Xiangxin Technology: Designated as a new energy vehicle project with estimated total project sales of about 300 million yuan

[Focus on hot topics]

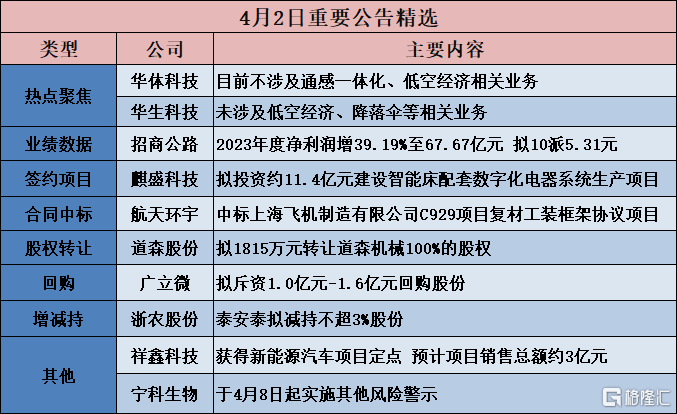

Huati Technology (603679.SH): Currently not involved in business related to integrated sensing or low-altitude economy

Huati Technology (603679.SH) announced that recently, the company paid attention to discussions on the company's related business on some media, stock bars and other platforms, covering hot concepts such as synesthetic integration and low-altitude economy. The main source of the company's revenue and profit is sales of street lighting products. Currently, it does not involve businesses related to integrated sensing or low-altitude economy.

Watson Technology (605180.SH): Does not involve low-altitude economy, parachute or other related businesses

Watson Technology (605180.SH) announced that recently, the company paid attention to discussions on the company's related business on some media, stock bars and other platforms, covering hot concepts such as the low-altitude economy and parachutes. According to the company's own investigation, the company is not involved in low-altitude economy, parachutes, etc. related businesses. Currently, the company's main products are divided into two categories: airtight materials and flexible materials. The above products are unrelated to parachute materials. The company's main business has not changed, and the daily business conditions and internal business order are normal.

[Investment projects]

Huading Co., Ltd. (601113.SH): Plans to invest 950 million yuan to build a “high quality differentiated nylon PA6 filament project with an annual output of 65,000 tons”

Huading Co., Ltd. (601113.SH) announced that the company plans to invest in the construction of the “65,000 tons of high-quality differentiated nylon PA6 filament project” in the Wuzhou factory area. The total investment of the project is expected to be 950 million yuan, and the construction period is 24 months.

Yantang Dairy (002732.SZ): Proposed construction of an industrial cluster project with the advantages and characteristics of the urban dairy industry

Yantang Dairy (002732.SZ) announced that on September 21, 2023, the company disclosed the company's “2023-2030 Development Plan”. In order to promote the implementation of the company's “2023-2030 Development Plan”, build a modern dairy industry group, create a model for the coordinated development of the entire dairy industry chain in China, and lead the high-quality development of South China's dairy industry, the company plans to build an urban dairy industry cluster project (hereinafter referred to as the “Cluster Project”). The construction period of the cluster project is 2024 to 2026.

Qisheng Technology (603610.SH): Plans to invest about 1.14 billion yuan to build a digital electrical system production project supporting smart beds

<项目投资协议>Qisheng Technology (603610.SH) announced that on April 2, 2024, the 14th meeting of the third board of directors of the company reviewed and passed the “Proposal on the Company” and agreed to sign the “Project Investment Agreement” with the People's Government of Wangjiangjing Town, Xiuzhou District, Jiaxing City. The main products of this project are intelligent electric bed electrical systems (hereinafter referred to as “electrical systems”) and smart bed supporting backrests and sewing jackets. Among them, the electrical systems include an adjustment system, an intelligent control system, a multi-function operating system, and an intelligent sleep management system. After completion, the project can produce 8 million sets/year of control systems, 4 million sets/year of control systems, 4 million units/year of operating systems, 1 million sets/year of intelligent sleep management systems, 1 million sets/year of sewing jackets, and 500,000 pieces/year for smart bed backrests. The total investment of the project is about 1.14 billion yuan.

[Contract won the bid]

Aerospace Huanyu (688523.SH): Won the bid for the composite tooling framework agreement project for the C929 project of Shanghai Aircraft Manufacturing Co., Ltd.

