearly has its own unique understanding.

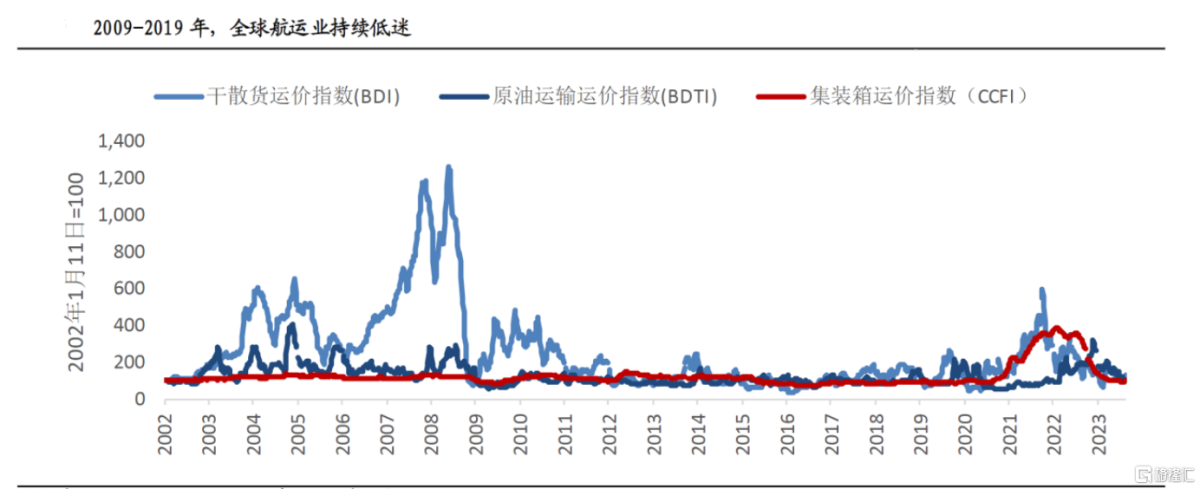

Looking back on the past, after the 2008 financial crisis, there was a ten-year shipping downturn from 2009 to 2019. Both shipping companies and shipyards faced high operating pressure, and production capacity continued to clear.

(Source: Wind, Clarkson, Guotai Junan Research)

China Ship Leasing was established during this period, and at a time of industry adversity, it “practiced internal skills” and gradually expanded its fleet. On top of the existing orders for 39 ships at the end of 2018, it also signed 43 new ship orders within 2019 and 2020, thus establishing a low cost advantage.

In recent years, China Ship Leasing has not given up on expanding its fleet to enhance the overall operating strength of integrated companies. By the end of 2023, the company's fleet had a total fleet size of 151 ships (including joint ventures and joint ventures), of which 128 ships were leased and operated, and 23 were under construction.

The expansion of scale, especially the expansion of capital-intensive industries such as ship leasing, must be supported by good capital cost control capabilities. In the current round of the Federal Reserve's extremely long interest rate hike cycle, it is actually not easy to do this well.

However, judging from the results, China's ship leasing performance is still remarkable. In 2023, the average cost of interest-bearing debt will be controlled at 3.7% through cross-currency financing, controlling the size of interest-bearing debt, and improving capital utilization efficiency.

According to reports, in 2023, China Ship Leasing will issue 2.2 billion yuan of panda bonds in China, adding about 2.57 billion yuan in project loans, and adding an average financing interest rate of 3.15% for additional RMB debt, which is significantly lower than the financing cost of more than 6% of the US dollar.

The reason behind this is the good credit rating that the company has developed over a long period of time. By the end of 2023, China Ship Leasing will continue to maintain Fitch's “A” and S&P “A-” international credit ratings, and maintain the highest “AAA” credit rating in China.

2. “Heavy operation” + “business model innovation” to lay the foundation for long-term growth

Based on the present, as ship prices rise and competition in the ship leasing industry continues to be interpreted. Adhering to the principle of countercyclical adjustment, China Ship Leasing will implement a more prudent and steady investment policy in the future, which is likely to slow down the expansion rate of the fleet.

But this will not affect the trend of increasing the company's long-term value center.

Currently, China Ship Leasing's current fleet is not only large, but the ship age is low enough. The average age of operating ships is about 3.65 years, which is far below the industry average. Even if no new ships are added to the fleet, it will be enough to guarantee the steady development of the company's future business. Furthermore, China's ship leasing business plan is quite clear, which has greatly improved the efficiency of the use of existing assets. According to reports, the average remaining length of the company's leases of 1 year or more is 7.29 years.

In order to further ensure the continued growth of the company's performance, China Ship Leasing carried out business innovation and launched a new model of “joint ventures with shipowners and ship management companies+locked long-term leases”, which laid the foundation for long-term performance growth in terms of both capital and leasing orders.

During the reporting period, the company ordered 2+2 175,000 square meter LNG carriers and 2 of the world's largest tonnage ships

The 2,500 passenger/3,850 meter lane luxury passenger roller boat provided financing, and also implemented the 93,000-square-meter VLGC financial leasing project.

Following the company's consistent “countercyclical investment and procyclical operation” strategy, China's ship leasing's subsequent development focus will be skewed from “expansion” to “heavy operation”.

As China's ship leasing expands its fleet at a slower rate, its future capital expenditure is likely to gradually decrease, and the company will have more capital to use as dividends.

Of course, as a subsidiary of a central enterprise, China Ship Leasing complies with a series of policy calls for state-owned enterprise reform. In order to better return investors, it itself has an incentive to increase dividends.

Moreover, Chinese ship leasing has always had a “high dividend” label. Since its listing in 2019, China Ship Leasing has paid dividends twice a year. The mid-year dividend was HK$0.03 per share, and the year-end dividend was HK$0.09 per share. The total annual dividend payout was HK$0.12 per share. Based on the closing price of HK$1.41 on March 26, its dynamic dividend rate reached 8.51%, which is attractive enough for more long-term capital.

III. Concluding Remarks

The exact timing of the arrival of a new cycle in the shipping industry is unknown, but “ship-savvy” players like Chinese ship leasing by optimizing the fleet structure, enhancing operational efficiency, and actively exploring new models in the ship leasing market have made preparations early. As scarce manufacturers in the Hong Kong stock market are the target of ship leasing, its value is expected to be revalued as the new industrial cycle arrives.