VirTra, Inc. (NASDAQ:VTSI) shareholders have had their patience rewarded with a 36% share price jump in the last month. The last month tops off a massive increase of 150% in the last year.

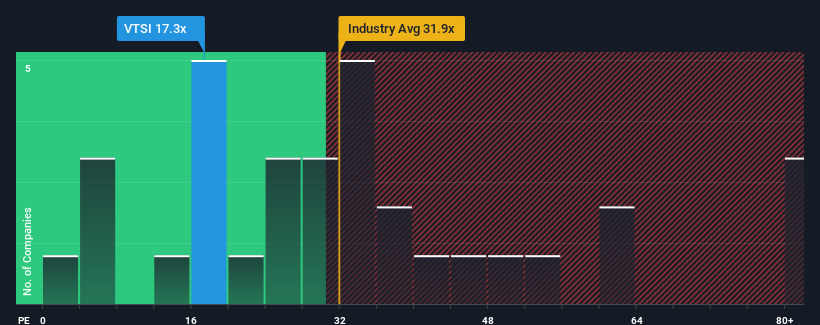

Even after such a large jump in price, it's still not a stretch to say that VirTra's price-to-earnings (or "P/E") ratio of 17.3x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for VirTra as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

How Is VirTra's Growth Trending?

The only time you'd be comfortable seeing a P/E like VirTra's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 326%. The latest three year period has also seen an excellent 297% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 3.5% as estimated by the only analyst watching the company. With the market predicted to deliver 11% growth , that's a disappointing outcome.

With this information, we find it concerning that VirTra is trading at a fairly similar P/E to the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Key Takeaway

VirTra appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of VirTra's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with VirTra.

Of course, you might also be able to find a better stock than VirTra. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.