Recently, Hong Kong stock listed companies entered the disclosure period of their annual reports. In the past 2023, the Hong Kong stock market experienced a liquidity crunch brought about by the Federal Reserve's continued high interest rate policy. Major stock indexes such as the Hang Seng Index continued to decline during the year. The overall trading atmosphere was weak, and the stock prices of most Hong Kong stock companies were under pressure.

Although the Shanghai and Shenzhen Stock Exchange and the Hong Kong Stock Exchange introduced new Hong Kong Stock Connect regulations at the beginning of last year, while reducing the market value included in the Hong Kong Stock Exchange Index (down to HK$5 billion), they also lowered the market value of the Hong Kong Stock Exchange Index (reduced to HK$4 billion), further enhanced the linkage between A shares and Hong Kong stocks, and injected a certain amount of liquidity into the market, the stock prices of many Hong Kong listed companies have not been able to escape the downward trend. It is not uncommon for the market value to fall below HK$4 billion for many months, implying a “defense” to avoid being transferred out of the Hong Kong Stock Exchange.

However, there are also a few companies whose stock prices have been mistakenly killed in an extreme market environment, but with steady operation, they still have the fundamentals of high growth in the medium to long term. The market value has remained above HK$4 billion over the past year, showing great resilience.

Shengye ((06069.HK)), a leading domestic supply chain technology platform, is one of them. Recently, Shengye released its 2023 financial report. Revenue and net profit from core financial data have further increased. This reflects the company's excellent fundamentals and further enhances its profitability. Through financial reports, the author can see that Shengye's platformization and technological upgrading and transformation have achieved remarkable results. The “dual drive+big platform” strategy has become an endogenous driving force for Shengye's business development and innovation, and the technology sector is expected to become a new engine for Shengye's later performance growth. Additionally, Shengye raised its dividend payout ratio significantly to 90%. Based on the closing price on the day of the announcement, the dividend rate is around 6.5%, which already has long-term investment value.

(Shengye closing data for April 2, 2024)

Currently, the company has been included in the MSCI series of indices, the Hang Seng Composite Index, the Shenzhen-Hong Kong Stock Connect and the Shanghai-Hong Kong Stock Connect. Last year, the company's MSCI (MSCI) ESG rating was A, the leading rating in the domestic financial industry. Combined with Shengye's business conditions (positive medium- to long-term performance, strong fundamental support) and market performance (long-term market capitalization greater than HK$4 billion), in the medium to long term, future performance is highly supportive. Benefiting from the upcoming Fed's interest rate cut cycle and further strengthening with A-shares, it is easy to be cared for by various sources of capital such as international capital and southbound capital.

Hong Kong Stock Connect further relaxed conditions, and HK$4 billion became the new transfer standard

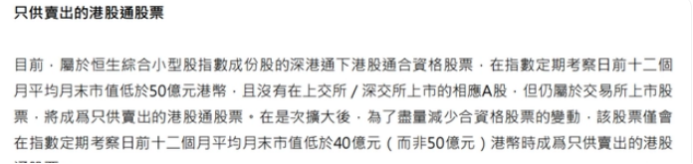

According to the relevant regulations of the “Shenzhen-Hong Kong Stock Connect Business Implementation Measures (2023 Revision)” issued by the Shanghai, Shenzhen and Hong Kong Exchanges last year, the latest guidelines of the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect clarify the criteria for stock transfers in and out.

In terms of the transfer mechanism, in order to reduce stock fluctuations, the eligible stocks of the Hong Kong Stock Connect under the Shenzhen-Hong Kong Stock Connect Index will only be adjusted to Hong Kong Stock Connect stocks for sale only if their average month-end market value for the 12 months before the regular inspection date falls below HK$4 billion. Previously, the threshold was HK$5 billion.

This adjustment means that Hong Kong Stock Connect's withdrawal standards have been relaxed, from an “average market value of less than HK$5 billion at the end of the month” to a “average market value of less than HK$4 billion at the end of the month” in the past 12 months.

Supported by excellent fundamentals, Shengye's value resilience is fully demonstrated

Despite further relaxation of conditions on Hong Kong Stock Connect, the linkage between A shares and Hong Kong stocks has been further strengthened, and the liquidity of Hong Kong stocks has increased. However, under the influence of external circumstances such as the Federal Reserve's continued high interest rates, the stock prices of many Hong Kong listed companies were still unable to escape the downward trend last year. The total market value fell below HK$4 billion for many months in a row, facing the risk of being transferred out of the Hong Kong Stock Exchange.

However, there are also a few Hong Kong stock listed companies. Despite facing an extreme market environment, their stock prices have returned to the bottom, but relied on their sound business strategy and medium- to long-term growth potential, successfully stabilized their market capitalization above HK$4 billion over the past year, demonstrating their extraordinary ability to withstand pressure and value resilience.

Shengye is one of the Hong Kong-listed companies. Back to the fundamentals of Shengye's company, according to Shengye's 2023 financial report, the company's core business revenue reached 964 million yuan last year, up 20.4% year on year; net profit of 286 million yuan was achieved, up 17.2% year on year.

Regarding the reason for the company's performance growth, Shengye said that it is mainly due to the continued deepening of the platform-based strategy to achieve further breakthroughs in the number of small, medium and micro enterprise customers, and the further increase and diversification of platform financial partners, the scale of the platform's inclusive matching business and digital finance solutions has been expanded.

Against the backdrop of a complex and changing international environment and China's economic recovery under pressure in the past year, Shengye was still able to achieve steady results, which showed that the company had strong profitability and effectively addressed various challenges.