Aerospace Huanyu (688523.SH) announced that the company's holding subsidiary Hunan Feiyu Aviation Equipment Co., Ltd. (“Feiyu”) recently received a “Notice of Transaction” from Shanghai Aircraft Manufacturing Co., Ltd. (“Shanghai Aircraft Manufacturing Co., Ltd.”). Feiyu's bid for the “Shanghai Aircraft Manufacturing Co., Ltd. C929 Project Composite Tooling Framework Agreement Project” (number SAMC-GZ 24007) has been completed, and the transaction amount is no more than 175 million yuan (RMB).

Jin Chengxin (603979.SH): Signed 110 million yuan mining operation contract for 8000 ton underground project

Jin Chengxin (603979.SH) announced that the company recently obtained an underground mining operation contract for the 8,000t underground project of Jiangxi Copper Group Yinshan Mining Co., Ltd. This contract is a unit price contract. The contract amount is estimated to be about 110 million yuan based on the estimated workload, and the final settlement amount is based on the actual inspection completed workload and settlement payment.

[[Share acquisition]

Dawson Co., Ltd. (603800.SH): Plans to transfer 100% of Dawson Machinery's shares for RMB 18.15 million

Dawson Co., Ltd. (603800.SH) announced that it plans to sell 100% of the shares of Suzhou Dawson Materials Co., Ltd. (“Dawson Materials”), a wholly-owned subsidiary of the company, to Suzhou Dawson Drilling & Production Equipment Co., Ltd. (“Dawson Limited”), which is controlled by Land & Sea Holdings, and 100% of the shares of Suzhou Dawson Machinery Co., Ltd. (“Dawson Machinery”), a wholly-owned subsidiary of the company. As agreed by all parties to the transaction, the transaction price for 100% of Dawson Materials was determined to be 60.2 million yuan, and the 100% share transfer transaction price of Dawson Machinery was set at 18.15 million yuan.

Minfa Aluminum (002578.SZ): Plans to acquire a total 25% share of Smart Aluminum Technology

Minfa Aluminum (002578.SZ) announced that the company held the second meeting of the 6th board of directors on April 1, 2024 to review and pass the bill “On the Acquisition of Minority Shareholders' Shares in Holding Subsidiaries”, agreeing that the company would acquire a total of 25% of the shares of Fujian Minfa Zhi Aluminum Technology Co., Ltd. (“Smart Aluminum Technology”) held by Huang Qiushui, Li Youping, and Chen Ronghua. The purchase price was not higher than the audited book value of the net assets of each share. After the transaction is completed, the company's shareholding ratio in Zhilu Technology will increase from 75% to 100%, and Zhilu Technology will change from a holding subsidiary of the company to a wholly-owned subsidiary.

Linzhou Heavy Machinery (002535.SZ): Plans to transfer 47% of Pingmei Shenma Machinery Equipment Group's shares in Henan Heavy Machinery to Henan Qiou

Linzhou Heavy Machinery (002535.SZ) announced that in order to further optimize resource allocation and adjust the industrial layout, the company transferred 47% of the shares of Pingmei Shenma Machinery Equipment Group Henan Heavy Machinery Co., Ltd. to Henan Qiou General Machinery Co., Ltd. (“Henan Qiou” for short). The share transfer price was 704.25 million yuan. After the transfer is completed, the company will no longer hold any shares in Pingmei Shenma Machinery Equipment Group Henan Heavy Machinery Co., Ltd.

[Performance data]

China Merchants Highway (001965.SZ): Net profit for 2023 increased by 39.19% to 6.767 billion yuan, and plans to distribute 10 to 5.31 yuan

China Merchants Highway (001965.SZ) announced its 2023 annual report. In 2023, the company achieved operating income of 9.731 billion yuan, up 17.29% year on year; net profit attributable to shareholders of listed companies was 6.767 billion yuan, up 39.19% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 5,095 billion yuan, up 30.48% year on year; basic income per share was 1.0553 yuan; it plans to distribute a cash dividend of 5.31 yuan (tax included) to all shareholders for every 10 shares.

Gold and Molybdenum Co., Ltd. (601958.SH): Net profit increased 132.19% year-on-year in 2023, and plans to pay 10 to 4 yuan

Gold and Molybdenum Co., Ltd. (601958.SH) announced its 2023 annual report. During the reporting period, it achieved operating income of 11,531 billion yuan, an increase of 20.99%; net profit attributable to shareholders of listed companies of 3,099 billion yuan, an increase of 132.19% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 2,958 billion yuan, an increase of 125.26% year on year; and basic earnings per share of 0.96 yuan. A cash dividend of 4 yuan (tax included) is proposed for every 10 shares.

