While Autolus Therapeutics plc (NASDAQ:AUTL) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 14% in the last quarter. On the other hand, over the last twelve months the stock has delivered rather impressive returns. During that period, the share price soared a full 202%. So we think most shareholders won't be too upset about the recent fall. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

While the stock has fallen 12% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Autolus Therapeutics recorded just US$1,698,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that Autolus Therapeutics comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There was already a significant chance that they would need more money for business development, and indeed they recently put themselves at the mercy of capital markets and raised equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Some Autolus Therapeutics investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

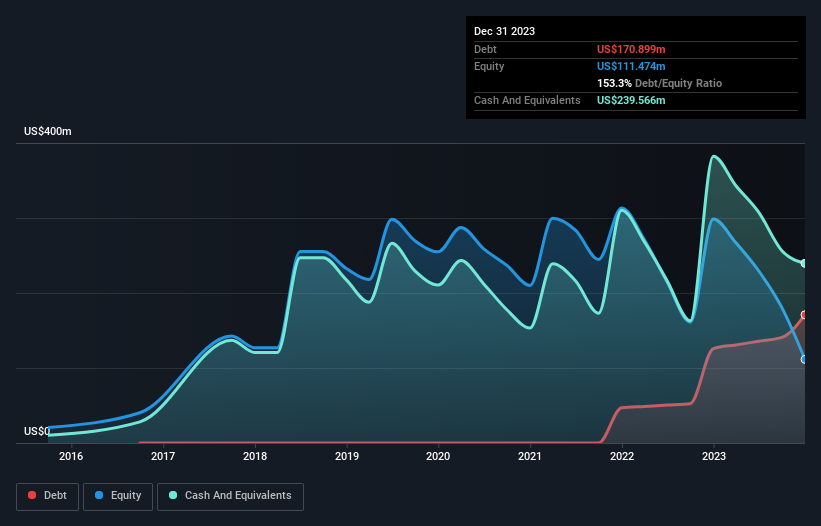

Our data indicates that Autolus Therapeutics had more in total liabilities than it had cash, when it last reported. That put it in the highest risk category, according to our analysis. So the fact that the stock is up 73% in the last year shows that the cash injection was a welcome one. Investors must really like its potential. The image below shows how Autolus Therapeutics' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. One thing you can do is check if company insiders are buying shares. It's often positive if so, assuming the buying is sustained and meaningful. You can click here to see if there are insiders buying.

A Different Perspective

We're pleased to report that Autolus Therapeutics shareholders have received a total shareholder return of 202% over one year. There's no doubt those recent returns are much better than the TSR loss of 12% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Autolus Therapeutics better, we need to consider many other factors. For instance, we've identified 3 warning signs for Autolus Therapeutics (1 is potentially serious) that you should be aware of.

But note: Autolus Therapeutics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.