Observe Shengye's revenue sources in multiple dimensions. As a supply chain technology platform, Shengye's main business includes digital financial solutions, platform services, and supply chain technology services. Shengye said in its financial report that the company insists on financial services to the real economy as its fundamental purpose, and further implements the “dual drive+big platform” strategy and uses digital technology to enhance the coverage of inclusive finance.

“Dual drive” refers to the integration of “industrial internet” and “digital finance” in the supply chain, where the two are cross-empowered. This model of combining industry and finance not only helps Shengye link the industrial ecosystem and achieve accurate customer acquisition, but also helps Shengye to carry out risk control, verify the authenticity and rationality of underlying transactions through mining industry data in multiple dimensions, and improve asset quality.

In terms of revenue composition, digital finance solutions, as one of the company's main revenue sources, brought the company 723 million yuan in revenue last year, an increase of 16% over the previous year. It can be seen from this that the company's digital finance solutions are growing strongly, and Shengye's layout and innovation ability in the digital finance field have been recognized by the market.

“Big platform” refers to strategically and efficiently connecting asset side, capital side, credit enhancement side and resource partners to open up different links and build a comprehensive supply chain financial service platform. In the financial report, Shengye said that state-owned joint ventures such as Ningbo Guofu Commercial Factoring Co., Ltd. and Wuxi Guojin Commercial Factoring Co., Ltd. have successively completed capital increases and share expansion or introduction of war investments, achieving deep links in the industrial ecosystem, receiving long-term and steady financial support, and accelerating the construction of a region-leading supply chain inclusive financial service platform, thus promoting the rapid expansion of the Group's overall business scale.

Specifically, Shengye's average daily supply chain asset balance last year was about 18.1 billion yuan, an increase of about 52% over the previous year. The total amount of supply chain assets handled by the platform was 193.4 billion yuan, an increase of about 22% over the same period last year. These data show the company's deep strength and broad influence in the field of supply chain finance. Supply chain finance is a bridge connecting industry and finance, and the expansion of its scale will help improve the financial efficiency and overall competitiveness of the industrial chain.

In addition, Shengye Platform has accumulated 15,326 customers, an increase of about 20% over the same period last year. This growth shows that the company's services are increasingly recognized and trusted by customers. Customer growth is an important foundation for the company's continuous development. It is also the key for the company to expand its market share and enhance its brand influence.

The positive factoring business accounts for more than 96%, and the number of small, medium and micro customers accounts for more than 97%. These two data reveal two major characteristics of the company's business: the first is the positive factoring business, that is, the accounts receivable financing application business initiated by micro, medium and micro suppliers, which reflects the company's specialization and deep cultivation in the field of supply chain finance. Through the risk control logic and business model of “heavy transactions over subjects”, it uses technological means to help micro, small and medium-sized suppliers transform transaction data into “data assets”, making up for the lack of main credit of small, medium and micro suppliers; second, it effectively solves the financing pain points of small, medium and micro suppliers; second, it mainly serves micro, small, medium and micro suppliers, which highlights the company's inclusiveness of benefits for micro, medium and micro suppliers. Strong financial commitment and practical action.

Shengye said it will continue to deepen its development direction and plans under the “dual drive+big platform” growth strategy this year.

Technology is expected to become a new engine for performance growth

Industry insiders pointed out that the current supply chain finance market has exceeded 36 trillion yuan, which can be described as a blue ocean market. At the same time, relevant reports show that China's micro, small and medium-sized enterprises are facing serious financing challenges, and the potential financing gap actually accounts for 43.18%. This further highlights the huge potential and market opportunities of supply chain finance in solving the financing problems of micro, small and medium-sized enterprises.

With the deepening development of the supply chain finance sector, technology is expected to become a new engine for Shengye's performance growth.

On the one hand, this means that the importance of technology revenue in the company's overall business is gradually increasing, making the company's revenue structure more diversified and reducing the risk of dependence on a single business. This also indicates that with Shengye's further deepening and innovation in the field of technology, technology revenue is expected to become an important pillar of the company's future performance growth.

Shengye's chief strategy officer Harano said in an interview with the media on the day the performance was released: “With the continuous increase in the number of partner funders on the platform and the additional business revenue brought about by the capital increase of state-owned enterprise joint ventures, we expect technology revenue to account for more than 30% of the company's overall revenue in 2024, and is expected to further increase to 50% in 2025.”

Behind this is Shengye's emphasis on research and development. As of December 31, 2023, the total R&D investment reached 200 million yuan, with a total of 62 national invention patents and computer software copyrights. With its strong technological strength and outstanding contribution in accurately serving micro, small and medium-sized enterprises, it was successfully selected by CNBC's “2023 Top 200 Global Fintech Companies” list.

Thanks to R&D investment and technology, Shengye also showed strong risk control capabilities. The annual report showed that the company's overdue rate was only 0.03%, and the defective rate was 0%.

End section

Combining Shengye's industry and fundamentals, the current supply chain finance market has surpassed 36 trillion yuan, which can be described as a blue ocean market; compounded by the fact that the share of China's SME capital gap remains high, Shengye is expected to stabilize more fundamentals under the deepening of the “dual drive+big platform” strategy, while technology is expected to become a new engine for growth, opening up room for growth.

Based on these factors, it is foreseeable that in the medium to long term, Shengye's performance will continue to be strongly supported. As the world enters the Fed's interest rate cut cycle in the future, the liquidity of Hong Kong stocks is expected to increase further. Furthermore, with the booming development of the fintech industry, Shengye is also expected to receive widespread attention and financial support from various investors such as Southbound Capital. Shengye, which is currently at the bottom of its valuation, is expected to usher in a valuation repair.