High-rolling investors have positioned themselves bearish on Root (NASDAQ:ROOT), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ROOT often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for Root. This is not a typical pattern.

The sentiment among these major traders is split, with 25% bullish and 75% bearish. Among all the options we identified, there was one put, amounting to $26,600, and 7 calls, totaling $1,210,469.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $80.0 for Root during the past quarter.

Insights into Volume & Open Interest

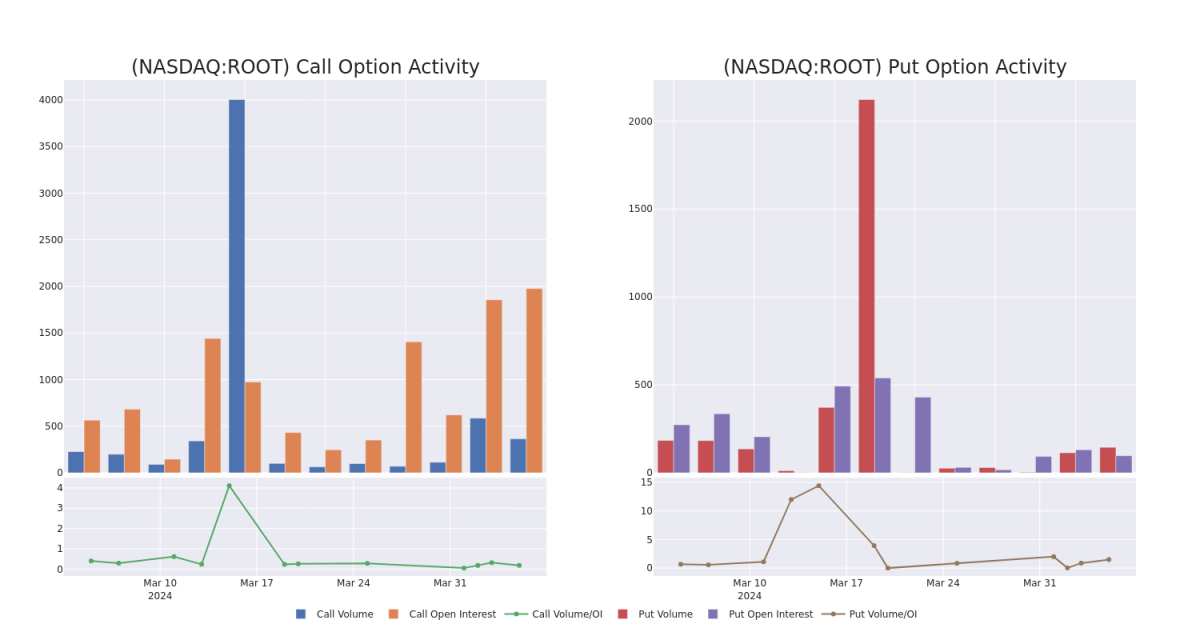

In today's trading context, the average open interest for options of Root stands at 259.12, with a total volume reaching 509.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Root, situated within the strike price corridor from $25.0 to $80.0, throughout the last 30 days.

Root Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROOT | CALL | SWEEP | BEARISH | 06/21/24 | $48.5 | $48.1 | $48.5 | $30.00 | $887.9K | 205 | 183 |

| ROOT | CALL | SWEEP | NEUTRAL | 05/17/24 | $22.7 | $20.7 | $21.11 | $65.00 | $84.4K | 111 | 41 |

| ROOT | CALL | SWEEP | BEARISH | 04/19/24 | $15.8 | $14.3 | $14.3 | $65.00 | $61.4K | 1.2K | 56 |

| ROOT | CALL | TRADE | BULLISH | 05/17/24 | $19.8 | $18.0 | $19.1 | $70.00 | $57.3K | 99 | 0 |

| ROOT | CALL | SWEEP | NEUTRAL | 04/19/24 | $7.3 | $6.4 | $7.4 | $80.00 | $52.0K | 139 | 74 |

About Root

Root Inc develops and launches a direct-to-consumer personal automobile insurance and mobile technology company. The company is a direct-to-consumer personal auto insurance, renters insurance and mobile technology company. It generates revenue from the sale of auto insurance policies within the United States.

Present Market Standing of Root

- With a trading volume of 527,251, the price of ROOT is up by 0.8%, reaching $71.5.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 26 days from now.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Root options trades with real-time alerts from Benzinga Pro.