[Repurchase]

Guangliwei (301095.SZ): Plans to spend 100 million yuan to 160 million yuan to buy back shares

Guang Liwei (301095.SZ) announced that the company plans to use part of the initial overraised capital to repurchase some of the company's issued RMB common shares (A shares) through centralized bidding to implement employee stock ownership plans or share incentives. If the company fails to use up the repurchased shares within 36 months after the share repurchase is completed, the unused repurchased shares will be cancelled. The total amount of capital to repurchase shares shall not exceed RMB 160 million and not less than RMB 10,000 million (all including capital). The total amount of capital actually used shall prevail. The price of the shares to be repurchased will not exceed RMB 80.00 per share (including the number of shares). The implementation period for this share repurchase is no more than 12 months from the date the board of directors of the company reviews and approves the repurchase plan.

Xinjufeng (301296.SZ): Plans to spend 25 million yuan to 50 million yuan to buy back the company's shares

Xinjufeng (301296.SZ) announced that the company plans to repurchase the company's shares through centralized bidding transactions to protect the company's value and shareholders' rights. The total amount of capital used for this repurchase is not less than RMB 25 million (inclusive) and no more than RMB 50 million (inclusive). The repurchase price is not more than RMB 12 per share. The implementation period for share repurchases is carried out within 3 months from the date the board of directors of the company reviews and approves the repurchase plan on the premise that the relevant requirements of the exchange are met.

Colic (002782.SZ): Plans to spend 40 million yuan to 80 million yuan to buy back shares

Colic (002782.SZ) announced that the company plans to repurchase shares to implement equity incentives or employee stock ownership plans. The total amount of repurchase capital is not less than RMB 40 million (inclusive) and not more than RMB 80 million (inclusive). The total amount of repurchase capital is based on the total amount of funds actually used. The repurchase price does not exceed RMB 17.00 per share (inclusive). The repurchase period shall not exceed 12 months from the date the board of directors deliberates and approves the share repurchase plan.

[Increase or decrease holdings]

Zhennong Co., Ltd. (002758.SZ): Taiantai plans to reduce its holdings by no more than 3%

Zhennong Co., Ltd. (002758.SZ) announced that Zhejiang Taiantai Investment Consulting Partnership (Limited Partnership) (“Taiantai”), the shareholder holding 63,482,171 shares of the company (accounting for 12.17% of the company's total share capital), plans to reduce the total holdings of the company's shares by no more than 15,646,432 shares through centralized bidding or bulk transactions (accounting for 3% of the company's total share capital).

Nanxin Pharmaceutical (688189.SH): Guangzhou Qianyuan plans to reduce its holdings by no more than 2.00% in bulk transactions

Nanxin Pharmaceutical (688189.SH) announced that due to shareholders' own capital requirements, Guangzhou Qianyuan plans to reduce its total holdings of the company's shares by no more than 5.488 million shares through bulk transactions, no more than 2.00% of the total number of shares in the company. Guangzhou Qianyuan's share holdings were reduced within 3 months after 3 trading days from the date of disclosure of this announcement, and the total number of shares reduced during any 90 consecutive days did not exceed 2.00% of the total number of shares of the company. The holdings reduction price will be determined according to the market price at the time the holdings reduction is implemented.

[Other]

Xiangxin Technology (002965.SZ): Designated as a new energy vehicle project with estimated total project sales of about 300 million yuan

Xiangxin Technology (002965.SZ) announced that in January-March 2024, the company received a fixed notice for a new energy vehicle project from a leading domestic automobile brand customer (the specific name of the customer, “customer” for short, cannot be disclosed according to the confidentiality agreement with the relevant customer), confirming that the company will supply products such as seat structures, insulation panels, water tanks, and power battery case structures for their new energy vehicles. According to customer forecasts, the mass production period for the targeted projects obtained this time is 2024 and 2025, respectively, and the life cycle is 1-5 years. The total estimated project sales are approximately RMB 300 million.

Ningke Biotech (600165.SH): Other risk alerts will be implemented from April 8

Ningke Biotech (600165.SH) announced that Ningxia Zhongke Biotechnology New Materials Co., Ltd. (known as Zhongke New Materials), an important holding subsidiary of the company, completed the packaging and storage of the current batch of products on February 7, 2024, and is still temporarily discontinued. As the company still has liquidity problems and no clear solutions, Zhongke New Materials is not expected to resume normal production within 1 month. According to the relevant provisions of the “Shanghai Stock Exchange Stock Listing Rules”, trading of the company's shares will be suspended for 1 day on April 3, 2024, and other risk warnings will be implemented from April 8, 2024. The abbreviation for A-share shares will be changed from “Ningke Biotech” to “ST Ningke”. After implementing other risk warnings, the daily rise and fall of the stock price will be limited to 5%, and the company's shares will be traded on the risk warning board.