Zhejiang Starry Pharmaceutical Co.,Ltd. (SHSE:603520) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

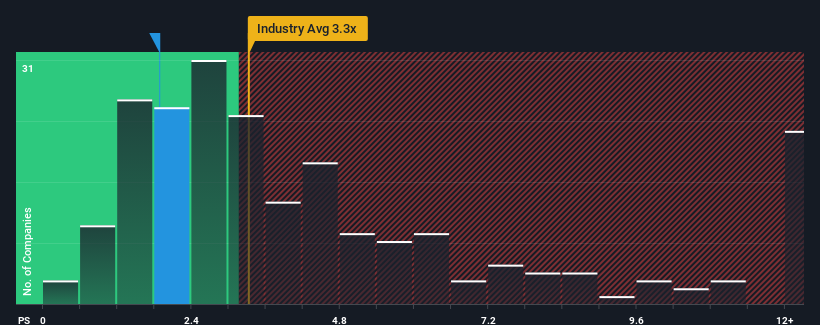

In spite of the firm bounce in price, Zhejiang Starry PharmaceuticalLtd's price-to-sales (or "P/S") ratio of 1.9x might still make it look like a buy right now compared to the Pharmaceuticals industry in China, where around half of the companies have P/S ratios above 3.3x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Zhejiang Starry PharmaceuticalLtd's P/S Mean For Shareholders?

Recent times haven't been great for Zhejiang Starry PharmaceuticalLtd as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Zhejiang Starry PharmaceuticalLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Zhejiang Starry PharmaceuticalLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. The latest three year period has also seen an excellent 74% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the six analysts following the company. That's shaping up to be materially lower than the 42% growth forecast for the broader industry.

In light of this, it's understandable that Zhejiang Starry PharmaceuticalLtd's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

The latest share price surge wasn't enough to lift Zhejiang Starry PharmaceuticalLtd's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Zhejiang Starry PharmaceuticalLtd's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Zhejiang Starry PharmaceuticalLtd, and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.