In 2023, the continued downturn in nickel prices posed a major challenge to the development of the global industrial chain.

According to the interim results of BHP Billiton Group, the world's largest mining company, as of December 31, 2023, the Group's net profit for the first half of the fiscal year fell 86% year-on-year due to the effects of depreciation of nickel assets and other provisions.

According to the 2023 financial report of Philippine nickel producer Nickel Asia Corporation (Nickel Asia Corporation), the company's net profit fell 53% year over year.

Glencore, the world's largest commodity trader, has even shut down its nickel business in New Caledonia in the South Pacific.

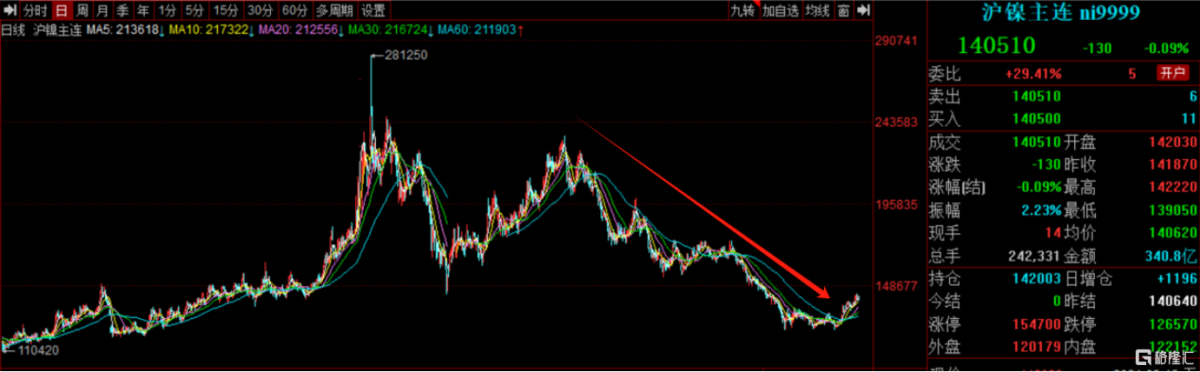

The domestic market was also unable to withstand the impact of the nickel downturn cycle. In 2023, Shanghai Nickel mainly fell by more than 46%. As one of the few pure nickel companies in China, Liqin Resources achieved operating income of 21.059 billion yuan in 2023, up 15.1% year on year, up 26.8% month on month, and realized net profit of 1,051 billion yuan, down 39.4% year on year and 110.9% month on month. Although there was a year-on-year decline, on a month-on-month basis, there was a significant improvement in the second half of the year compared to the first half of the year, which is not easy.

(Source: Communications Letter)

The decline in the overall nickel industry performance in 2023 actually reflects the reality that the global nickel oversupply situation has not been effectively transformed in the past two years. Furthermore, against the backdrop of the Federal Reserve's continued interest rate hikes, the strengthening of the US dollar is driving commodities such as nickel denominated in US dollars. Reduced market risk will cause capital to withdraw from commodities such as nickel, etc., and a slowdown in economic growth may reduce demand for industrial metals such as nickel. Under multiple influences, nickel prices will maintain a one-sided fluctuating downward trend.

However, from a long-term perspective, these suppressing factors are gradually dissipating.

On the one hand, as America's core inflation falls and the risk of its own recession intensifies, expectations for the Fed to cut interest rates are getting higher and higher. Federal Reserve Chairman Powell also said that in line with inflation signals, interest rate cuts will begin this year. Although the schedule for interest rate cuts is currently unclear, the direction of interest rate cuts is unquestionably confirmed.

On the other hand, there is an expectation that there will be a marginal improvement in the supply and demand pattern of nickel, which will undoubtedly have a greater effect on boosting nickel prices. Since the end of January this year, Shanghai Nickel has continued to rise by more than 10%, and pure nickel companies' performance recovery expectations have also increased.

Although this cannot be described as a complete reversal of the nickel cycle, signs of marginal improvement at the bottom of the cycle should be taken seriously.

1. The value of existing fire law assets benefits from higher demand for stainless steel

The main application scenario for nickel is stainless steel, and the demand for stainless steel is closely related to macroeconomic recovery.

Stimulated by a series of policies for steady growth, China's macroeconomic economy maintained a recovery trend last year. According to a report from the Stainless Steel Branch of the China Iron and Steel Association, in 2023, China's crude stainless steel production was 366.759 million tons, up 12.59% year on year, and apparent consumption was 31.0822 million tons, up 10.56% year on year.

However, theoretically speaking, simple fiscal measures such as tax cuts and fee cuts and loose monetary policies such as interest rate cuts have limited effect on promoting enterprise production and consumer consumption. Essentially, our country's effective demand is insufficient, social expectations are weak, and poor internal circulation is a major obstacle to China's economic recovery.

To this end, the Executive Meeting of the State Council passed the “Action Plan to Promote Large-scale Equipment Renewal and Consumer Goods Trade-in” to directly promote investment and consumption through the renewal of old agricultural machinery, educational and medical equipment, and the trade-in of consumer goods such as automobiles and home appliances.

Whether it is the renewal of equipment or the replacement of consumer goods, the large-scale effects of upgrading cannot be ignored, which will inject new impetus into the development of the steel industry. As a key reinforcing element for improving the corrosion resistance, strength, toughness, and stability of stainless steel, the demand for nickel is expected to increase at the same time.

More importantly, due to the long-term decline in nickel prices, the price of stainless steel is also at a historically low level, which makes stainless steel more economical and further drives demand for nickel upward.

