Recently, Guangdong Investment made adjustments to dividends at the same time as announcing results. Affected by this, there were obvious shocks in the capital market.

As a proper leader in the Hong Kong stock market in the past, Guangdong Investment has always been known for its steady operation and continues to maintain high dividends to give back to shareholders. Now, once it has changed its attitude of positive dividends in the past, the market reaction is actually understandable.

But how exactly should we view this change in the company? Perhaps the answer can be found in financial reports.

1. The basic plate is still firm

Looking at overall performance, Guangdong Investment's revenue increased slightly in the past year, but profits declined to a certain extent.

According to the data, in 2023, Guangdong Investment achieved consolidated revenue of HK$24.2 billion, up 4.3% year-on-year, and comprehensive profit attributable to company owners decreased by 34.5% year-on-year to HK$3.122 billion. The company pointed out that the reason for the decline in profit was mainly due to changes in the fair value of investment properties, depreciation of owned properties under development and completed properties for sale.

Look at the business level.

The first is the water resources business sector.

As one of the company's core businesses, the profit contribution from the Dongshen Water Supply Project is still an important part of the company's profit. The total water supply to Hong Kong, Shenzhen and Dongguan during the year was 2,209 billion tons, generating revenue of HK$6.383 billion.

Other water resources projects operated steadily during the year. The total profit before tax (excluding net exchange differences and net financial expenses) of Guangdong investment from other water resources projects during the year was HK$1,854 billion, a slight increase of 1.1% over the previous year.

Let's take another look at the non-water resources business sector.

In the property investment and development business segment, Guangdong Land's performance over the past year has been affected by the real estate environment. According to financial reports, Guangdong Land achieved a loss of HK$296 million before tax, excluding changes in the fair value of investment properties, net income from disposal of the property, impairment of owned properties for sale and completed properties for sale, and net financial expenses, and realized a pre-tax profit of HK$85.97 million for the same period last year.

At the same time, the hotel operation and management business ushered in a new situation with the end of the epidemic and customs clearance. The overall revenue of the sector increased sharply by 67.8% to HK$649 million from year to year, and successfully turned a loss into a profit. Profit before tax (excluding changes in fair value of investment properties and net exchange differences) reached HK$106 million.

In terms of department store operations, total revenue of HK$759 million was achieved. After adjusting the income from fair value of investment properties and changes in leasing, profit before tax increased by 74.6% to HK$101 million, compared to only HK$577.76 million in the same period last year.

In terms of energy projects, the Guangdong Energy Project achieved revenue of HK$1,818 billion and realized profit before tax (excluding net financial expenses) of HK$99.722 million, reversing the situation of large losses in the past.

Guangdong Electric Power Jinghai Power achieved revenue of HK$8.259 billion, an increase of 2.4% over the previous year, and realized an accrued profit of HK$89.626 million. Compared with the previous year's share loss of HK$106 million, it achieved a significant reduction in losses in 2023.

In the road and bridge business segment, Guangdong Expressway achieved revenue of HK$664 million, an increase of 2.5% year on year, and realized profit before tax (excluding net financial expenses) of HK$372 million, an increase of 4.1% year on year. Guangdong Silver Bottle achieved pre-tax profit of HK$134 million (excluding other operating income), an increase of 20.6% over the previous year.

As can be seen, the profit fluctuations of Guangdong Investment over the past year were mainly affected by the real estate sector, but they were also basically non-operating losses. Although the real estate sector has borne some profit pressure, the company's overall operating base has remained stable. This can be seen from the positive maintenance of overall profits.

If you look at the real estate industry as a whole from the perspective of the real estate industry, in the past year, many housing enterprises have faced declining profits or even losses. With its diversified business layout and sound financial foundation, Guangdong Investment has demonstrated the company's resilience and adaptability to market fluctuations.

Overall, Guangdong Investment's performance over the past year has been quite impressive. Despite facing multiple challenges, the company has been able to maintain steady profitability, all core businesses have gone hand in hand, and the quality of operations has reached a new level.

2. Dividend balance

While maintaining a stable basic market, profits from Guangdong Investment have inevitably declined due to the general environment in the real estate industry. Therefore, this dividend adjustment has also become the focus of controversy in the market.

In the author's opinion, the core reason for dividend adjustments is not pressure from the company's annual profit level, but rather based on trade-offs at the level of overall management strategy. In fact, the core reason why the company's profits have been under pressure in the past year was property depreciation. This was only a short-term effect; it did not affect the company's long-term dividends.

However, it is undeniable that although the company may still maintain a relatively stable level of profit, it is necessary to carefully consider the use and allocation of capital in the face of an increasingly complex market environment and future development needs.

Of course, investors often invest in listed companies for two purposes, either to earn capital gains or to receive dividends. As far as the former is concerned, it is often highly uncertain due to large market fluctuations, while the latter is generally relatively certain. Many listed companies either do not pay dividends or maintain stable dividends all year round, and precisely because of this certainty, listed companies that maintain steady dividends are also often favored by market investors.

