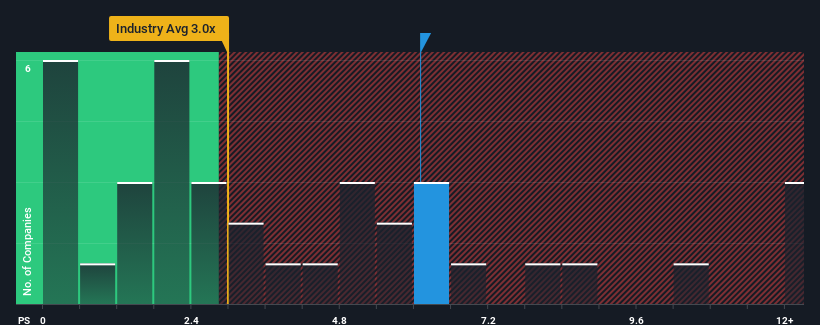

MicroPort CardioFlow Medtech Corporation's (HKG:2160) price-to-sales (or "P/S") ratio of 6.1x may look like a poor investment opportunity when you consider close to half the companies in the Medical Equipment industry in Hong Kong have P/S ratios below 3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How MicroPort CardioFlow Medtech Has Been Performing

With revenue growth that's inferior to most other companies of late, MicroPort CardioFlow Medtech has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MicroPort CardioFlow Medtech.Is There Enough Revenue Growth Forecasted For MicroPort CardioFlow Medtech?

In order to justify its P/S ratio, MicroPort CardioFlow Medtech would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. The strong recent performance means it was also able to grow revenue by 223% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 51% per annum as estimated by the four analysts watching the company. That's shaping up to be similar to the 51% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that MicroPort CardioFlow Medtech's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given MicroPort CardioFlow Medtech's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 1 warning sign for MicroPort CardioFlow Medtech you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.