Recently, Tianlun Gas (01600.HK), a Hong Kong stock listed company, released its 2023 financial report.

Through this financial report, as can be seen from the main financial data, Tianlun Gas's revenue and net profit to mother continued to grow positively, reflecting the company's steady operation and further improvement in profitability. Furthermore, the company's management has a clear strategic plan to accelerate the new energy business layout and move towards a first-class integrated clean energy supplier around the “dual carbon” strategy and “3060” goals, which will help open up growth space and continue to enhance the company's core competitiveness and market position.

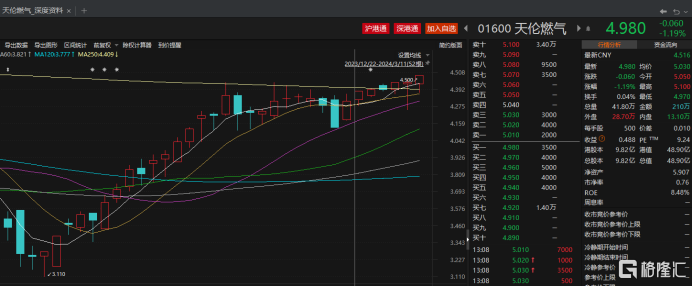

Looking at the Hong Kong stock market, Dongfang Wealth Choice market trading software data shows that since 2024, Tianlun Gas's stock price performance has been strong, and the year-to-date increase far exceeds the average of the market and the utility industry in which it is located. Judging from the current valuation situation of the company, the key indicators such as the price-earnings ratio of Tianlun Gas are all within a reasonable range and have high investment value.

Steady operation and further improvement in profitability

According to the 2023 financial report, Tianlun Gas's revenue reached 7.725 billion yuan last year, up 2.4% year on year; realized net profit of 506 million yuan, up 7.9% year on year. At the same time, net profit returned to mother also achieved a year-on-year increase of 7.9%, reaching 480 million yuan.

In terms of gross margin, despite facing adverse factors such as fluctuations in raw material prices, Tianlun Gas maintained a stable gross margin level in 2023 thanks to the accelerated improvement of the favorable price mechanism. According to the data, the overall gross profit margin of Tianlun Gas was 18.8% last year, compared to 18.5% for the same period in 2022. A stable level of gross margin provides a strong guarantee for the company's continued profit.

Looking further, the steady increase in Tianlun Gas's revenue and net profit is mainly due to the steady growth in the company's gas business volume and strong performance in value-added business.

Looking at the macro environment, the domestic economy showed a steady upward trend in 2023, and the natural gas industry recovered and grew. According to data released by the National Development and Reform Commission, the country's apparent consumption of natural gas reached 394.53 billion cubic meters in 2023, an increase of 7.6% over the previous year.

In the context of industry recovery, Tianlun Gas has seized the opportunity, deepened the layout of the three core business lines, promoted the steady development of various businesses, and achieved both annual revenue and net profit growth, showing its strong market competitiveness and good operating capabilities, and reflecting the steady increase in the company's profitability.

Judging from the specific revenue structure, Tianlun Gas's revenue mainly comes from gas sales business, engineering installation and service, and other businesses. Among them, the gas sales business is the core business of Tianlun Gas. The share of revenue in 2023 further increased to 79.6%, reaching 6.149 billion yuan, an increase of 7.3% over the previous year.

As can be seen from financial reports, the increase in Tianlun Gas's gas sales business revenue is mainly due to an increase in gas sales volume. Financial reports show that Tianlun Gas's total gas sales volume last year was 2,085 billion cubic meters, an increase of 9.1% over the previous year. Among them, retail sales increased 4.5% year over year.

As can be seen from the increase in the total gas sales volume of Tianlun Gas and the further increase in the share of gas sales business revenue, Tianlun Gas is continuously consolidating and enhancing its market position in the gas sales field.

