Unfortunately for some shareholders, the Mawson Infrastructure Group Inc. (NASDAQ:MIGI) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

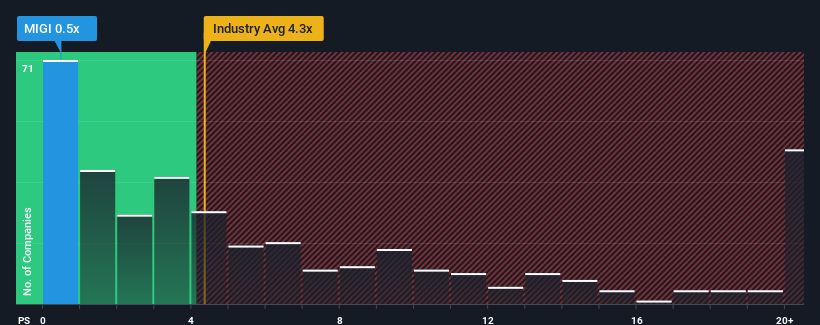

After such a large drop in price, Mawson Infrastructure Group may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.3x and even P/S higher than 11x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

What Does Mawson Infrastructure Group's P/S Mean For Shareholders?

Mawson Infrastructure Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Mawson Infrastructure Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Mawson Infrastructure Group's Revenue Growth Trending?

Mawson Infrastructure Group's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 48%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 14% over the next year. With the industry predicted to deliver 15% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Mawson Infrastructure Group's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Mawson Infrastructure Group's P/S Mean For Investors?

Shares in Mawson Infrastructure Group have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Mawson Infrastructure Group currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 4 warning signs for Mawson Infrastructure Group you should be aware of, and 2 of them don't sit too well with us.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.