In 2023, the total revenue of Xile Education increased by 41.9% year-on-year to reach 571 million yuan (unit: RMB, same below), and equity holders' net profit during the year increased by 58.0% to reach 85.988 million yuan. Excluding share option benefit expenses and net losses from the live e-commerce business, the adjusted net profit attributable to equity holders of the company reached RMB 108 million, an increase of 98.5% over the previous year!

The performance of Thinking Music Education has drawn the market's attention to the education and training industry. Currently, both supply and demand are booming in the education and training industry, policies are becoming more and more clear, and the education and training industry market is expected to continue.

regressionsupbringingtracks, climb the peak again

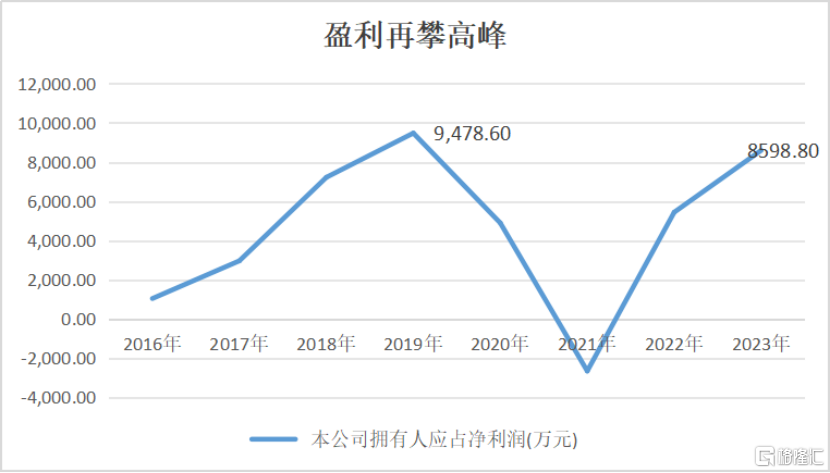

This financial report is far more than just a bottoming rebound in performance. It is also the second peak achieved by Xile since 2016 — equity holders should account for the year's net profit in 2023, second only to net profit of 94.786 million yuan in 2019, and the difference between the two is not far. Since the “double reduction”, Xile has actively taken steps to promote business transformation. After experiencing a decline in 2020 and 2021, it began returning to a growth trajectory in 2022. The current financial report also indicates that the company has broken through the trough and returned to its peak in 2023.

As a leading private education service provider in South China, SiLe Education has been deeply involved in the industry for 12 years. Since the “double reduction”, the company has actively adjusted its business priorities and launched non-subject literacy courses for primary and secondary schools in the fall of 2021. It has created courses including scientific literacy, love Chinese studies, logical thinking training, and Miowei international literacy around its “Happy Learning” brand. At present, the company has formed a complete quality education system and has become a leading quality education service provider.

Over the past year, Thinking Music Education has continued to lean resources towards quality education, and has achieved positive results. In 2023, revenue from literacy courses increased from 369.8 million yuan last year to 518.9 million yuan, and related tutoring hours also increased from 4.28 million lessons last year to 5.97 million class hours. This fully shows that while the company actively promotes the quality of education, it has been highly recognized by students and parents.

While based on the basic model, Think Le is actively developing the second curve and announced the launch of an educational tourism business and international courses. Industry insiders pointed out that the current study abroad market continues to pick up, and the backlog of demand due to public health incidents has yet to be released. According to data from research institutions, the number of students studying abroad in 2020 fell sharply by 36% to 451,000 due to the epidemic, and in 2022 it has recovered to 662,000 to 2018 levels. In a recently released research report, BOC International predicts that the number of students studying abroad/market size will gradually rise to 2019 levels (700,000/16.1 billion yuan).

At present, the company has basically passed the business adjustment period — all business lines have been sorted out, the management structure has been straightened out, and the development path and growth path are relatively clear. Looking ahead, the financial report sent a positive signal. If performance and profit indicators are lagging behind, they are post-test indicators; we can still easily find strong forward-looking indicators in financial reports.

In 2023, the company's contract debt was 276 million yuan, an increase of 52.23% over the previous year. As an education service provider, contract liabilities are generally advance payments from students, which can be regarded as an indicator of prosperity in 2024. The year-on-year growth rate of contract debt was not only higher than the year-on-year growth rate of earnings in the first half of 2023, but also higher than the year-on-year growth rate of earnings for the full year of 2023, sending a relatively positive signal.

In addition, in 2023, Syle Education employed a total of 2,319 employees, an increase of 71.78% over the previous year; the company's property management fees increased due to an increase in the total number of learning centers. According to the Tianfeng Securities Research Institute, using the campus disclosed on the company's official website as a reference, the company currently operates more than 100 study centers, which are basically all concentrated in the Shenzhen area. It is expected that in the future, along with the development of non-subject training businesses, the company may restart its network expansion, expand learning centers in Guangdong Province and even other provinces, and further expand its market share.

As non-subject training gradually matures, the company also ushered in favorable policies, and the pace of restarting the path of expansion is expected to accelerate further.

Sending positive policy signals

In the first quarter of this year, the Ministry of Education issued the “Regulations on the Administration of Out-of-School Training (Draft for Comments)”, which mentions various aspects, such as subject-based out-of-school training for students in compulsory education, government guidance price management should be implemented in accordance with the law, and provincial people's governments shall formulate fee management measures. Fees for other off-campus training shall be reported to the approval authority for the record.

Minsheng Securities pointed out that this draft for solicitation of comments clarifies the scope of application of the regulations governing out-of-school training: out-of-school training for primary and secondary school students and preschoolers aged 3-6 is included in the scope of management, while the high school level is not within the scope of administration. The publication of this opinion draft further boosts market confidence and will play an important role in stabilizing long-term expectations.

It is worth mentioning that it has been three years since the current “double reduction” policy was implemented. Not only is the policy environment in a relatively stable state, but the competitive environment has also improved dramatically.

On the one hand, in the past, due to relatively loose regulations, it was easier to obtain licenses, the entry threshold for the industry was low, and there were many self-employed people. According to statistics from the “China Education Finance Household Survey Report 2021” and public reviews, as of May 2019, there were about 864,000 education and training institutions nationwide, of which K12 subject training institutions accounted for about 22%, reaching about 187,000. The number of training institutions in Beijing, Shanghai, Guangzhou and other places is over 4,000. However, the chain rate of K12 subject training institutions is only about 6.5%. The entire industry is highly fragmented and competitive. However, Tianfeng Securities Research Institute pointed out that after experiencing the impact of the epidemic and under current policy supervision, small and medium-sized institutions with slightly poor qualifications may gradually be liquidated, and it is beneficial to gain greater market share with trust endorsements and resource support from leading brands.

On the other hand, the quality education market still has great opportunities for development. According to estimates by the Duowhale Education Research Institute, the domestic quality education market is expected to exceed 478.7 billion yuan in 2023, and the five-year compound annual growth rate from 2018 to 2023 is expected to be 15.3%. The percentage of parents investing in training courses has stabilized or increased to 85%, showing that demand for quality education is still very strong.

As the policy environment, competitive environment, and user needs begin to change, the market also creates new opportunities. Thinking has been deeply involved in the industry for many years, and has accumulated a standardized chain expansion model, quality education concept, good education brand image and user reputation, and is expected to stand out now that the industry is becoming standardized and mature.