The International Business Settlement Holdings Limited (HKG:147) share price has done very well over the last month, posting an excellent gain of 44%. Notwithstanding the latest gain, the annual share price return of 5.9% isn't as impressive.

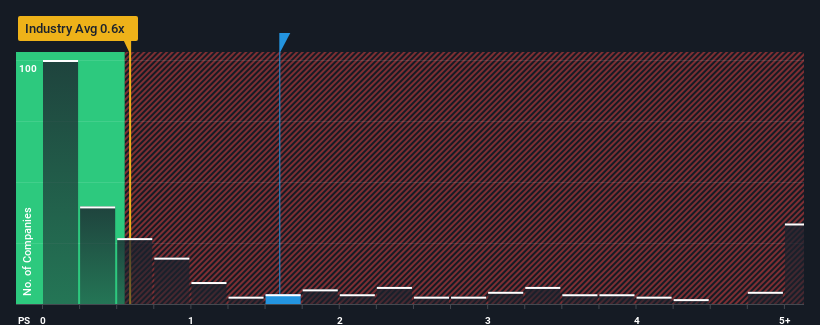

After such a large jump in price, you could be forgiven for thinking International Business Settlement Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.6x, considering almost half the companies in Hong Kong's Real Estate industry have P/S ratios below 0.6x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How International Business Settlement Holdings Has Been Performing

With revenue growth that's exceedingly strong of late, International Business Settlement Holdings has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on International Business Settlement Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like International Business Settlement Holdings' to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 3.9% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why International Business Settlement Holdings' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

The large bounce in International Business Settlement Holdings' shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of International Business Settlement Holdings revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for International Business Settlement Holdings that you should be aware of.

If you're unsure about the strength of International Business Settlement Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.