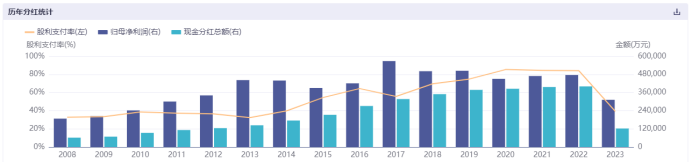

Judging from the investment situation in Guangdong, the company is a benchmark for dividends in the Hong Kong stock market. It has maintained a steady dividend policy in the past. According to iFind data, from 2008 to 2022, it paid dividends every year and maintained steady growth, with a cumulative cash dividend amount of nearly HK$35 billion. Among them, dividend payment rates for 2020, 2021, and 2022 all remained at a high level of 84% or more.

(Source: iFind)

Guangdong Investment plans to pay a final dividend of HK$0.12 per share at the end of the year, adding HK$0.19 to the mid-year payment and HK$0.31 for the full year of 2023, with a dividend rate of 65% for the full year.

Obviously, the company's current dividend fell short of market expectations, which caused controversy and short-term fluctuations in the market. However, considering the company's overall strategy, the author believes that such decisions will help the company to better cope with future challenges and opportunities. Anyway, in a dynamically changing market environment, if an enterprise wants to develop in the long term, it is necessary to learn to respond flexibly to various changes and always put long-term development goals first.

3. The inflection point has been reached, combining safety and certainty

Looking at it now, you can clearly see that Guangdong Investment has two major characteristics, and has already reached an inflection point in business, and the potential for subsequent growth is quite impressive.

First, from a safety perspective, combined with the company's cash flow situation over the past year, it is easy to see that the company has shown a significant improvement trend.

In 2023, the company's net cash inflow from operating activities during the year was approximately HK$10.711 billion, compared with a net cash outflow of HK$1,399 billion in the same period of the previous year. In particular, Guangdong Land, its real estate development division, had a net cash inflow of approximately HK$3,607 billion from operating activities, a significant reversal from the net cash outflow of HK$6.661 billion in the same period last year.

The company maintains confidence in its cash position. In response to this, Guangdong Land also stated in its financial report that the Group's current cash resources, combined with stable cash flow from operating operations, are sufficient to meet the Group's liabilities and business requirements. The company maintained sufficient cash on hand. By the end of 2023, Guangdong Investment's cash and bank balance reached HK$12.594 billion, an increase of HK$3,565 billion over the same period last year.

Second, from a deterministic perspective, on the one hand, is the continued stability of the main water business. The pre-tax profit of this business in 2023 accounted for 85% of the company's total share. Among them, the water supply business to Hong Kong is full of cash cows.

It is worth mentioning that at the end of 2023, the company announced a new agreement on Dongjiang water supply from 2024 to 2026. According to the new agreement, according to the annual water supply limit of 820 million cubic meters, basic water prices from 2024 to 2026 will reach HK$5.136 billion, HK$5.259 billion and HK$5.385 billion respectively, an increase of 2.39% per year.

In addition, the company's mainland water production capacity is also increasing rapidly. By the end of 2023, the company's mainland water supply operating capacity was 8.54 million tons/day, compared to only 5.43 million tons/day, joint water supply was 1.95 million tons/day, and construction was 1.44 million tons/day; sewage operation capacity was 2.05 million tons/day, compared to 1.92 million tons/day in the same period last year. These all brought definite expectations for the subsequent growth in the water resources business's performance.

On the other hand, the real estate industry is currently benefiting from policy support, and both the supply and demand sides continue to recover and improve. At the same time, in an environment where the economy continues to recover, the steady recovery of businesses such as hotels and department stores has been promoted, and the company's electricity, road and bridge businesses have maintained a steady development attitude. These will all provide solid support for the future performance of investment in Guangdong.

In addition to this, considering that the US interest rate hike has reached an inflection point, Guangdong investment, which has the characteristics of a public utility stock, will also usher in new opportunities in the capital market. With the arrival of a new cycle of interest rate cuts, a series of pressures such as the degree of inversion of the gap between China and the US, capital outflows, and the degree of devaluation of the RMB exchange rate will be alleviated. These will all help reduce the company's financial costs, reduce the company's exchange losses, have an increasing effect on profits, and help repair capital market valuations.

4. Conclusion

After the financial report was announced, Guangdong Investment received a continuous increase in shareholders' holdings. The company announced that from March 26 to 28, the controlling shareholder Guangdong Holdings purchased 14.258 million shares of the company on the open market at an average price of HK$3.51 per share. After the increase in holdings, Guangdong Holdings held a total of 3.707 billion shares, and the shareholding ratio has increased from about 56.49% of the company's total issued shares to about 56.71%.

At the same time, the announcement stated that the increase in holdings shows that Guangdong Holdings has full confidence in the company's future development prospects and fully supports the company's long-term development. Based on confidence in the company's prospects and recognition of its long-term investment value, Guangdong Holdings will continue to increase its shares in due course.

While shareholders' holdings increased significantly, Southbound capital also maintained an inflow trend. Among them, on February 28, their holdings increased by 27.986 million shares, boosting Hong Kong Stock Connect's shareholding ratio by 0.43 percentage points, ranking in the top six in the ranking for increasing holdings on the same day. This is enough to show that market capital is confident in the future development of Guangdong investment and provides positive support for the company's subsequent market performance.

(Source: iFind)