In 2023, in an environment where external uncertainties still exist, the Hong Kong stock pharmaceutical market experienced significant fluctuations, and the sector is still below the historical valuation center.

However, there are still excellent companies in the pharmaceutical sector that have shown good ability to cross the cycle, and have performed well with high performance flexibility and stable fundamentals, such as Xingkerong Pharmaceutical, a leading marketing, promotion and channel management service provider in the domestic pharmaceutical industry.

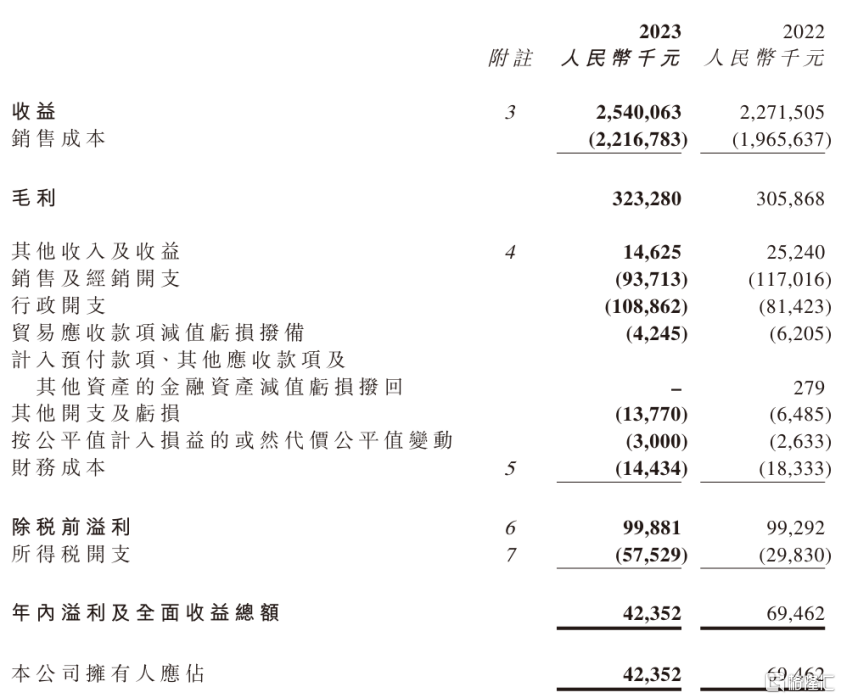

Recently, Xingkerong Pharmaceutical announced its 2023 annual results.According to the results announcement, the company's revenue achieved a steady increase of 11.8%, reaching RMB 2.54 billion. This achievement was mainly due to an increase in sales revenue of human albumin injections of approximately RMB 250 million.The company's gross profit increased by 17.4 million yuan to 323 million yuan. The increase in gross profit was mainly due to increased sales of human albumin and revenue from medical and aesthetic services. However, it is worth noting that the company's net profit declined, mainly due to increased administrative expenses due to the expansion of the business operations of the Pharmaceutical Research and Manufacturing Division and the Aesthetic Services Division. The announcement also revealed that the company's board of directors has passed a resolution to distribute dividends of HK0.39 cents per common share, totaling HK$8 million, which can be implemented after approval by the shareholders' meeting.

Chart 1: Xingke Rong Pharmaceutical's comprehensive profit and loss and other comprehensive income statements

Data source: Company announcements, compiled by Gelonhui

Steady development of the main business, strengthening the company's hematopoietic capacity

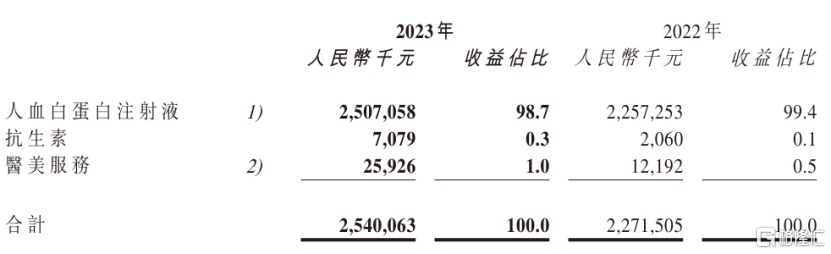

Judging from the business structure of Xingkerong Pharmaceutical, the company mainly involves the three major business segments of biological products, medical and aesthetic products, biomedical cold chain and supply chain services. Among them, sales of human albumin injections are the top priority of the company's business.

In 2023, the company's sales of human albumin injections were RMB 2,507 billion, accounting for 98.7% of the company's annual revenue. Sales of this product increased by approximately RMB 249 million compared to 2022, or 11.1%. This category is currently the largest selling variety in the blood products market, and is currently the only blood product that can be imported. It has maintained a high growth rate in the past. For example, the number of batches issued in 2023 was 78.1 million bottles, up about 15.36% from 67.7 million bottles in the same period in 2022.