In addition, Tianlun Gas's value-added business revenue also showed a strong growth momentum, rising 11.5% year over year to 371 million yuan. This is mainly due to the company's continuous optimization of product structure and service quality, as well as effective marketing strategies.

It can be seen that when providing value-added business, Tianlun Gas focuses on product innovation and service quality improvement, and has adopted appropriate strategies in marketing and sales, increasing brand awareness and market share to meet the diverse needs of the market, thus driving the growth of value-added business revenue.

As of December 31 of last year, Tianlun Gas had 69 urban gas projects across the country, providing gas services to over 5.55 million urban and rural residents and more than 40,000 industrial and commercial enterprise users. The further expansion of the number of users not only reflects Tianlun Gas's dominant position in market competition, but also lays a solid foundation for its future continuous development.

In terms of shareholder returns, Tianlun Gas has maintained a consistent stable dividend payment policy. According to the 2023 financial report, the company announced a dividend of RMB 10.82 points per share for the final year of 2023, and the cumulative dividend payout for the whole year reached 17.64 points per share.

In the author's view, this dividend policy not only reflects the company's responsibility and commitment to shareholders, but also helps enhance investors' confidence and loyalty.

Moving towards a first-class integrated clean energy provider

From the 2023 financial report, the author can also see that Tianlun Gas is moving towards a first-class integrated clean energy supplier, opening up room for the company's growth.

On the one hand, looking ahead to 2024, China's economy will further recover to its potential growth rate. It will still be the driving force for global economic recovery in the future, and the total consumption of gas by domestic residents will further increase, which means that domestic demand will continue to improve.

Furthermore, under the transformation of the global energy structure and China's “carbon peak and carbon neutrality” development strategy, natural gas as a clean and efficient form of energy is still regarded as an important channel for resource transformation, bringing new development opportunities to the gas industry.

According to the research report of Shenwan Hongyuan, an established domestic brokerage firm, natural gas is of great significance in improving China's energy structure. It is estimated that in 2030, natural gas supply and demand will increase to nearly 550 billion cubic meters, an increase of more than half of 2023. The compound annual growth rate is about 4.8%, and the industry will grow steadily. It further confirms the stability and growth of the industry in which Tianlun Gas is located.

Tianlun Gas said that the company will seize major development opportunities under the dual carbon target and continue to promote the transformation and upgrading from gas supply to a comprehensive clean energy business. Overall, Tianlun Gas will be based on the main gas business with a more systematic energy security and supply strategy, while actively developing collaborative development business with renewable energy, reviewing the current situation, and actively promoting the integrated energy service business.

Looking specifically at it,In the financial report, the company stated that it will continue to enhance the competitive advantage of its core gas business through various dimensions such as increasing the share of industrial and commercial gas sales business, expanding new users, improving the competitiveness of gas sources, and rationalizing terminal gas prices. Furthermore, relying on the country's huge urban gas layout and brand influence, the company is developing in a cleaner and lower carbon direction, gradually expanding comprehensive energy services, guided by user needs, and striving to create higher economic and social value for the country.

It can be seen from this that Tianlun Gas management has forward-looking strategic planning and execution capabilities, and can make timely adjustments in line with market changes.

Overall, the rapid development of the new energy sector has also provided Tianlun Gas with huge market opportunities and broad development prospects. Tianlun Gas has clear room for future growth. On the basis of a steady gas business, it explores growth value, including new energy business, and opens up a business model, and will continue to contribute to new performance increases and become a first-class comprehensive clean energy supplier.

End section

In the 2023 financial report, Tianlun Gas showed steady performance and a trend of further strengthening profitability; in addition, the company's management had a clear strategic plan and expanded the company's future development space by increasing the layout of the new energy sector in a timely manner, etc., laying a solid foundation for the company's future growth. For investors seeking long-term stable returns and growth potential, Tianlun Gas is certainly a high-quality investment target worthy of in-depth research and attention.