Generally speaking, most of the production of stainless steel is smelted using pyrotechnics. The advantages of pyrotechnic processes are higher maturity and higher production efficiency. However, pyrotechnic processes also cause certain environmental pollution problems, and major nickel industry countries, such as Indonesia, tend to limit the expansion of such processes.

As a result, the value of those existing pyrotechnic projects will naturally increase along with it.

For example, the first HJF production line of the Liqin Resources Fire Project began to be put into operation in October 2022, and all eight lines will be put into operation and fully completed within 2023. At the same time, thanks to the continuous improvement and upgrading of the smelting process and equipment by Liqin Resources, Liqin Resources improved the utilization rate of heat energy and reduced the maintenance and repair costs of machinery and equipment, thereby reducing the energy consumption and production costs of the entire production process. The HJF production line in the first phase of the Fire Law Project HJF production line all reached the advanced level of the same industry, and achieved a cumulative total of more than 70,000 metal tons of nickel throughout the year.

According to reports, construction related to the second phase of Liqin Resources' fire law project is progressing steadily according to the established plan. After completion, it will have a design production capacity of 185,000 metal tons of nickel and iron per year, which is expected to increase the company's overall fire process output, and will further help Liqin Resources to enjoy the incremental dividends of the industry.

II. Wet processes with leading technical advantages enjoy the growth dividends of new energy vehicles

If stainless steel is the basic plate of nickel, then the rapid growth of new energy vehicles is the main driving force behind the increase in demand for nickel.

As one of the benchmark industries under the concept of new quality productivity, new energy vehicles are an important gripper for China to overtake curves in the automobile industry. Against the backdrop of policy support and technological maturity, production and sales of new energy vehicles in China are constantly increasing.

According to data from the China Automobile Association, China's NEV production and sales volume in 2023 was 9.587 million units and 9.495 million units, respectively, up 35.8% and 37.9% from the previous year, respectively, and the market penetration rate increased by 5.9 percentage points to 31.6%.

From a medium- to long-term perspective, the trend of the continuous increase in the penetration rate of new energy vehicles will not change. As a top priority for new energy vehicles, power batteries are naturally the core beneficiary of this trend.

Although the line dispute between Sanyuan and lithium iron has not stopped, from an actual application perspective, both have their own usage scenarios, and the structure is already balanced. Thanks to the rise in the NEV market, demand for both should have increased accordingly.

For ternary batteries, if you want to increase battery energy density, high nickelization is currently the mainstream route. In an environment where the mileage of new energy vehicles is uncertain, the increase in demand for ternary batteries will directly drive higher demand for nickel. Combined with the cost advantages brought about by the current low nickel price range, the penetration rate of high-nickelized ternary batteries is expected to increase further.

As one of the few nickel manufacturers that have fully mastered the high-pressure acid immersion smelting process for laterite nickel ore, Liqin Resources successfully put into operation battery-grade nickel sulfate and cobalt sulfate for the first time in Indonesia. The capacity utilization rate of the completed hydrometallurgy projects has exceeded 100%.

Looking at Liqin Resources's hydrometallurgy project from the perspective of technological innovation, efficient allocation of production factors, and environmental friendliness and sustainability, which emphasizes “new quality productivity,” the long-term value of this part of the asset may be better understood.

1) Technological innovation

The third-generation HPAL process used in the Liqin Resources HPAL project is the mainstream process for hydrometallurgical nickel smelting of nickel. It is also currently the most advanced process for treating medium and low grade laterite nickel ore in the world. This is a reflection of the drive driven by technological innovation in the new quality productivity theory.

Since this type of process needs to be carried out in an environment of high temperature, high pressure and the use of concentrated sulfuric acid in the actual application process, the technical strength and operating experience of the enterprise are extremely high. As a leader in the industry, Liqin Resources makes it easier to gain an advantage in such high barriers with rich project operation experience.

2) Efficient allocation of production factors

Generally speaking, wet process smelting projects in the industry often fail to start production or take a long time to finally reach production. The first phase and phase two production lines of the Liqin Resources HPAL project were successfully put into operation within 2 months. At the same time, the HPAL project is at the left end of the cost curve. It is a nickel-cobalt compound production project with the lowest cash cost, setting a new industry record. This is inseparable from the continuous optimization of Liqin Resources's production process and the continuous improvement of the level of automation.

By the end of 2023, the first phase and second phase of the Liqin Resources Wet Process Project achieved an annual design capacity of 55,000 tons of nickel ahead of schedule and achieved overproduction. The total production of hydrometallurgical products over 60,000 tons of metallic nickel throughout the year was over 60,000 tons. Since the quality of the company's products has been widely recognized by the market, Liqin Resources is still actively constructing the wet process phase III project. Currently, the main wet process phase III project has been fully completed according to schedule.

3) Environmental friendliness and sustainability

Although the main nickel and cobalt metals from nickel ore have been extracted, tailings still contain a variety of valuable metal components, which can be gradually refined, recycled and effectively used.

Liqin Resources is experimenting with adding tailings treatment technology to hydrosmelting HPAL projects. In the future, Liqin Resources may have the ability to recover ferrous metal from HPAL project tailings, which can not only expand new profit growth points, but also effectively solve the environmental pressure and treatment costs caused by tailings.

III. Concluding Remarks

In the past two years, nickel prices have gradually returned to a rational range from the high level in 2022. The wide fluctuation and downward process has put a lot of profit pressure on all relevant companies, but from a medium- to long-term perspective, this has also led to the clearance of some low-end production capacity, and market share will accelerate the concentration of leading companies like Liqin.

Looking forward to the future, “trade-in” and the increase in the penetration rate of new energy vehicles will bring about continuous improvement in demand. Combined with our own technology and cost advantages, the growth of strength resources will become more and more certain after crossing the bottom of the industry cycle.