Chart 2: Xingke Rong Pharmaceutical's comprehensive profit and loss and other comprehensive income statements

Data source: Company announcements, compiled by Gelonhui

With the approval of new indications and the increase in diagnosis and treatment rates, the International Plasma Protein Therapy Association (PPTA) expects the global blood products market demand to maintain a high growth rate in the future. Meanwhile, the human albumin injections sold by Xingkerong Pharmaceutical are produced by Octefama, one of the world's giants in blood products. According to statistics on the number of blood albumin injections issued in batches in China in 2023, Octefama human albumin injections market share is about 12.0%.Considering the high market share of Octefama human blood albumin injections sold by Xing Kerong Pharmaceutical, it has been included in the National Medical Insurance Catalogue as a Class B product. The indications include shock due to decreased blood volume, elimination of edema and toxic substances, and neonatal hyperbilirubinemia. From the perspective of behavioral economics and behavioral inertia, future new demand will habitually select large brands and transform into long-term demand for Xingkerong Pharmaceutical products.

On the other hand, the annual report stated that “gross margin fell from 13.5% in 2022 to 12.7% during the reporting period. The decrease is mainly due to the increase in the procurement cost of human blood albumin due to the depreciation of the RMB exchange rate against the US dollar during the reporting period.” Considering that the average exchange rate of the US dollar to RMB in 2023 was 7.0467, up from the average exchange rate of 6.7261 in 2022, the RMB depreciated 4.55% from the previous year.Xing Kerong Pharmaceutical's gross margin has declined to the rate of devaluation of the RMB, which means that the company's premium capacity for domestic sales has increased, the profitability of product sales has increased compared to the past, and the company's hematopoietic capacity to actually profit from sales has increased. This ability will contribute more profit to the company in years when the exchange rate is stable.

Chart 3: Exchange rate chart between US dollar and RMB from 2022 to 2023

Data source: Public information, compiled by Glonghui

The layout is long-term,Ready to go

While giving full play to its main business advantages, Xingkerong Pharmaceutical has also paid attention to the layout of medical and aesthetic products, biomedical cold chain and supply chain services in recent years. Judging from the company's revenue structure, these businesses are rising rapidly.

On the medical and aesthetic circuit, through cooperation with Beijing Norconda, the company has developed a series of medical and aesthetic products, such as injectable polycaprolactone fillers (needles for girls) and intimate needles.

As of the reporting period, all the plants, production equipment and facilities related to the project have been completed and put into use after being tested and passed by the Sichuan Drug Inspection Research Institute. The Juvenile Acupuncture Type S material completed the main document registration of the Medical Device Technical Evaluation Center of the State Drug Administration in October 2023; the Adolescent Needle S completed pilot testing, verification and clinical sample production in June 2023. The registration test passed the registration test by the Sichuan Drug Inspection Research Institute. The clinical plan has been determined, and preparations for clinical trials are ongoing. The project for intimate needles and their polycaprolactone filling materials is also being accelerated.

In terms of biomedical cold chain and supply chain services, Xingkerong Pharmaceutical has invested in the construction of cold chain storage facilities in Shuangliu District, Chengdu City, Sichuan Province. The first phase of the cold chain warehouse that has been built so far (with an area of 15,000 square meters) fully meets the company's storage needs and can effectively ensure the quality and safety of blood products in the company's product portfolio. Following the completion of the second phase logistics base, it is expected to become one of the largest professional pharmaceutical cold chain logistics centers in western China.

In order to match business development, especially the business development of the Pharmaceutical Research and Manufacturing Division and the Medical Aesthetic Division, Xingkerong Pharmaceutical's administrative expenses began to increase rapidly, increasing by about 27.5 million yuan over the same period last year, which is similar to the scale of the decline in the company's net profit. This portion of expenses is mainly used to cover increased office rental expenses, tax expenses, amortization expenses, travel expenses, and other miscellaneous expenses as the number of employees increases.

With the expansion of phased investment, Xingkerong Pharmaceutical is promoting the development of other business segments. For example, the increasing acceptance of medical and aesthetic services among today's people can shape the company's future business needs. Market demand for pharmaceutical cold chain storage services will also form a stable source of revenue for the company. Through investment in the future, Xingkerong Pharmaceutical is forming its own new growth point, promoting the optimization of the company's business structure, laying a solid foundation for the company's future development, and ultimately achieving a positive cycle of development.

Summarize

Judging from Xing Kerong Pharmaceutical's current revenue performance and future layout, the company's management has a forward-looking strategic vision and keen market insight. They are not only focusing on driving steady growth in their main business, but are also actively seeking new growth points. The company is currently actively exploring new tracks such as medical aesthetics and pharmaceutical cold chains, and is showing strong growth momentum and long-term market demand. Although short-term investment and energy reserves may increase the company's operating and administrative costs, putting pressure on profits. However, in the long run, when the new track produces benefits, it will bring more impressive performance to the company and at the same time contribute more long-term value to the company's shareholders. In future market competition, Xingkerong Pharmaceutical is expected to use its deep accumulation and advantages in the fields of medicine, health, medicine and aesthetics to achieve continuous growth in performance and continuous optimization of business. You just have to wait, the potential is promising!